Exclusive Analysis by Dr. Nancy Yamaguchi

Oil prices eased Friday, but they maintained some of the week’s gains coming from a significant drawdown from crude oil inventories and bolstered by a strong Jobs Report. These have, at least temporarily, comforted markets troubled by the distressing increase in COVID-19 infections and fatalities. Ahead of the Independence Day weekend, 36 states were reporting increases in infections, and some state governors were restoring social distancing measures, or at least pausing on economic re-opening plans. West Texas Intermediate (WTI) crude prices were clinging to the $40 a barrel level. Crude and refined product prices are showing a gentle downward trend, but the week appeared likely to be headed for a finish in the black. Trading over the holiday weekend was expected to be limited.

The U.S. Bureau of Labor Statistics (BLS) Thursday released the June Employment Situation Report, also known as the Jobs Report, reporting that total nonfarm payroll employment rose by 4.8 million in June. The unemployment rate fell to 11.1%. The Jobs Report set off a stock market rally Thursday in the U.S., Europe and Asia, now flattening. Markets are in a continual back-and-forth. Signs of slow, but promising, economic recovery are tempered by the knowledge that the pandemic is far from over.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have passed two grim milestones: infections are now in excess of 10 million, and deaths have passed the half-a-million mark. Global cases have risen to 10,902,347, with 521,940 deaths. Confirmed cases in the U.S. rose to 2,740,353. U.S. deaths attributed to the disease have reached 128,741.

Mask wearing has become a political issue to some. However, Goldman Sachs recently conducted an economic analysis concluding that a nationwide mandate requiring masks could partially substitute for renewed lockdowns, potentially saving 5% of U.S. GDP.

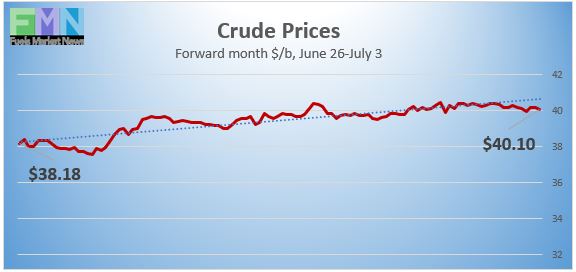

WTI crude futures prices opened at $40.38 a barrel Friday, up by $1.29 a barrel (3.3%) from last Friday’s open of $39.09 a barrel. Prices Friday were easing. Our weekly price review covers hourly forward prices from Friday, June 26 through Friday, July 3. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Gasoline Prices

Gasoline futures prices rebounded to open at $1.244 per gallon Friday on the NYMEX, compared with $1.2057/gallon on June 26. This was a recovery of 3.83 cents (3.2%.) Last week, markets slumped as COVID-19 infections and fatalities began to climb, threatening economic recovery. March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline rose by 4.5 cents/gallon during the week ended June 29. Three weeks ago, retail prices reclaimed the territory above $2 per gallon. Retail prices averaged $2.174/gallon at the national level. Gasoline futures prices trended down modestly Friday, trading in the range of $1.23/gallon to $1.26/gallon. The week appeared to be hanging on for a finish in the black. The latest price is $1.2396/gallon.

Source: Prices as reported by DTN Instant Market

Diesel Prices

Diesel Prices

Diesel opened on the NYMEX Friday at $1.2262/gallon, a gain of 6.65 cents, or 5.7%, from last Friday’s open of $1.1597/gallon. U.S. average retail prices for diesel rose by 0.5 cents per gallon during the week ended June 29 to average $2.430/gallon. Diesel prices have weakened more or less steadily this year, missing some of the price recovery seen in crude and gasoline markets. Diesel futures prices Friday were easing, but the week appeared to be headed for a finish in the black. At the time of this writing, diesel is trading in the range of $1.21-$1.23/gallon. The latest price is $1.2173/gallon.

Source: Prices as reported by DTN Instant Market

WTI Crude Prices

WTI crude forward prices opened on the NYMEX Friday at $40.38 a barrel, compared with $39.09 a barrel last Friday. This was an increase of $1.29 a barrel (3.3%.) Prices strengthened upon news of a significant drawdown from crude oil inventories midweek, followed by a strong Jobs Report. The current increase of COVID-19 infections and fatalities is placing a lid on prices, as 36 states report a rise in infections—a cause of concern as the U.S. moves into the Fourth of July weekend and an expected increase in social events and outings. Nonetheless, oil prices appeared to be headed for a finish in the black. WTI prices were trading in the $40–$41 a barrel range. The latest price is $40.10 a barrel.

Source: Prices as reported by DTN Instant Market

PRICE MOVERS THIS WEEK: BRIEFING

Oil prices were easing Friday but were maintaining some of the week’s gains coming from a significant drawdown from crude oil inventories and bolstered by a strong Jobs Report. These have, at least temporarily, comforted markets troubled by the distressing increase in COVID-19 infections and fatalities. Some state governors are restoring social distancing measures, or at least pausing on economic re-opening plans. West Texas Intermediate (WTI) crude prices were clinging to the $40 a barrel level. Crude and refined product prices were stabilizing with a gentle downward trend, and the week appeared to be headed for a finish in the black. Trading over the holiday weekend was expected to be limited.

The U.S. Bureau of Labor Statistics (BLS) released the June Employment Situation Report, also known as the Jobs Report, reporting that total nonfarm payroll employment rose by 4.8 million in June. The unemployment rate fell to 11.1%. According to the BLS: “These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing and professional and business services.”

The Jobs Report set off a stock market rally Thursday in the U.S., Europe and Asia, which now has leveled off. The signs of slow, but promising, economic recovery supported the idea that demand will recover, which in turn supports oil prices. The gains are modest, however, tempered by the knowledge that the pandemic is far from over. Also, although the unemployment rate is declining, it still is above the 10% rate seen at the height of the Great Recession.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have passed two grim milestones: Infections are now beyond the 10-million mark, and deaths have surpassed the half-a-million mark. Global cases have risen to 10,902,347, with 521,940 deaths. Confirmed cases in the U.S. rose to 2,740,353. U.S. deaths attributed to the disease have reached 128,741. By now, 36 states are reporting an increase in new COVID-19 cases. States with significant increases include Alabama, Arizona, Arkansas, California, Florida, Georgia, Idaho, Kansas, Louisiana, Mississippi, Ohio, Oklahoma, Oregon, South Carolina and Texas and Utah. The economic re-opening has placed many people back to work and into normal social contact. Moreover, infections were rising as the country moved into the Fourth of July weekend, a time of widespread socializing. Some individuals continue to refuse to adopt guidelines, and even mandatory requirements, concerning social distancing and mask wearing.

Mask wearing has become a political issue to some. However, Goldman Sachs recently conducted an economic analysis concluding that a nationwide mandate requiring masks could partially substitute for renewed lockdowns, potentially saving 5% of U.S. GDP.

Oil prices rose midweek when the American Petroleum Institute (API) released information showing a significant drawdown of 8.2 mmbbls from crude oil stockpiles, plus a drawdown of 2.5 mmbbls from gasoline inventories. Diesel inventories rose by 2.6 mmbbls. The API’s net inventory draw was a significant 8.1 mmbbls. Market analysts had predicted a similar pattern, but with smaller volumes and a lesser overall draw.

Oil prices were reinforced on Wednesday when U.S. Energy Information Administration (EIA) official statistics also showed a drawdown from oil stockpiles. The EIA reported a smaller, but still significant, draw of 7.195 mmbbls from crude stockpiles, plus a draw from diesel inventories of 0.593 mmbbls. Gasoline stocks rose by 1.199 mmbbls. The EIA net result was an inventory draw of 6.589 mmbbls. Crude oil inventories have expanded in 19 of the 25 weeks since the first week of January, sending a total of 106.56 mmbbls of crude oil into storage. The volume of crude flowing into stockpiles has slowed over the past month, however, as production is being cut and demand is picking up.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks steadily have been drained since then, falling to 45,582 mmbbls during the week ended June 26. Some surplus crude is being stored in the National Strategic Petroleum Reserve (SPR.) The EIA reports that SPR additions were made in the weeks ended April 24 (1.150 mmbbls), May 1 (1.716 mmbbls), May 8 (1.933 mmbbls), May 15 (1.882 mmbbls), May 22 (2.111 mmbbls), May 29 (4.02 mmbbls), June 5 (2.22 mmbbls), June 12 (1.731 mmbbls), June 19 (1.991 mmbbls,) and June 26 (1.692 mmbbls.) Current SPR stocks are 655.413 mmbbls.

U.S. crude production has been flat. The EIA reported that U.S. crude production during the week ended June 26 averaged 11.0 mmbpd, unchanged from prior week. According to the EIA’s weekly data series, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd during the first four weeks of June. The EIA has revised downward its forecast of 2020 production, cutting it to 11.56 mmbpd. However, the forecast of demand has been cut as well, leaving a supply overhang.