Bearish Mood Lifts

- Concerns arise about new supply

- US crude oil output falls again

- Competition intensifies for Mideast leadership

- Natural gas storage grows at a slower pace

Sincerely, Alan Levine Chairman, Powerhouse

Table covers crude oil and principal products. Other products, including residual fuel oil and “other oils” are not shown, and changes in the stocks of these products are reflected in “Total Petroleum Products.” Statistics Source: Energy Information Administration “Weekly Petroleum Status Report” available at www.eia.doe.gov

The Matrix

The bearish tone that has characterized oil markets in recent months is dissipating, replaced by a cautiously bullish sense. Concerns about the sources of new supply and strong demand created by low product prices are contributing to the change.

The impact of Canadian wildfires and renewed pipeline attacks in Nigeria are expected to contribute to lower production for the rest of 2016 according to market analysts. In addition, U.S. production has been falling, now at 8.8 million barrels daily.

Nigerian production has reportedly fallen to twenty year lows, estimated now to be just slightly over one million barrels per day. Civil unrest has plagued the country for many years. Anti-government fighters, the Niger Delta Avengers, have forced shuttering of facilities at Forcados and other facilities, taking over 300,000 barrels daily of crude oil out of circulation.

At the same time, competition for market share between Iran and Saudi Arabia is gaining strength. Iranian exports are expected to reach 2.1 million barrels per day for May, nearly sixty per cent greater than last year at this time. The growth reflects price cutting by Iran, apparently made necessary to retake customers lost during Iran’s time under sanctions. Saudi Arabia, for its part, is planning to increase production in an effort to blunt Iran’s advance. Some analysts expect an increase as much as one million barrels daily to be marketed.

Intense marketing competition between Iran and Saudi Arabia reflects shifting regional geopolitics. The increase in Iranian supply erodes Saudi regional strength. And Saudi Arabia itself is facing serious internal tensions that have caused the Kingdom to seek greater diversification away from oil. Middle East ferment will continue to be central to the price and availability of petroleum for a long time to come.

Supply/Demand Balances

Supply/demand data in the United States for the week ending May 13, 2016 were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased 0.7 million net barrels during the week ending May 13th, 2016.

Builds were reported in stocks of K-jet fuel, propane, and other oils. Draws were reported in stocks of gasoline, fuel ethanol, distillates, and residual fuel oil.

Crude oil supplies in the United States increased to 541.3 million barrels, a build of 1.3 million barrels.

Crude oil supplies decreased in three of the five of the PAD Districts. PAD District 1 (East Coast) crude oil stocks fell 0.2 million barrels, PADD 2 (Midwest) crude stocks decreased 0.1 million barrels, and PADD 4 (Rockies) stocks declined 0.3 million barrels. PAD District 3 (Gulf Coast) crude oil stocks increased 1.2 million barrels and PADD 5 (West Coast) stocks grew 0.7 million barrels.

Cushing, Oklahoma inventories increased 0.5 million barrels to 68.3 million barrels.

Domestic crude oil production decreased 11,000 barrels daily to 8.791 million barrels per day.

Crude oil imports averaged 7.677 million barrels per day, a daily increase of 22,000 barrels.

Refineries used 90.5 per cent of capacity, an increase of 1.4 percentage point from the previous report week.

Crude oil inputs to refineries increased 192,000 barrels daily; there were 16.371 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased 250,000 barrels to 16.570 million barrels daily.

Total petroleum product inventories saw a decrease of 2.0 million barrels from the previous report week.

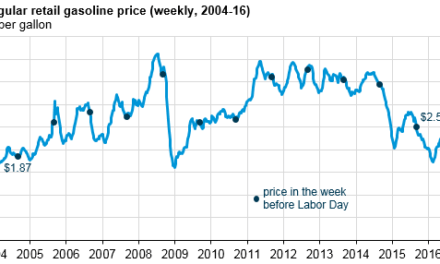

Gasoline stocks decreased 2.5 million barrels; total stocks are 238.1 million barrels. Demand for gasoline increased 97,000 barrels per day to 9.755 million barrels daily. This is only seven thousand barrels daily fewer that the record established in August, 2007.

Total product demand increased 822,000 barrels daily to 20.775 million barrels per day.

Distillate fuel oil supply decreased 3.2 million barrels; total stocks are 152.2 million barrels. National distillate demand was reported at 4.326 million barrels per day during the report week. This was a weekly increase of 312,000 barrels daily.

Propane stocks increased 1.0 million barrels to 74.2 million barrels. Current demand is estimated at 1.007 million barrels per day, an increase of 90,000 barrels daily from the previous report week.

Natural Gas

According to the EIA:

Working gas in the Lower 48 states posted its fifth consecutive week of net injections, at 73 Bcf for the week ending May 13. Net injections into storage this week are significantly lower than the five-year average and lower than last year’s injections. The five-year average net injections into storage is 91 Bcf, while last year’s net injection was 98 Bcf. Working gas stocks could finish the cooling season near the record high, which was in 2015, when working gas stocks totaled 3,931 Bcf, following a summer with normal temperatures. Working gas stocks are 795 Bcf above the five-year average and 791 Bcf above last year at this time.

El Nino, the weather phenomenon that rises from warmer-than-normal waters in the Pacific, is now cooling. Its meteorological opposite, La Nina, could develop later this year with cooler than normal temperatures and other extreme weather phenomena.

The National Oceanic and Atmospheric Administration (NOAA) projects La Nina will develop later this year. Tropical Pacific trade winds, now slackened by El Nino, will soon return, creating cooler ocean temperatures and new global weather patterns. La Nina could usher in an active Atlantic hurricane season, focused on the United States. (The U.S. has not had significant hurricanes in several years.) In addition, La Nina could give the Northeast and the Midwest colder weather into 2017.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

or call: 202 333-5380

Copyright © 2016 Powerhouse, All rights reserved.