Winter Weather Forecasts From The Old Farmers Almanac

- Winter “not extremely cold”

- Low solar activity overridden by climate change

- Snow “more than normal” in Northeast

- Weather risks can be offset by derivatives

- Natural gas broke resistance

The Matrix

Oil prices have been bounded in a tight range for several months. Uncertainty has been the flavor of the oil-pricing month. And the greatest uncertainty of all is the weather. With winter just ahead, it’s time to look for wooly caterpillars.

One of the mainstays of long-term weather forecasting is the Old Farmers Almanac. OFA has been published since 1792. It claims 80% accuracy in its forecasts. Meteorologists doubt these claims, but the OFA’s predictions are hard to refute. OFA starts this year’s weather guess-fest with a “not extremely cold” winter.

OFA uses solar activity measurements in its work. Lower levels translate into cooler temperatures. And while solar activity has been low recently, rising temperatures should offset solar influences and yield a warmer winter than might be expected with low solar activity. Northeastern New England, specifically Maine, is expected to be “uncommonly chilly.”

Warming should be the main feature of winter weather, particularly in the eastern and northern United States. On balance, OFA forecasts close to normal weather.

Precipitation is the other determinant of winter’s intensity. OFA expects “rain or average to below-average snowfall to be the standard throughout most of the country.” Regionally, snow should be greater than normal in the Northeast, Wisconsin, Michigan’s UP and the High Plains.

Temperatures and precipitation can turn a company’s P&L upside down in a single incident. Too few HDDs or too many inches of snow create such a risk. Financial managers now have instruments to deal with such risks.

The East Coast, for example, has had, in the past ten years, among the highest and the lowest snow totals over the last century. It is possible to fix costs of snow removal—even in unusually heavy snowfalls—with weather futures and options.

In a similar fashion, threats to net profits from unbalanced heating degree days can be covered with weather derivatives. Climate change is shaping a future with greater extremes of temperature and precipitation. Weather derivatives are offered by Powerhouse to help businesses survive these extremes.

Supply/Demand Balances

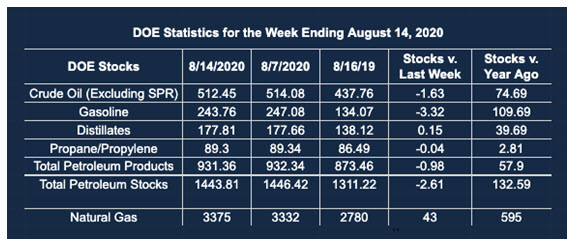

Supply/demand data in the United States for the week ended August 14, 2020, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell by 5.3 million barrels during the week ended Aug. 14, 2020.

Commercial crude oil supplies in the United States decreased by 1.6 million barrels from the previous report week to 512.5 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Plus 0.8 million barrels to 11.8 million barrels

PADD 2: Minus 0.6 million barrels to 141.8 million barrels

PADD 3: Minus 2.2 million barrels to 279.2 million barrels

PADD 4: Minus 0.1 million barrels to 25.4 million barrels

PADD 5: Plus 0.5 million barrels to 54.4 million barrels

Cushing, Oklahoma inventories were down 0.6 million barrels from the previous report week to 52.7 million barrels.

Domestic crude oil production was unchanged from the previous report week at 10.7 million barrels daily.

Crude oil imports averaged 5.730 million barrels per day, a daily increase of 109,000 barrels. Exports decreased 1.0 million barrels daily to 2.137 million barrels per day.

Refineries used 80.9% of capacity, down 0.1% from the previous report week.

Crude oil inputs to refineries fell 171,000 barrels daily; there were 14.487 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 26,000 barrels daily to reach 15.082 million barrels daily.

Total petroleum product inventories fell 1.3 million barrels from the previous report week to 931 million barrels.

Gasoline stocks decreased 3.3 million barrels daily from the previous report week; total stocks are 243.8 million barrels.

Demand for gasoline fell 253,000 barrels per day to 8.630 million barrels per day.

Total product demand decreased 2.210 million barrels daily to 17.159 million barrels per day.

Distillate fuel oil stocks increased 0.2 million barrels from the previous report week; distillate stocks are at 177.8 million barrels. EIA reported national distillate demand at 3.253 million barrels per day during the report week, a decrease of 610,000 barrels daily.

Propane stocks were unchanged from the previous report week; propane stocks are 89.3 million barrels. The report estimated current demand at 1.106 million barrels per day, a decrease of 13,000 barrels daily from the previous report week.

Natural Gas

Spot natural gas futures prices traded in a range between $1.53 and $2.16 since early January with only a few exceptions. Prices broke higher earlier this month.

Values now appear set to advance further, reflecting typical seasonal factors, modest increases in demand and LNG exports.

Reductions in supply have been reported as well. Lesser natural gas supply accompanies declining crude oil production that has brought output down to 10.7 million barrels per day.

Elliott Wave analysis suggests a modest pullback to $2.27 in spot natural gas futures prices before a new attack on the highs. A new price objective is at $2.90 or so.

According to the EIA:

The net injections [of natural gas] into storage totaled 43 Bcf for the week ending August 14, compared with the five-year (2015–19) average net injections of 44 Bcf and last year’s net injections of 56 Bcf during the same week. Working natural gas stocks totaled 3,375 Bcf, which is 442 Bcf more than the five-year average and 595 Bcf more than last year at this time.

The average rate of injections into storage is 11% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 10.1 Bcf/d for the remainder of the refill season, the total inventory would be 4,165 Bcf on October 31, which is 442 Bcf higher than the five-year average of 3,723 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2020 Powerhouse Brokerage, LLC, All rights reserved