Excerpted from This Week in Petroleum

U.S. production capacity for renewable diesel could increase significantly through 2024, based on announced projects and those that are under construction. Growing targets for state and federal renewable fuel programs and incentives for renewable diesel production are driving this expansion. As of the end of 2020, we estimate U.S. production capacity for renewable diesel totaled nearly 0.6 billion gallons per year (gal/y), or 38,000 barrels per day (b/d), and we forecast it to reach 5.1 billion gal/y (330,000 b/d) by 2024 (Figure 1).

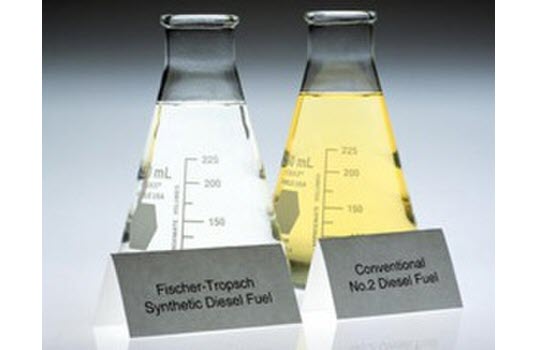

Renewable diesel is a renewable fuel that is chemically the same as petroleum diesel and nearly identical in its performance characteristics. As a result, it can be used in existing distribution infrastructure and traditional diesel engines. Renewable diesel shares the same fat, oil, and grease feedstocks as biodiesel. However, because renewable diesel is chemically the same as petroleum diesel, it can be blended into petroleum diesel at any level, unlike biodiesel, which can be blended at rates of between 2% and 20% of diesel fuel by volume. Because of these advantages over biodiesel, as well as increasing renewable fuel standards at both state and federal levels, both new renewable diesel production facilities and existing petroleum refinery capacity converted into renewable diesel production have experienced significant investment in the United States recently.

Renewable diesel is often produced at a biorefinery or by co-processing at a petroleum refinery. Feedstocks are typically processed via hydrotreating, gasification, or pyrolysis. Facilities must also account for other aspects of renewable diesel production, such as feed pretreatment and processing coproducts such as renewable liquefied petroleum gas (LPG) and naphtha. Some U.S. refiners are assessing the viability of converting current petroleum processing capacity to renewable diesel production capacity with existing equipment. For example, as a result of the challenging market conditions for traditional petroleum-based fuels and increasing market interest in renewable diesel production, a number of refineries have closed in the past year, and many of these facilities have announced plans to reopen as renewable diesel plants.

One such refinery is Marathon Petroleum’s refinery in Martinez, California. Since closing the facility in 2020, Marathon has announced that it will begin converting the refinery to produce renewable diesel. Marathon expects the facility will start producing renewable diesel in 2022 and will reach its full production capacity of 730 million gal/y (48,000 b/d) in 2023.

The Phillips 66 refinery in Rodeo, California, is also undergoing reconfiguration. The Phillips 66 Rodeo Renewed project would produce 800 million gal/y (52,000 b/d) of renewable fuels when completely converted, making it the world’s largest facility of its kind. Phillips 66 has already completed its initial diesel hydrotreater conversion and begun producing renewable diesel. It expects to complete the second phase of the conversion by 2024.

In addition to its flexibility in existing petroleum infrastructure, renewable diesel receives some of the most favorable greenhouse gas (GHG) reduction scores among existing fuel pathways for programs such as the Renewable Fuel Standard (RFS) and the California Low-Carbon Fuel Standard (LCFS). As a result, participants in those programs are increasingly using renewable diesel to meet rising renewable fuel targets, which has driven renewable diesel to the most demand growth among domestic biofuels over the last five years. The significant growth in new domestic renewable diesel production capacity has positioned renewable diesel to displace some imported volumes of renewable diesel.

Given the strong demand for renewable diesel to meet LCFS targets in California, nearly all U.S. imports of renewable diesel enter the country on the West Coast (PADD 5). Although the majority of existing domestic renewable diesel production capacity is on the Gulf Coast (PADD 3) near existing refineries, the vast majority of renewable diesel is consumed in California and other West Coast markets. As a result, the majority of estimated new renewable diesel capacity will likely be built on the West Coast to serve nearby markets, and the remainder will likely be built on the Gulf Coast to capitalize on existing refinery infrastructure (Figure 2).

Although the expected buildout in renewable diesel production capacity is substantial, it will still be relatively small compared with existing petroleum diesel refining capacity. Based on our estimates of current proposed renewable diesel capacity expansions and existing petroleum refinery capacity, renewable diesel production capacity could represent 20% of total diesel production on the West Coast by 2024. In contrast, by 2024, it could represent 4% of total estimated diesel production capacity in the major refining complex on the Gulf Coast and 5% across the United States. In addition, although we expect significant capacity to be built on the Gulf Coast, we anticipate that a large portion of the Gulf Coast’s output will be consumed in California and other western states such as Oregon and Washington to meet future LCFS program targets in those areas.

One of the primary risks to the accelerated expansion in renewable diesel production capacity centers on feedstock availability. Currently, most renewable diesel is produced using recycled animal fats, used cooking oil, or other marginal oil feedstocks, the supply of which has increasingly tightened as renewable diesel production has increased. Renewable diesel can also be produced using other oil feedstocks such as soybean oil, which has created competition between biodiesel producers and food producers in global agricultural markets.

To date in 2021, these feedstocks have faced lower supply and higher demand, leading to sharp increases in agricultural commodity prices and prices of renewable identification number (RIN) credits for RFS compliance. RIN prices reached record highs earlier this year. Due to these high feedstock costs, to remain profitable and compete with petroleum diesel, renewable diesel and biodiesel producers have been relying heavily on incentives such as the biomass-based diesel tax credit and high tradeable credit prices for renewable diesel in the RFS and LCFS. Feedstock availability and government incentives will likely continue to play a large role in the financial viability of new renewable diesel production capacity in the near term.