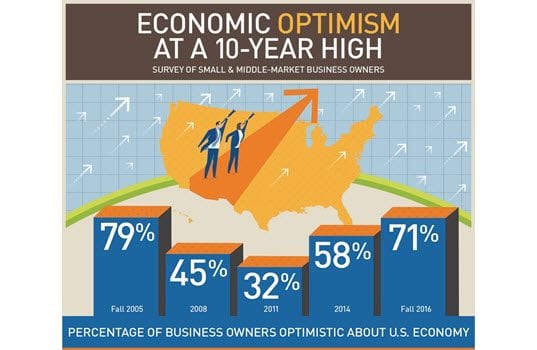

Owners of small and mid-sized businesses are upbeat about the U.S. economy amid steady expectations for their sales and hiring during the next six months, according to the latest PNC Economic Outlook Survey findings.

The fall findings of PNC’s biannual telephone survey, which began in 2003, reveal that 71% are optimistic about the national economy, the most since 2005, and up from 55% in the spring. Meanwhile, 77% are optimistic about their local economy, the highest since 2014.

Asked what term best describes their feelings about the business climate during the next six months, “hope” was chosen by 55%. This compares to 16% for “enthusiasm.” On the negative side, 11% chose “fear” and 4% picked “despair.”

Outlook: Stable Sales and Prices, Limited Hiring

Half (51%) expect their sales to increase during the next six months and 47% say profits will rise–consistent with the past two surveys.

At the same time, 22% expect to hire new full-time employees compared to 24% in the spring. Most (67%) will maintain the same number of full-time workers while only 8% will reduce staff.

“The glass for small business owners appears half full instead of half empty, but they aren’t ready to buy a round for everyone,” said Stuart Hoffman, PNC’s Chief Economist. “We expect to see moderate economic growth for the rest of this year with enough improvement for a federal funds rate increase at the Federal Open Market Committee’s meeting in December.”

If the survey results are a bellwether, inflation may remain in check. Price pressures have eased significantly as 37% expect supplier prices to increase, down from 44% in spring and 50% one year ago. One quarter (23%) expect to raise their own prices versus 29% in spring and 28% one year ago.

Findings: Election, Overtime Pay, Cyber Fraud

When asked about the presidential election, business owners are dissatisfied. Two-thirds (65%) say they are not satisfied with how Hillary Clinton and Donald Trump are addressing the issues most important to them as business owners, a substantial increase from 53% in the spring.

Other PNC survey results included:

- Overtime Pay Rule–Limited Impact on Hiring: New regulations on overtime take effect December 1, 2016. Four in ten owners have at least one employee they expect to be covered by the new law. Few expect it to affect their hiring: just one in ten say they would reduce their workforce or cut back in hiring while nearly eight in ten say it would not affect hiring in any way. Five percent say they would hire more part-time employees.

- Fraud Mitigation: One in ten (9%) say they have been a victim of an information security breach. Nine in ten say they take at least one precaution, the most common being antivirus software and backing up data. Next are firewall/encryption and establishing security practices and policies for sensitive information.

The PNC Financial Services Group, Inc. is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management.