MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

February 7, 2020: Oil prices are continuing to fall, as coronavirus continues to spread. Twenty-eight countries now have confirmed cases of 2019-nCoV. Over 31,500 cases have been reported, with 638 deaths. U.S. oil inventories rose once again. Two key events this week brought market optimism, which then was extinguished: First, a spot of optimism arrived midweek when researchers in China announced the development of a treatment for the disease, while a team in the U.K. reported success with a vaccine. But the severity of the disease was reinforced by the quarantine of a cruise ship in Japan, where 61 people have been quarantined. Second, the OPEC+ group began to discuss deeper production cuts, which strengthened prices. But the gains were erased overnight when the group did not reach consensus. Today, however, a robust U.S. Jobs Report has just been released, showing 225,000 jobs formed in January 2020, which should give a boost to markets today. WTI crude futures prices opened at $51.11/b this morning. Prices dipped below $50/b during the week. WTI prices currently are in the $50.00-$51.00/b range. The week appears to be headed for a finish in the red, the sixth weekly decline in a row.

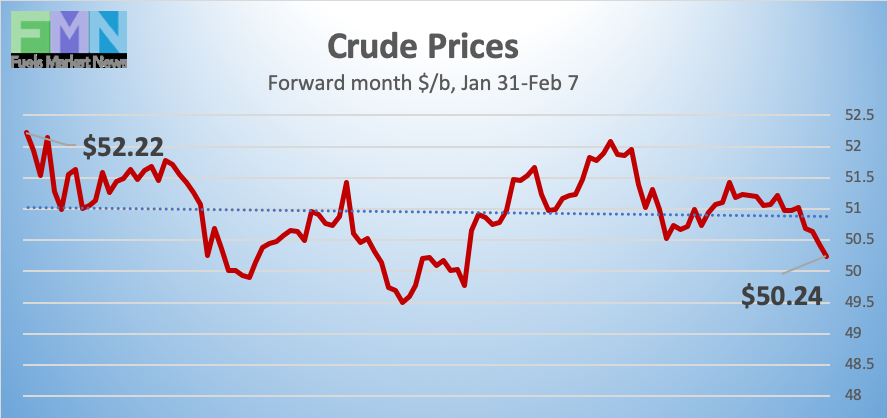

WTI futures crude prices opened on Friday, January 31, at $52.92/b, and prices slid to an open of $51.11/b today, down by $1.81/b. WTI futures prices dipped below $50/b midweek. Tuesday’s low point of $49.31 was the lowest since May 2017. Gasoline and diesel prices also continued to fall, following crude down, though diesel prices have retained relative strength. Our weekly price review covers hourly forward prices from Friday, January 31st, through Friday, February 7th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

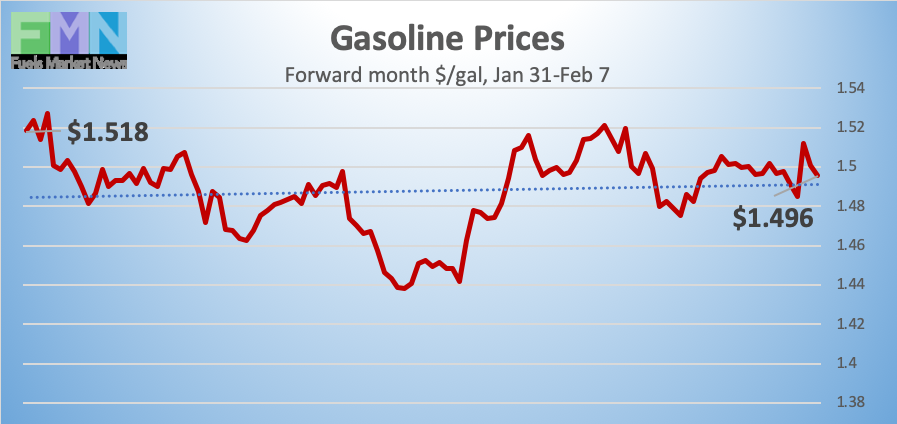

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.5328/gallon on Friday, January 31, and prices slid to open at $1.4981/gallon on Friday, February 7. This was a decline of 3.47 cents (2.3%.) Gasoline futures prices ranged this week from a low of $1.4345/gallon on Tuesday to a high of $1.5254/gallon on Thursday, a large range of 9.09 cents. U.S. average retail prices for gasoline fell by 5.1 cents/gallon during the week ended February 3rd. Gasoline prices currently are showing an uptick. Trades are occurring mainly in the range of $1.48-$1.52/gallon. The latest price is $1.5106/gallon.

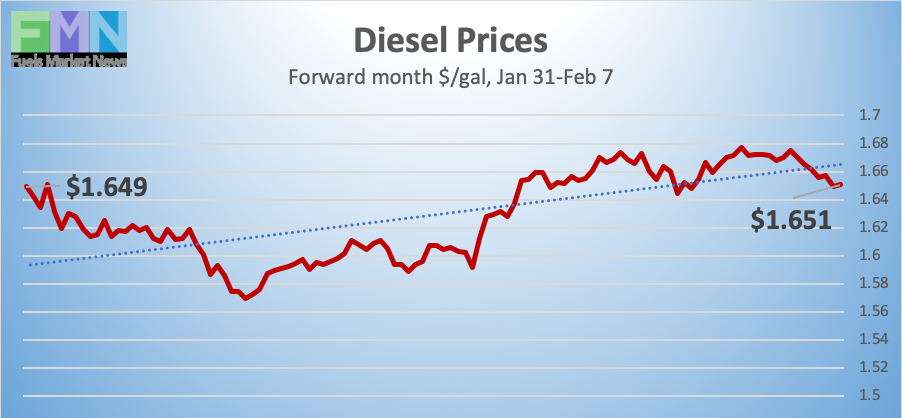

DIESEL PRICES

Diesel opened on the NYMEX at $1.6677/gallon on Friday, January 31, and opened on Friday, February 7, at $1.6712/gallon, up slightly by 0.35 cents (0.2%.) U.S. average retail prices for diesel fell by 5.4 cents/gallon during the week ended February 3rd. Diesel futures prices spanned a wide range this week, ranging from a high of $1.6783/gallon on Thursday to a low of $1.5684/gallon on Tuesday, a range of 10.99 cents. Prices are recovering currently. If the upward movement is sustained, the week may finish slightly in the black, which would break a five-week string of price declines. Contracts have been trading in the $1.64-$1.67/gallon range. The latest price is $1.6503/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, January 31, at $52.92/b. Prices opened at $51.11/b today, a drop of $1.81 (3.4%.) Prices fell every day except for Thursday this week. Tuesday brought a low point of $49.31/b. The coronavirus outbreak was the chief market mover, though an addition to U.S. oil inventories also weighed on prices. Hopes for a vaccine and a treatment are emerging, though there is no firm news. The week appears to be heading for a finish in the red, which would be the sixth consecutive weekly decline. WTI futures prices currently are trading mainly in the range of $50.00-$51.00/b. The latest price is $50.23/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices continued to fall this week, as the coronavirus continued to spread. Twenty-eight countries now have confirmed cases of 2019-nCoV. Over 31,500 cases have been reported, with 638 deaths. Two key events this week brought market optimism, which then was extinguished: First, a spot of optimism arrived midweek when researchers in China announced the development of a treatment for the disease, while a team in the U.K. reported success with a vaccine. But the severity of the disease was reinforced by the quarantine of a cruise ship in Japan, where 61 people have been quarantined. Toyota Motor Corp. and Honda Motor Co. have extended shutdowns at their manufacturing plants in China. Second, the OPEC+ group began to discuss deeper production cuts, which strengthened prices. But the gains were erased overnight when the group did not reach consensus. Saudi Arabia has been pressing for deeper cuts, while Russia is not convinced of the need. WTI crude futures prices opened at $51.11/b this morning. This week, WTI prices dipped below $50/b. WTI prices currently are in the $50.00-$51.50/b range. The week appears to be headed for a finish in the red, the sixth weekly decline in a row.

Looking back, the SARS (Severe Acute Respiratory Syndrome) outbreak in 2003 was a coronavirus, which infected over 8000 people and had a 10% fatality rate. The SARS outbreak caused crude prices to fall by over 20%. Brent crude spot prices averaged $32.77/b in February 2003, and prices dropped to an average of $25/b in April 2003. WTI crude spot prices dropped from $35.83/b in February 2003 to $28.17/b in April 2003. April was the month that the World Health Organization issued a global health alert about SARS. The WTI futures price averaged $59.86/b in December. If 2019-nCoV causes a similar drop, WTI prices could fall to approximately $47.30/b.

Today, however, a robust U.S. Jobs Report has just been released, showing 225,000 jobs formed in January 2020, which should give a boost to markets today. Job gains focused on construction, health care, transportation, and warehousing. Economists had expected jobs formation at 165,000. The unemployment rate edged up to 3.6 percent, from 3.5 percent in December 2019.

On Tuesday, the American Petroleum Institute (API) reported a stock build of 4.18 mmbbls to U.S. crude oil inventories. The API also reported a stock build of 1.96 mmbbls of gasoline and a drawdown of 1.78 mmbbls from diesel inventories. Industry experts had anticipated additions to inventories of crude oil and gasoline, and a very small diesel stock draw. The API’s net inventory build was 4.36 mmbbls.

The U.S. Energy Information Administration (EIA) released a less bearish set of official statistics: an addition to crude stocks of 3.355 mmbbls, a drawdown of 0.091 mmbbls from gasoline stockpiles, and a drawdown from distillate stockpiles of 1.512 mmbbls. The EIA net result was an inventory build of 1.752 mmbbls.

The EIA also reported that U.S. crude production fell off its record-high 13.0 mmbpd, declining to 12.9 mmbpd during the week ended January 31st. Approximately 1.2 mmbpd was added to U.S. crude oil output in 2019.