MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

November 1, 2019: Crude prices shed last week’s gains, largely in response to an unexpected addition to crude oil inventories, a hurdle in the U.S.-China trade war, and Russia’s standoffish stance toward a deeper production cut. Countering this, the Fed cut interest rates by 0.25%, and the U.S. economy has so far resisted recession. The labor market remains strong, with unemployment remaining unchanged at 3.6% in October, and nonfarm payroll rising by 128,000, significantly above forecasts. WTI futures crude prices opened on Friday, October 25 at $56.07/b, and prices declined to an open of $54.15/b today, a drop of $1.92/b. Currently, prices are recovering, and WTI is hovering around $55/b. This week appears to be heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, October 25 through Friday, November 1. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.6595/gallon on Friday, October 25, and prices opened at $1.5946/gallon on Friday, November 1. This was a drop of 6.49 cents (3.9%.) Note that futures contracts switched to December forward month, so the weekly chart does not show the November starting basis price. Gasoline futures had risen for the three prior weeks. U.S. average retail prices fell by 4.2 cents/gallon during the week ended October 28th. This morning, futures prices are trending back up, recapturing lost ground. The week appears to be heading for a finish in the red when November forward prices are considered. Trades are occurring mainly in the range of $1.59-$1.63/gallon. The latest price is $1.6242/gallon.

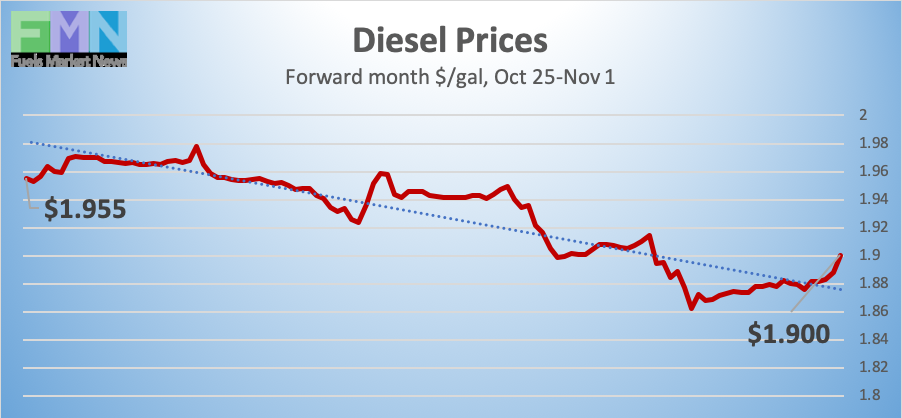

DIESEL PRICES

Diesel opened on the NYMEX at $1.9838/gallon on Friday, October 25 and opened on Friday, November 1 at $1.8749/gallon, down significantly by 10.89 cents (5.5%.) Note that futures contracts switched to December forward month, so there is a discontinuity in the price series. Prior to this week, diesel prices had risen for three consecutive weeks. Diesel futures prices are trending back up in early morning trades, but the upward momentum is now slowing. The week appears to be heading for a finish in the red. Contracts currently are trading in the $1.87-$1.91/gallon range. The latest price is $1.8987/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, October 25 at $56.07/barrel and declined to an open of $54.15/barrel on Friday, November 1, a decline of $1.92/b (3.4%.) This handed back the $1.98/b gain accomplished last week, when WTI futures hit highs over $56.50/b. Futures contracts switched to December forward month. Crude prices are rising this morning in early trades, though the week still appears to be heading for a finish in the red. WTI crude is trading mainly in the range of $54.00/b-$55.00/b. The latest price is $54.86/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices sagged this week, handing back last week’s gains. WTI crude prices dropped by nearly $2/b Friday-to-Friday. A strong U.S. Jobs report is likely to boost markets today, and prices are recovering in early trades. WTI prices are hovering under $55/b currently. Supplies increased this week, with U.S. production remaining at its record-high 12.6 mmbpd level, inventories growing once again. Internationally, the OPEC+ producers group potentially lost some potency when Russia demurred from agreeing to cut production further in December. Demand side worries were elevated when China indicated that it would not budge on some of the key issues in U.S.-China trade negotiations. The trade war is expected to carry on.

The U.S. economy is resisting recession, but growth has fallen far short of the promised 3%+ promised by the Trump Administration. In the 3rd quarter of 2019, inflation-adjusted GDP grew at an annualized rate of 1.9%. This was down from 2.0% in the second quarter. Markets reacted favorably to a rate cut by the Fed this week, though the Fed signaled that additional cuts were not to be expected this year. The jobs market continues to be strong. This morning, the Bureau of Labor Statistics released the October Employment Situation Report. The unemployment rate was unchanged at 3.6%, and total nonfarm payroll employment rose by 128,000 jobs, beating expectations.

Fuel prices received support Tuesday when the American Petroleum Institute (API) reported across-the-board drawdowns from inventories: 0.7 million barrels (mmbbls) from U.S. crude stockpiles,1.6 mmbbls from gasoline inventories, and 4.7 mmbbls from diesel inventories. Market experts had predicted a small crude build outweighed by drawdowns of gasoline and diesel. The API’s net inventory draw was a 7.0 mmbbls.

Prices waned when the EIA released official statistics on Wednesday. The EIA reported a stock build of 5.702 mmbbls of crude. Gasoline and diesel inventories fell by 3.037 mmbbls and 1.032 mmbbls respectively. The net result was an inventory build of 1.633 mmbbls.

The EIA also reported that U.S. crude production was maintained at its record-high level of 12.6 mmbpd for the fourth week running. This has been accomplished despite a steady downward trend in active oil and gas rigs. The Bake Hughes rig count showed a weekly drop of 21 active rigs during the week ended October 25th. For the year to date, 245 rigs have exited the field.