Analysis by Dr. Nancy Yamaguchi

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended September 2, 2019. Data was delayed in honor of the Labor Day holiday. Prices for both fuels continued to fall, though at a modest rate. On a national average basis, retail prices for gasoline fell by 1.1 cents/gallon for the week. National average prices for gasoline were 26.1 cents/gallon below where they were in the same week one year ago. On a national average basis, retail prices for diesel decreased by 0.7 cents/gallon. National average prices for diesel were 27.6 cents/gallon lower than they were in the same week last year.

Futures Prices and Retail Price Outlook

During the week August 23-August 3, 2019, West Texas Intermediate (WTI) crude futures rose by $3.38/b (6.3%.) Gasoline futures prices fell by 5.94 cents/gallon (3.6%.) Diesel futures prices increased by 4.1 cents/gallon (2.28%.) Although the relationship between futures market prices and retail prices is not immediate and one-for-one, the most recent trend in futures prices suggests that gasoline prices will weaken while diesel prices will rise in the coming week. Markets have been volatile, however, because of uncertainty concerning the U.S.-China trade war.

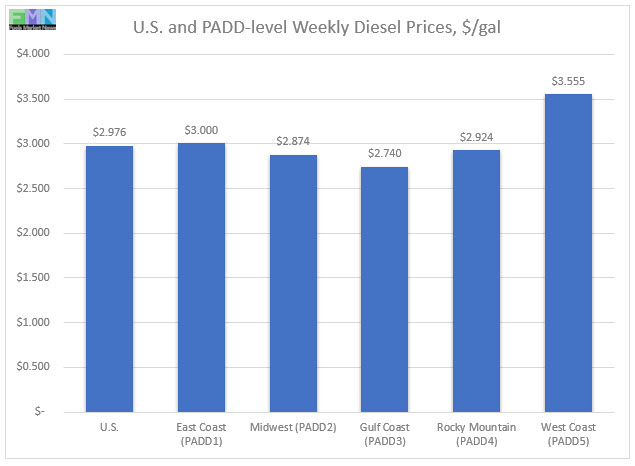

Retail Diesel Prices

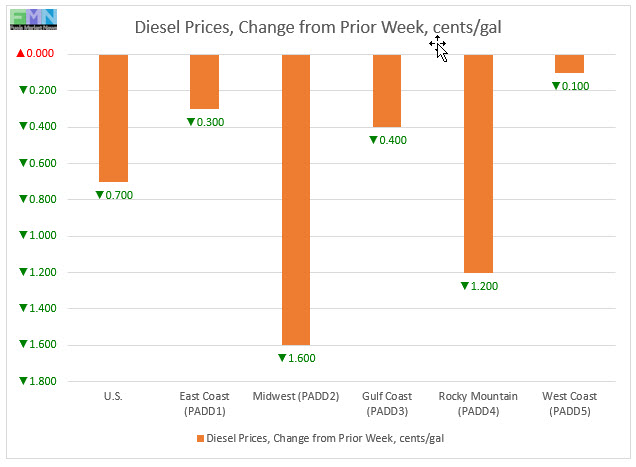

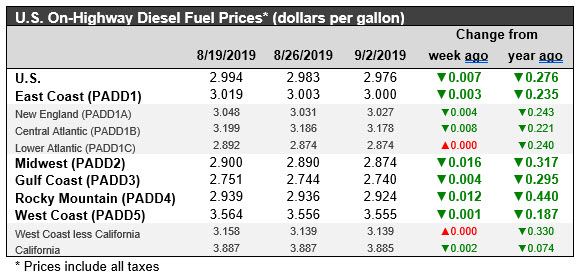

For the current week ended September 2nd, retail diesel prices fell by 0.7 cents to settle at an average price of $2.976/gallon. This is the third consecutive week that national average retail prices have been below the $3/gallon mark. Between mid-October and late-January, retail diesel prices fell for fourteen consecutive weeks. During those fourteen weeks, the price decline totaled 42.9 cents/gallon. From February through April, diesel prices crept back up by 20.4 cents/gallon. The month of May brought a modest reversal in the upward trend in diesel prices. During the five weeks of June including the week ended July 1st, diesel prices fell more substantially, declining by 10.9 cents/gallon. For the current week ended September 2nd, diesel prices declined in all PADDs, though the price change was modest. The national average price for the week was 27.6 cents/gallon below where it was during the same week last year.

In the East Coast PADD 1, diesel prices fell by 0.3 cents to arrive at an average price of $3.000/gallon. Within PADD 1, New England prices fell by 0.4 cents to average $3.027/gallon. Central Atlantic diesel prices fell by 0.8 cents to average $3.178/gallon. Lower Atlantic prices were unchanged at an average price of $2.874/gallon. PADD 1 prices were 23.5 cents/gallon below their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 1.6 cents to average $2.874/gallon. This was the largest price decrease among the PADDs. Prices were 31.7 cents/gallon below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17th in having diesel prices fall below $3/gallon.

In the Gulf Coast PADD 3, retail diesel prices declined modestly by 0.4 cents to average $2.740/gallon. PADD 3 typically has the lowest diesel prices among the PADDs. Prices were 29.5 cents lower than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices fell by 1.2 cents to arrive at an average of $2.924/gallon. Nine weeks ago, PADD 4 joined PADDs 3 and 2 in having diesel prices below $3/gallon. PADD 4 prices were 44.0 cents lower than for the same week in the prior year. This is the largest year-on-year price drop among the PADDs.

In the West Coast PADD 5 market, retail diesel prices edged down by 0.1 cent to settle at an average of $3.555/gallon. PADD 5 prices were 18.7 cents below their level from last year. Prices excluding California remained flat at an average of $3.139/gallon. This price was 33.0 cents below the retail price for the same week last year. California diesel prices declined by 0.2 cents to settle at an average price of $3.885/gallon. Until the week ended June 24th, California had been the only major market where diesel prices were above $4/gallon. The state’s prices had been above the $4/gallon mark for nine weeks. California diesel prices were 7.4 cents lower than they were at the same week last year.

Retail Gasoline Prices

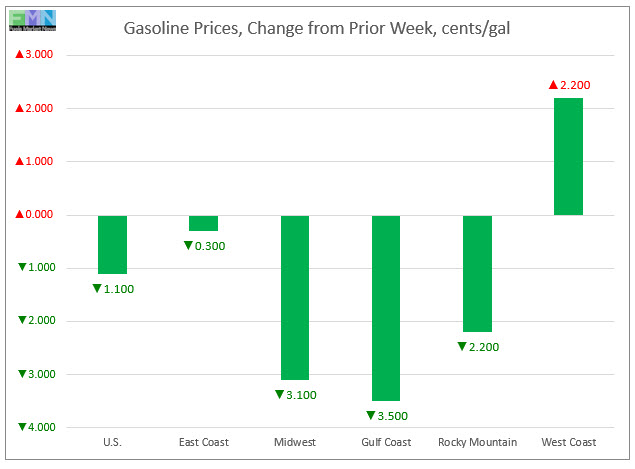

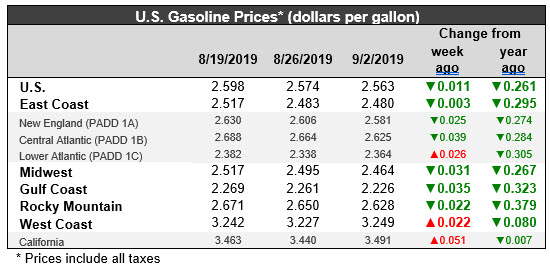

U.S. retail gasoline prices fell by 1.1 cents/gallon to settle at an average of $2.563/gallon during the week ended September 2nd. Prices fell in all PADDs except for the West Coast PADD 5. Retail prices for the current week were 26.1 cents per gallon lower than they were one year ago. Gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for fourteen weeks in a row, shedding a total of 66.6 cents per gallon. In the next seventeen weeks, prices marched back up by 66.0 cents/gallon. Prices came very close to the peak they hit in early October, before the months of May and the June brought an easing of prices. Gasoline prices in May and June retreated by 23.3 cents per gallon. The week ended July 1st reversed that downward trend and sent prices up once again.

During the first three weeks of July, gasoline prices rose by 12.5 cents/gallon. This outpaced the increases in crude oil and diesel prices mainly because of the explosion and fire at the 335,000-bpd, gasoline-maximizing Philadelphia Energy Systems (PES) refinery. Tropical Storm Barry then caused an uptick in prices as it disrupted oil production, refining and distribution. Fortunately, the storm was less severe than expected. Prices began to relax, and they have now fallen for seven consecutive weeks beginning with the week of July 22nd, with a total price drop of 18.7 cents/gallon.

For the current week ended September 2, East Coast PADD 1 retail prices for gasoline declined by 0.3 cents to average $2.480/gallon. The average price was 29.5 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices fell by 2.5 cents to average $2.581/gallon. Central Atlantic market prices fell by 3.9 cents to average $2.625/gallon. Prices in the Lower Atlantic market rose by 2.6 cents to arrive at an average of $2.364/gallon.

In the Midwest PADD 2 market, retail gasoline prices fell by 3.1 cents to settle at an average price of $2.464/gallon. PADD 2 prices for the current week were 26.7 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices fell by 3.5 cents to average $2.324/gallon. This was the largest price drop among the PADDs. PADD 3 continues to have the lowest average prices among the PADDs, currently 33.7 cents/gallon below the average U.S. price. Prices for the week were 32.3 cents lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices declined by 2.2 cents to settle at an average price of $2.628/gallon. This week’s prices were 37.9 cents lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices rose by 2.2 cents to arrive at an average of $3.249/gallon. This was the only price increase among the PADDs. PADD 5 continues to have the highest gasoline prices among the five PADDs. It is the only PADD where retail prices continue to exceed $3/gallon. Prices were 8.0 cents below last year’s level. Excluding California, West Coast prices declined by 1.2 cents to average $2.958/gallon. This price was 16.5 cents lower than at the same time last year. In California, pump prices rose by 5.1 cents to average $3.491/gallon. California prices were 0.7 cents per gallon below their levels from the same week last year.