Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

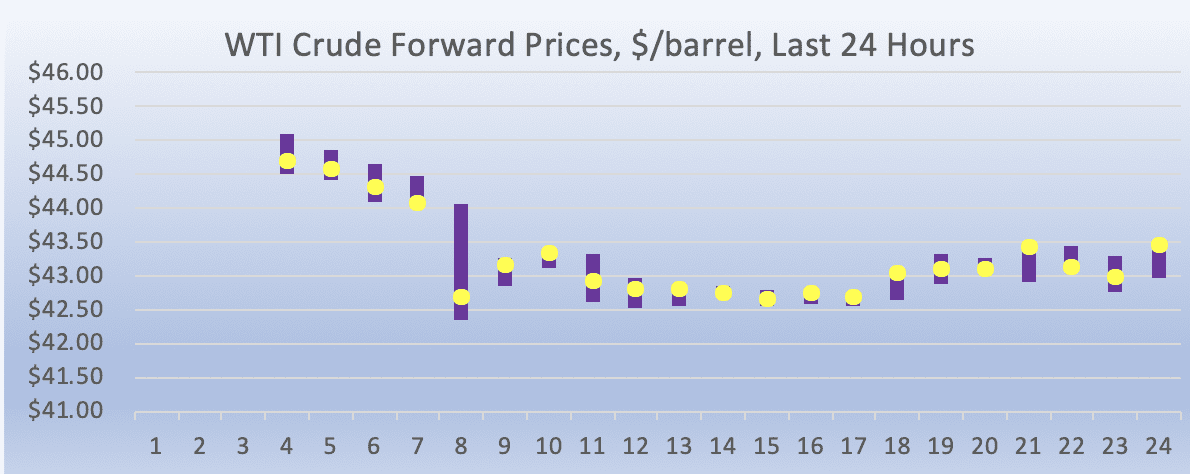

Markets continued to sink over the Christmas holiday. The “Santa Rally” never arrived to rescue stock markets. The Dow Jones Industrial Average plummeted by 653 points (2.91%,) adding to the eye-widening losses from the prior two sessions. Crude oil futures prices continued to sink. WTI (West Texas Intermediate) crude forward prices opened at $42.85/b today, a drop of $2.60 (5.72%) from Monday’s opening price of $45.45/b. Gasoline and diesel forward prices also opened with losses today. Currently, the downward trend has levelled off, and prices are recovering as traders return after the holiday to cover any overselling.

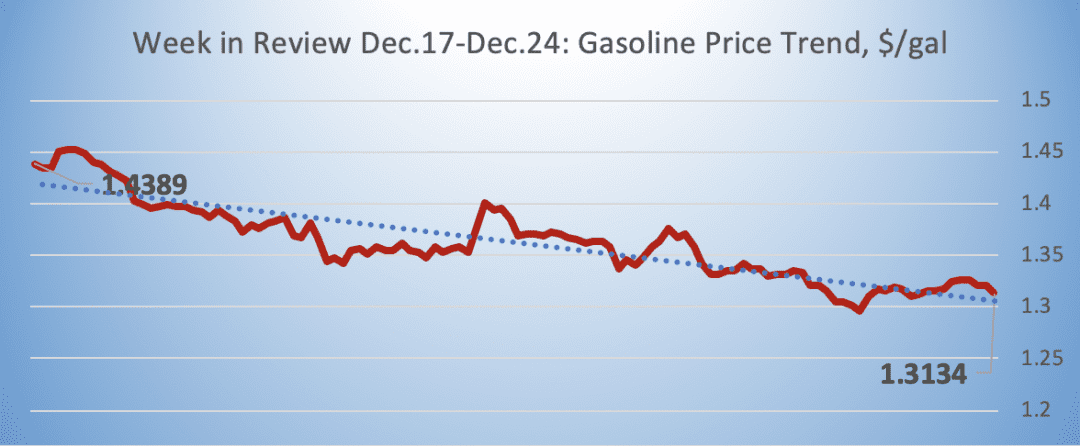

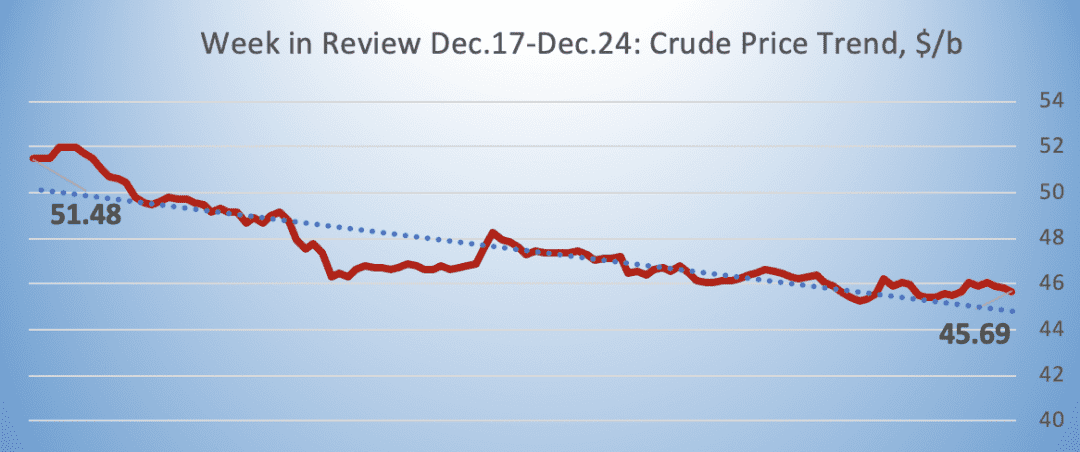

During the week ended December 21st, WTI crude forward prices collapsed by $5.66/b (11.0%.) WTI prices started the week at $51.25/b, and they ended on Friday at $45.59/b. Diesel forward prices opened on Monday at $1.8452/gallon and closed on Friday at $1.7327/gallon, a loss of 11.25 cents/gallon (6.1%.) Gasoline forward prices opened on Monday at $1.4362/gallon, and they fell by 11.79 cents (8.2%) to end on Friday at $1.3183/gallon.

This morning, stock markets in Asia and Europe are opening shakily, indicating that Wall Street may have another volatile session. The Dow Jones opened with a recovery of 175 points this morning, as investors cautiously re-enter. President Trump and Congress adjourned on Friday without agreement, bringing the Federal Government into partial shutdown. Fallout continued over the resignation of U.S. Defense Secretary Jim Mattis, exacerbated when President Trump abruptly cut short the transition period between Secretary Mattis and his temporary replacement. President Trump blamed the Federal Reserve for the stock market crash, and he instructed staff to explore whether he could fire Fed Chairman, Jerome Powell. The chaos added to the worst Christmas Eve for the stock market on record.

OPEC announced that it could call an “extraordinary meeting” to discuss extending the production cuts of 1.2 million barrels per day (mmbpd.) The cuts are to begin in the New Year, but prices have collapsed by roughly $25/b since October. Many analysts believe that prices will stabilize once the cuts take effect in the first half of 2019. The fresh OPEC announcement may be a way to keep attention on the upcoming cuts. The latest round of selloffs may be driven more by the drop in equities markets than by the fundamental supply-demand balance.

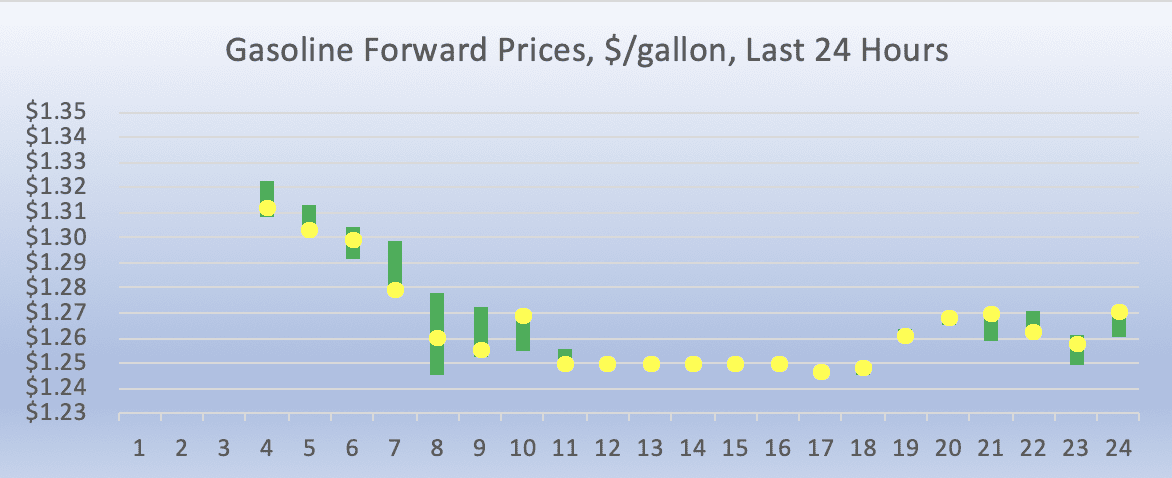

GASOLINE

Gasoline opened on the NYMEX at $1.26/gallon today, a drop of 5.15 cents (3.87%) from Monday’s opening price of $1.3115 cents/gallon. Since Monday at 9AM EST, gasoline prices fell by 4.77 cents/gallon (3.65%.) Currently, gasoline prices are recovering. The latest price is $1.2828/gallon.

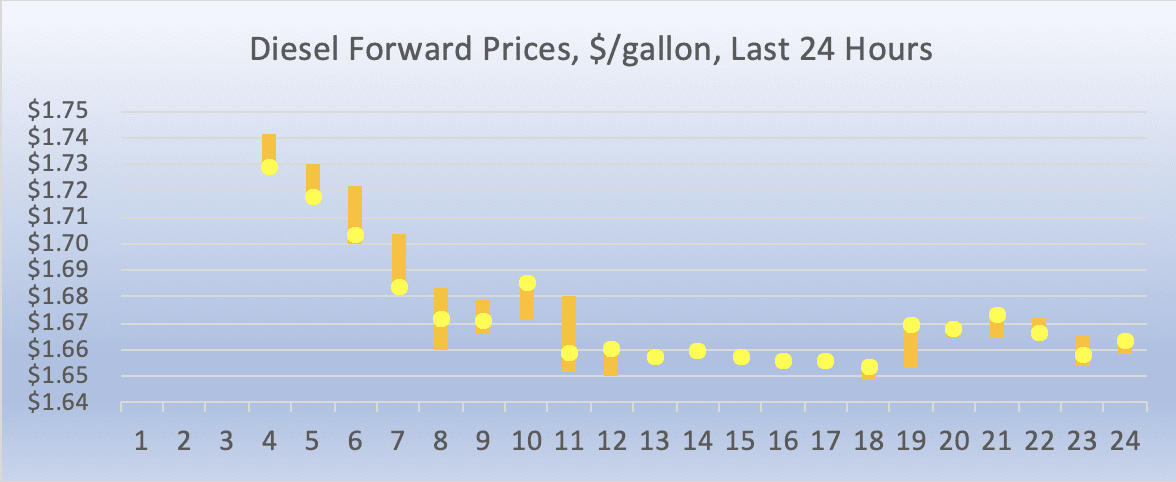

DIESEL

Diesel opened on the NYMEX at $1.671/gallon today, a drop of 6.33 cents (3.61%) from Monday’s opening price of $1.7343/gallon. Since Monday at 9AM EST, diesel prices fell sharply by 7.78 cents/gallon (4.48%.) Diesel prices currently are recovering. The latest price is $1.69/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $42.85/b today, a drop of $2.60 (5.72%) from Monday’s opening price of $45.45/b. This was the sixth consecutive session that WTI prices have opened below $50/b. It was the lowest opening price since February 2016. Since Monday at 9AM EST, crude futures prices have fallen by $1.82/b (4.06%.) Until just the past two weeks, WTI lows have not dipped below $50/b, much less below $43/b. Prices currently are rising. The latest price is $44.12/b.