Forecast Highlights

Release Date: July 7, 2020

- The July Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty because mitigation and reopening efforts related to the 2019 novel coronavirus disease (COVID-19) continue to evolve. Reduced economic activity related to the COVID-19 pandemic has caused changes in energy supply and demand patterns in 2020. Uncertainties persist across the U.S. Energy Information Administration’s (EIA) outlook for all energy sources, including liquid fuels, natural gas, electricity, coal, and renewables. The STEO is based on U.S. macroeconomic forecasts by IHS Markit, which assumes U.S. gross domestic product declined by 6.4% in the first half of 2020 from the same period a year ago before rising from the third quarter of 2020 through 2021.

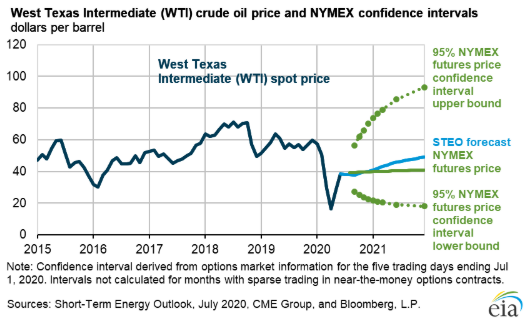

- Daily Brent crude oil spot prices averaged $40 per barrel (b) in June, up $11/b from the average in May and up $22/b from the multiyear low monthly average price in April. Oil prices rose in June as numerous regions worldwide began to lift stay-at-home orders and as global oil supply fell as a result of production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+). In June, OPEC+ announced that they extended through July their period of deepest cuts that had been set to relax on July 1. EIA expects monthly Brent spot prices will average $41/b during the second half of 2020 and rise to an average of $50/b in 2021, $4/b and $2/b higher than forecast in last month’s STEO, respectively.

- The forecast of rising crude oil prices reflects EIA’s expectation of declines in global oil inventories during the second half of 2020 and through 2021. EIA expects high inventory levels and surplus crude oil production capacity will limit upward price pressures in the coming months, but as inventories decline into 2021, those upward price pressures will increase. EIA estimates global liquid fuels inventories rose at a rate of 6.7 million barrels per day (b/d) in the first half of 2020 and expects they will decline at a rate of 3.3 million b/d in the second half of 2020 and then decline by a further 1.1 million b/d in 2021.

- EIA expects annual average U.S. crude oil production to fall in 2020 and 2021 as forecast West Texas Intermediate (WTI) spot prices remain less than $50/b through 2021. EIA forecasts that U.S. crude oil production will average 11.6 million b/d in 2020 and 11.0 million b/d in 2021. These levels are 0.6 million b/d and 1.2 million b/d, respectively, lower than the 2019 average of 12.2 million b/d. EIA finalized this month’s forecast before a U.S. District Court ordered on July 6 the temporary closure of the Dakota Access Pipeline. The operators of the pipeline have announced they will file a motion to stay the decision.

- EIA forecasts U.S. liquid fuels consumption will average 18.3 million b/d in 2020, down 2.1 million b/d from 2019. Declines in U.S. liquid fuels consumption vary across products. From 2019 to 2020, EIA expects jet fuel consumption to fall by 31% and gasoline and distillate fuel consumption to both fall by 10%. The declines reflect travel restrictions and reduced economic activity related to COVID-19 mitigation efforts. EIA expects the largest declines in U.S. liquid fuels consumption have already occurred and consumption will generally rise through the second half of 2020 and in 2021. EIA forecasts U.S. liquid fuels consumption will average 19.9 million b/d in 2021.

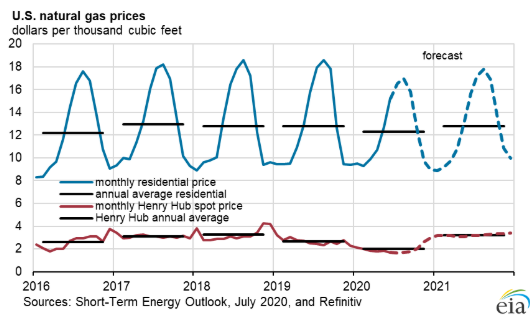

- EIA expects U.S. dry natural gas production to average 89.2 billion cubic feet per day (Bcf/d) in 2020, down from 92.2 Bcf/d in 2019. This 3% decrease is the result of falling natural gas prices that caused a decline in drilling activity and production curtailments. EIA expects annual average dry natural gas production in the United States will decline by 6% in 2021 to 84.2 Bcf/d. However, EIA expects production to increase during the second half of 2021 as natural gas prices in the forecast rise.

- EIA expects U.S. natural gas consumption will decline by 3% in 2020. The main driver of the decline is lower consumption in the industrial sector because of COVID-19 mitigation efforts and related reductions in economic activity. Forecast U.S. natural gas consumption declines by 5% in 2021 as a result of expected rising natural gas prices. The rising prices will reduce the use of natural gas in the electric power sector, which will more than offset increases in natural gas consumption in the industrial, commercial, and residential sectors.

- The Henry Hub natural gas spot price averaged $1.63 per million British thermal units (MMBtu) in June, the lowest inflation-adjusted price going back to at least 1989, as a result of low demand. EIA expects falling production will put upward pressure on natural gas prices through the end of 2021. EIA forecasts that Henry Hub spot prices will average $1.93/MMBtu in 2020 and $3.10/MMBtu in 2021.

- EIA forecasts working natural gas in storage will reach 4,039 billion cubic feet (Bcf) at the end of October, which would be the most U.S. natural gas in storage as of the end-of-October on record. This forecast level surpasses the previous end-of-October record of 4,013 Bcf reached in October 2016.