Crude Oil Prices Supported by Bullish Conditions

- Heightened Brent prices reflect Middle East tensions.

- Other regional and transitory events add to supply concerns

- Some analysts project Brent crude oil at mid-$ ’80s in 2019

- Local natural gas prices rising; could herald a price bottom

The Matrix

Events in the Middle East have heightened tensions in oil markets. They have accentuated concerns over global availability of crude oil. Anxiety can be seen in action in the price of Brent crude oil. The futures price of nearby Brent crude oil has gained around $3.50 since May 6.

A round of provocations against Saudi Arabia emphasizes how tenuous the political situation has become. Two tankers have taken fire and oil facilities on land have been attacked. Potential military involvement cannot be excluded and the impact on oil supply could be substantial.

Production limitations are also inhibiting output in Africa. Libya is facing internal political problems. Nigeria faces issues affecting the availability of light, sweet crude oil.

Some events may be ephemeral. We have discussed the contaminated Urals crude oil as a loss of supply. The problem seems to be under control, but it shows the potential problems that can arise in any petroleum system, causing refiners to search for replacement supply with bullish effects on price.

Analysts anticipate Brent to rise to $76 in the third quarter of 2019. There are also projections as high as mid-$80’s under more extreme regional tightness.

The impact of these issues on WTI was remarkably restrained. Where Brent gained about $3.50, WTI crude oil added only a dollar. Certainly, continued high levels of domestic crude oil production induce some level of complacency among crude oil users.

Crude oil has backed up into production regions because pipeline capacity is lagging. The availability of offtake capacity is growing. This should improve crude oil supply in refining and export locations.

The problem of supply availability remains important because of the IMO 2020 mandate which could add more than 1.5 million barrels daily to demand for distillates.

The global crude oil supply outlook is bullish.

Supply/Demand Balances

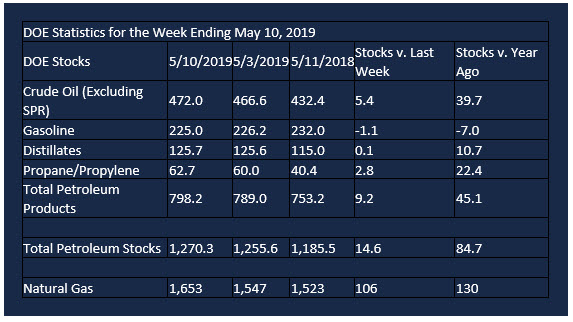

Supply/demand data in the United States for the week ending May 10, 2019, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose 14.6 million barrels during the week ending May 10, 2019.

There were gains in stocks of K-jet fuel, distillates, crude oil, propane, residual fuel oil and other oils. There were declines in stocks of gasoline and ethanol.

Commercial crude oil supplies in the United States grew 5.4 million barrels from the previous report week to 472.0 million barrels.

Crude oil supplies increased in four of the five PAD Districts. PADD 2 (Midwest) crude oil stocks rose 2.0 million barrels, and PADD 5 (West Coast) stocks advanced 0.5 million barrels. PADD 1 (East Coast) stocks added 0.7 million barrels, PADD 3 (Gulf Coast) stocks gained 3.0 million barrels. PADD 4 (Rockies) stocks declined 0.5 million barrels.

Cushing, Oklahoma inventories increased 1.8 million barrels from the previous report week to 47.8 million barrels.

Domestic crude oil production fell 100,000 barrels per day from the previous report week to 12.1 million barrels daily.

Crude oil imports averaged 7.612 million barrels per day, a daily gain of 919,000 barrels. Exports increased 1.025 million 3.347 barrels daily to 2.322 million barrels per day.

Refineries used 90.5 percent of capacity, an increase of 0.6 percentage points from the previous report week.

Crude oil inputs to refineries increased 271,000 barrels daily; there were 16.676 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 291,000 barrels daily to 16.978 million barrels daily.

Total petroleum product inventories rose 9.3 million barrels from the previous report week.

Gasoline stocks decreased 1.1 million barrels daily from the previous report week; total stocks are 225.0 million barrels.

Demand for gasoline fell 723,000 barrels per day to 9.148 million barrels per day.

Total product demand decreased 931,000 barrels daily to 19.477 million barrels per day.

Distillate fuel oil stocks were unchanged from the previous report week; distillate stocks are at 125.6 million barrels. National distillate demand was reported at 4.094 million barrels per day during the report week. There was no weekly reduction in stocks.

Propane stocks increased 2.7 million barrels from the previous report week; propane stocks are 62.7 million barrels. Current demand is estimated at 500,000 barrels per day, a decrease of 230,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Net injections [of natural gas] into storage totaled 106 Bcf for the week ending May 10, compared with the five-year (2014–18) average net injections of 89 Bcf and last year’s net injections of 104 Bcf during the same week. Working gas stocks totaled 1,653 Bcf, which is 286 Bcf lower than the five-year average and 130 Bcf more than last year at this time.

Powerhouse has commented before on ultra-low natural gas prices, especially in the Permian Basin. A price of minus ten cents had been reported at Waha.

This has apparently led to cuts in natural gas production as reflected in strengthening cash prices and announced production reductions. One large producer announced deferral of about 250 MMcf/d. Other producers have acted similarly. The shrinking output could help find a base for natural gas prices.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this memo helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.