U.S. and Europe Seek Alternatives for Russian Oil

- U.S. distillate supplies still falling

- Iran considered as an alternate crude oil source

- Russia blocking renewed Iranian nuclear deal

- U.S. LNG export landscape changing

Sincerely,

Alan Levine, Chairman

Powerhouse

(202) 333-5380

The Matrix

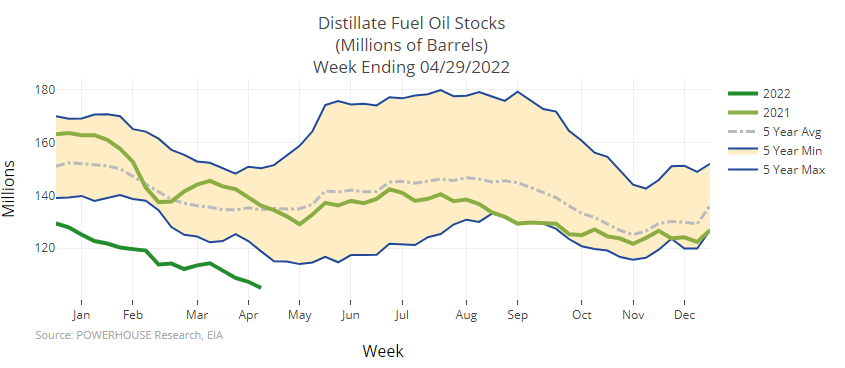

Domestic supplies of distillate fuel oils continued to disappear, following a by-now familiar pattern. The United States lost another 2.3 million barrels of inventory for the week ended April 29, 2022. Local demand increased modestly during the week, and exports of distillate fuels ran at 1.2 million barrels daily for the second week in a row and among the highest level recorded since 2019. One reason for this outsized outflow was supply to the European Union, replacing oil embargoed from Russia.

A more comprehensive constraint on Russian oil exports has now been presented by the European Commission. (The Commission is the EU’s “politically independent executive arm.” It implements decisions of the Council of the EU.) This proposal defers the ban for six months to allow for a smoother transition to new oil sources. The U.S. has been one such source, with expensive implications for domestic supply and price.

Some analysts have looked to Iran for an alternative source of crude oil. Iran can produce two million barrels of oil daily, an obvious benefit to oil-strapped Europe. The Iranian embargo itself must be revived to add this supply.

Ironically, Russia is part of the original agreement. It is a member of the group that oversees compliance. Its approval of a renewed deal may not be required, but China and Iran might not proceed without it.

Negotiations are now underway. Russia is throwing up its own barriers to renewal. It now demands that a “restored nuclear deal must ensure that all its participants have equal rights to develop cooperation in all areas with Iran.” This could interfere with other sanctions already imposed on Russia.

The United States has brushed Russian demands aside, but these are, after all, negotiations. Two million barrels of oil for global demands may depend on their outcome.

Supply/Demand Balances

Supply/demand data in the United States for the week ended April 22, 2022 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose 2.6 million barrels during the week ended April 29, 2022.

Commercial crude oil supplies in the United States increased by 1.3 million barrels from the previous report week to 415.7 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Minus 0.3 million barrels to 8.2 million barrels

PADD 2: Minus 0.4 million barrels to 105.5 million barrels

PADD 3: Plus 3.5 million barrels to 231.8 million barrels

PADD 4: Minus 0.6 million barrels 23.1 million barrels

PADD 5: Minus 0.9 million barrels to 47.1 million barrels

Cushing, Oklahoma, inventories were plus 1.3 million barrels from the previous report week to 28.8 million barrels.

Domestic crude oil production was UNCH from the previous report week at 11.9 million barrels daily.

Crude oil imports averaged 6.332 million barrels per day, a daily increase of 397,000 million barrels. Exports decreased 147,000 barrels daily to 3.574 million barrels per day

Refineries used 88.4% of capacity; 1.9 percentage points lower from the previous report week.

Crude oil inputs to refineries decreased 210,000 barrels daily; there were 15.466 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 328,000 barrels daily to 15.867 million barrels daily.

Total petroleum product inventories were plus 1.3 million barrels from the previous report week, rising to 730.7 million barrels.

Total product demand decreased 354,000 thousand barrels daily to 19.467 million barrels per day.

Gasoline stocks decreased 2.2 million barrels from the previous report week; total stocks are 228.6 million barrels.

Demand for gasoline rose117,000 barrels per day to 8.856 million barrels per day.

Distillate fuel oil stocks decreased 2.3 million barrels from the previous report week; distillate stocks are at 104.9 million barrels. EIA reported national distillate demand at 3.956 million barrels per day during the report week, an increase of 122,000 barrels daily.

Propane stocks increased 1.6 million barrels from the previous report week; propane stocks are at 40.8 million barrels. The report estimated current demand at 0.981 million barrels per day, an increase of 117,000 barrels daily from the previous report week.

Natural Gas

Natural gas spot futures ended the week of May 6 on a solid down note. An intraday high on Friday grazed $9.00, but the day ended down $0.75 from the prior day at $8.03. The subsequent bearish follow-through in the price action opens the possibility of a test down to the $6.35 – $6.50 zone.

The trade press has commented extensively on the fact that it is much more difficult for European natural gas buyers to find alternatives to Russian supply due to the long lead time involved in developing new LNG export projects. The one constant in all things is change and change is evident in the LNG export sector too.

In response to global market conditions, U.S. natural gas exporters have significantly shortened the construction time involved with LNG export facilities. A new U.S. LNG export facility is being developed at Calcasieu Pass, Louisiana. The plant produced its first LNG 30 months (2.5 years) after the final investment decision (FID) was made which is the shortest amount of time between FID and first LNG production in the U.S. In comparison, the development time for other U.S. LNG export projects ranged from 3.5 years to 5.5 years.

On March 1, Calcasieu Pass loaded and shipped its first LNG cargo which delivered LNG to the Netherlands and France. As of May 4, Calcasieu Pass has shipped eleven cargoes.

If the substantial price differential between U.S. and European/Asian natural gas prices continues to exist, expect the market to respond and find ways to speed U.S. LNG exports to market faster.

According to the EIA:

Net injections [of natural gas] into storage totaled 77 Bcf for the week ended April 29, compared with the five-year (2017–2021) average net injections of 78 Bcf and last year’s net injections of 53 Bcf during the same week. Working natural gas stocks totaled 1,567 Bcf, which is 306 Bcf lower than the five-year average and 382 Bcf lower than last year at this time.

Was this memo helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2021 Powerhouse Brokerage, LLC, All rights reserved