Prices Cool While Tensions in the Strait of Hormuz Heat Up

- Petroleum prices continue to move lower

- China’s economic growth rate falls to a 27 year low

- Geopolitical tensions with Iran continue, despite talk of negotiations

- Natural gas prices lower despite heat dome causing blistering temperatures

The Matrix

Crude oil and petroleum products moved lower as stories of disappointing demand, and higher supply weighed on prices. Last week’s trading began with a sigh of relief as weakened Barry made landfall as a tropical storm. A slate of bearish headlines, from increasing Russian output to slowing global demand kept the pressure on prices. It took the downing of an Iranian drone by the U.S. in the Strait of Hormuz to remind traders of the geopolitical threat to prices that still exists.

China’s economic growth rate slowed to 6.2 percent in the second quarter, the slowest growth rate in 27 years. The U.S./China trade dispute continues with no end in sight. Negotiations are at a standstill as Beijing demands that the U.S. ease restrictions on Huawei Technologies. As the trade war drags on, the Paris based IEA revised down global demand growth forecasts to 1.1 million bpd. IEA Executive Director Fitih Birol stated in an interview with Reuters, “China is experiencing its slowest economic growth in the last three decades, so are some of the advanced economies … if the global economy performs even poorer than we assume, then we may even look at our numbers once again in the next months to come.”

Russian oil production recovered after falling to a three-year low. Production fell after the shipment of contaminated Urals crude was discovered in April. Energy Minister Alexander Novak confirmed that Russia has now restored its output back to levels agreed to under the OPEC/non-OPEC deal struck at the beginning of July. Russia’s quota is 11.191 million barrels per day.

Iran was front and center in the news throughout the week. Selling intensified when it was reported that Secretary of State Pompeo indicated that Iran was willing to negotiate on its missile program, which Iran ultimately denied. Yet, there seemed to be some willingness on the part of the Iranians to open negotiations. The U.K.’s Guardian reported that Iran made a ‘substantial’ nuclear offer in return for U.S. lifting sanctions.

As market participants were reacting to a cooling of tensions, the U.S. downing of an Iranian drone and the seizure of a British tanker by the Iranians put a floor on prices. The reaction to the news of escalating tensions in the Strait of Hormuz was relatively tepid thanks to the backdrop of falling global demand and, of course, growing U.S. production. It is easy to get complacent about oil prices, but we urge caution. Events involving the world’s most crucial oil passageway can still have the power to rally prices.

Supply/Demand Balances

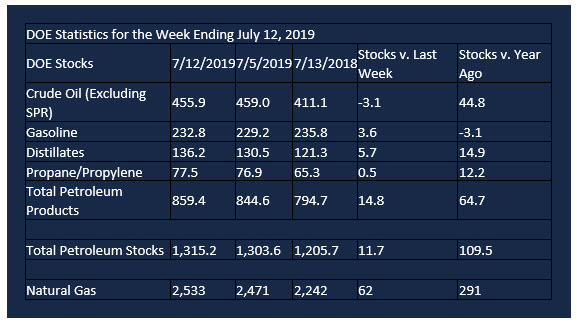

Supply/demand data in the United States for the week ending July 12, 2019, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose 11.7 million barrels during the week ending July 12, 2019.

There were builds in stocks of gasoline, fuel ethanol, K-jet fuel, distillates, residual fuel, propane, and other oils.

Commercial crude oil supplies in the United States fell 3.1 million barrels from the previous report week to 455.9 million barrels.

Crude oil supplies decreased in four of the five PAD Districts. PAD District 1 (East Coast) crude oil stocks declined 0.2 million barrels, PADD 2 (Midwest) stocks fell 1.5 million barrels, PADD 4 (Rockies) stocks decreased 0.5 million barrels, and PADD 5 (West Coast) stocks retreated 1.5 million barrels. PAD District 3 (Gulf Coast) stocks increased 0.5 million barrels.

Cushing, Oklahoma inventories fell 1.4 million barrels from the previous report week to 50.8 million barrels.

Domestic crude oil production declined 300,000 barrels per day from the previous report week to 12.0 million barrels daily.

Crude oil imports averaged 6.832 million barrels per day, a daily decrease of 470,000 barrels. Exports fell 514,000 barrels daily to 2.534 million barrels per day.

Refineries used 94.4 percent of capacity, down 0.3% from the previous report week.

Crude oil inputs to refineries decreased 171,000 barrels daily; there were 17.267 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 67,000 barrels daily to 17.741 million barrels daily.

Total petroleum product inventories rose 14.8 million barrels from the previous report week.

Gasoline stocks increased 3.6 million barrels daily from the previous report week; total stocks are 232.8 million barrels.

Demand for gasoline fell 540,000 barrels per day to 9.214 million barrels per day.

Total product demand decreased 986,000 barrels daily to 20.306 million barrels per day.

Distillate fuel oil stocks increased 5.7 million barrels from the previous report week; distillate stocks are at 136.2 million barrels. EIA reported national distillate demand at 3.565 million barrels per day during the report week, an increase of 15,000 barrels daily.

Propane stocks increased 0.5 million barrels from the previous report week; propane stocks are 77.5 million barrels. The report estimated current demand at 1.298 million barrels per day, an increase of 273,000 barrels daily from the previous report week.

Natural Gas

The heat dome is summer’s answer to the polar vortex. In the agency’s warning about the extreme heat that would affect a large part of the country, NOAA described the phenomenon:

“A heat dome occurs when high pressure in the upper atmosphere acts as a lid, preventing hot air from escaping. The air is forced to sink back to the surface, warming even further on the way. This phenomenon will result in dangerously hot temperatures that will envelop the nation throughout the week.”

In the past, news of extreme heat would have translated to higher gas prices. But with U.S. production of dry gas expected to reach record levels in 2019, the heat dome did not move the needle, even with storage levels running slightly behind.

According to the Energy Information Administration:

Working gas in storage was 2,533 Bcf as of Friday, July 12, 2019, according to EIA estimates. This represents a net increase of 62 Bcf from the previous week. Stocks were 291 Bcf higher than last year at this time and 143 Bcf below the five-year average of 2,676 Bcf. At 2,533 Bcf, total working gas is within the five-year historical range.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.