Bearish Forces Massing at Resistance

- Bullish price factors nearing completion

- Money managers holding significant length

- Onset of refinery turnaround could back up crude oil, supporting gasoline crack spread

- Cold weather boosting natural gas prices; upside objective at $3.21.

Sincerely, Alan Levine, Chairman of Powerhouse (202) 333-5380

The Matrix

The rally that has supported oil prices since November appears to have run out of steam. The second half of 2017 brought several bullish factors to bear on pricing. These include the extraordinary hurricane activity that so inundated the Texas Gulf Coast and interruption of North Sea movements of Brent crude oil. These supported price, but their impact appears now to have diminished. And even unusually cold weather has not provided significant further price support to the oils.

Data on futures market activity show money managers holding record length in Brent futures. The long side imbalance has carried over to other energy futures as well. This situation occurring when refineries are expected to enter turnaround, reduce throughput and be a bearish sign for the crude oil price. The closure of facilities and the loss of demand for crude oil could prove to be the thing that starts a gasoline crack spread advance early in 2018.

It is particularly important to recognize during this holiday period that market activity is usually slow. It becomes challenging to offer projections on price. But, soon enough, these holidays will be over. The normal tension of market action should return.

We have pointed out that oil markets have been significantly changed in recent years. The emergence of the United States as a major supplier to global markets contests with tighter fundamentals overseas to hold prices in a rough parity for now. Traders have recognized the potential power of U.S. production as an offset to foreign geopolitics. Volatilities have fallen.

This is all now rendered moot as conflicting forces come to bear on the oil price. And futures markets are taking an important role in pricing. Trading data show that 2017 volumes for spot WTI futures will hit a record of nearly 150 million trades. This is more than twice as much as Brent. In part, this reflects the requirement of many U.S. banks that expected production must be hedged as a condition of a loan.

This is not common in the Middle East, but some national producers are now considering using hedging techniques. And if Middle East producers hedge, they lock in price and can expand production with even more obvious bearish effect on price.

Supply/Demand Balances

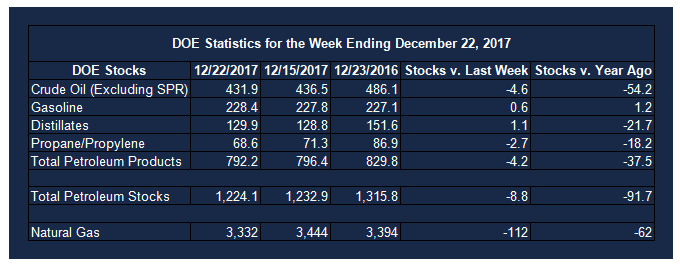

Supply/demand data in the United States for the week ending December 22, 2017 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 8.8 million barrels during the week ending December 22, 2017.

Builds were reported in stocks of gasoline, distillates, and residual fuel oil. Draws were reported in stocks of fuel ethanol, propane, and other oils. Stocks of K-jet fuel were unchanged from the previous report week.

Commercial crude oil supplies in the United States decreased to 431.9 million barrels, a draw of 4.6 million barrels.

Crude oil supplies decreased in one of the five PAD Districts. PAD District 3 (Gulf Coast) crude oil stocks fell 5.7 million barrels. PAD District 1 (East Coast) crude stocks increased 0.3 million barrels and PADD 2 (Midwest) stocks rose 0.7 million barrels. PAD District 4 (Rockies) and PADD 5 (West Coast) crude stocks were unchanged from the previous report week.

Cushing, Oklahoma inventories decreased 1.6 million barrels from the previous report week to 51.4 million barrels.

Domestic crude oil production decreased 35,000 barrels daily to 9.754 million barrels per day from the previous report week.

Crude oil imports averaged 7.993 million barrels per day, a daily increase of 159,000 barrels. Exports fell 648,000 barrels daily to 1.210 million barrels per day.

Refineries used 95.7 per cent of capacity, an increase of 1.6 percentage points from the previous report week.

Crude oil inputs to refineries increased 335,000 barrels daily; there were 17.398 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 311,000 barrels daily to 17.715 million barrels daily.

Total petroleum product inventories saw a decrease of 4.2 million barrels from the previous report week.

Gasoline stocks rose 0.6 million barrels from the previous report week; total stocks are 228.4 million barrels.

Demand for gasoline increased 58,000 barrels per day to 9.485 million barrels daily.

Total product demand decreased 336,000 barrels daily to 20.775 million barrels per day.

Distillate fuel oil supply rose 1.1 million barrels from the previous report week to 129.9 million barrels. National distillate demand was reported at 4.326 million barrels per day during the report week. This was a weekly increase of 400,000 barrels daily.

Propane stocks decreased 2.7 million barrels from the previous report week to 68.6 million barrels. Current demand is estimated at 1.533 million barrels per day, an increase of 210,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Working gas in storage was 3,332 Bcf as of Friday, December 22, 2017, according to EIA estimates. This represents a net decrease of 112 Bcf from the previous week. Stocks were 62 Bcf less than last year at this time and 85 Bcf below the five-year average of 3,417 Bcf. At 3,332 Bcf, total working gas is within the five-year historical range.

Cold weather has had important effects on the natural gas price. On December 21, natural gas spot futures bottomed at $2.568. In the four subsequent trading days, prices reached $2.948 more than half way back to recent highs at $3.218. Should prices continue to advance, producers might use the opportunity to lock in production for 2018 and 2019.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright © 2018 Powerhouse, All rights reserved.