Oil Price May Be Nearing A Short-Term Top

- Modest divergence appearing in oil price data could mean near-term top

- U.S. crude oil production reaches 12 million barrels per day

- Global oil consumption could grow 1.5 million barrels daily in 2019 and 2020

- Natural gas withdrawals were 15% lower than the 5-year average

The Matrix

Oil futures have moved slowly higher in recent weeks. Caught between bullish efforts by OPEC and other like-minded oil producers (OPEC+) to reduce crude oil production outside the United States and U.S. oil output adding to supply, prices did little to advance. Nonetheless, new highs were reached as the week of February 22 ended. One caution for price bulls is that prices have been in a rally phase for several weeks. And periods of correction and consolidation are a normal part of a price cycle. Some analytical statistics used to evaluate price patterns are showing, for the first time, modest divergence. This suggests that some degree of setback may be developing. Support for ULSD can be found at $1.95. Price bulls should be cautious.

The U.S. Petroleum Balance Sheet, Week Ending 2/15/2019 reported additional conflicting data. In particular crude oil production reached 12 million barrels per day for the first time.

World Liquid Fuels Production and Consumption Balance

2014-2020 Source: EIA

This is consistent with EIA’s view that “In 2020, EIA expects oil production to increase by 1.7 million b/d because of production growth in the United States, Canada, Brazil, and Russia, while overall OPEC crude oil production is expected to remain flat. EIA forecasts global oil demand to grow by 1.5 million b/d in 2019 and in 2020. In both 2019 and 2020, China is the leading contributor to global oil demand growth.”

EIA anticipates growth in global fuels consumption of 1.5 million barrels daily in both 2019 and 2020.

Annual Change in World Liquid Fuels Consumption

2017-2020 Source: EIA

Note: The Energy Information Administration’s International Energy Outlook 2018 said that “Faster economic growth in China means higher energy use, but the amount depends on how quickly China transitions to a more service-oriented, personal consumption-based economy. China remains by far the world’s largest producer of energy-intensive goods in 2040.”

Supply/Demand Balances

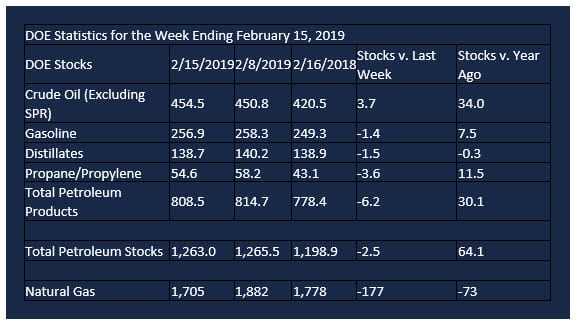

Supply/demand data in the United States for the week ending February 15, 2019 were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased 2.5 million barrels during the week ending February 15, 2019.

There were draws in stocks of gasoline, distillates, residual fuel, propane, and other oils. There were builds reported in stocks of fuel ethanol and K-jet fuel.

Commercial crude oil supplies in the United States increased 3.7 million barrels from the previous report week to 454.5 million barrels.

Crude oil supplies increased in two of the five PAD Districts. PADD 2 (Midwest) stocks rose 3.4 million barrels and PADD 3 (Gulf Coast) stocks were up 1.6 million barrels.

PADD 1 (East Coast) stocks fell 0.5 million barrels, PAD 4 (Rockies) stocks declined 0.6 million barrels, and PADD 5 (West Coast) stocks decreased 0.3 million barrels.

Cushing, Oklahoma inventories increased 3.4 million barrels from the previous report week to 45.0 million barrels.

Domestic crude oil production rose 100,000 barrels daily previous report week to 12.0 million barrels per day.

Crude oil imports averaged 7.522 million barrels per day, a daily increase of 1.312 million barrels per day. Exports rose 1.243 million barrels daily to 3.607 million barrels per day.

Refineries used 85.9 per cent of capacity, unchanged from the previous report week.

Crude oil inputs to refineries decreased 57,000 barrels daily; there were 15.711 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased 2,000 barrels daily to 15.987 million barrels daily.

Total petroleum product inventories fell 6.2 million barrels from the previous report week.

Gasoline stocks decreased 1.5 million barrels from the previous report week; total stocks are 256.8 million barrels.

Demand for gasoline increased 153,000 barrels per day to 8.800 million barrels per day.

Total product demand increased 1.606 million barrels daily to 20.720 million barrels per day.

Distillate fuel oil stocks decreased 1.5 barrels from the previous report week; distillate stocks are at 138.7 million barrels. National distillate demand was reported at 4.216 million barrels per day during the report week. This was a weekly increase of 448,000 barrels daily.

Propane stocks decreased 3.6 million barrels from the previous report week; propane stock are 54.6 million barrels. Current demand is estimated at 2.049 million barrels per day, an increase of 674,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Net withdrawals from storage totaled 177 Bcf for the week ending February 15, compared with the five-year (2014–18) average net withdrawals of 148 Bcf and last year’s net withdrawals of 134 Bcf during the same week. Working gas stocks totaled 1,705 Bcf, which is 362 Bcf lower than the five-year average and 73 Bcf lower than last year at this time.

The average rate of net withdrawals from storage is 15% lower than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawals from storage matched the five-year average of 9.8 Bcf/d for the remainder of the withdrawal season, total inventories would be 1,274 Bcf on March 31, which is 362 Bcf lower than the five-year average of 1,636 Bcf for that time of year.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved