Oil Prices Near Resistance

Powerhouse Wants You To Have A Wonderful 2020

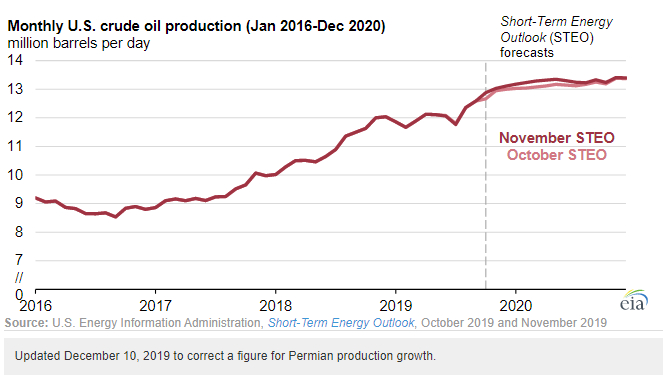

- Crude oil production reaches 12.9 million barrels per day

- Refinery use grows

- ULSD crack spreads trending higher

- Natural gas in storage tracking 5-year average

The Matrix

The U.S. Petroleum Balance Sheet for the week ending December 20, 2019, was largely bearish. Crude oil production reached 12.9 million barrels daily – matching the record high output of two recent weeks.

The growth in production supports EIA’s forecast of 12.3 million barrels per day for all of 2019. EIA increased its projection based on higher than expected output last summer, higher output in the Texas Permian through 2020 and a higher crude oil price from November 2019 through January 2020.

RBOB and ULSD have been in uptrends since early December. Both markets are nearing their Saudi attack highs and could run out of steam; gasoline is a more likely candidate than distillate, due to winter demand declines.

Their price charts are in sustainable uptrends now; their rates of advance have not taken on a parabolic shape. Growing crude oil production is a bearish factor for pricing. Increasing demand by refineries for crude oil is a bullish consideration.

The conflict facing oil prices shows no sign of resolution. Price spreads followed by Powerhouse, specifically, gasoline crack spreads, are starting to show tradeable trends.

Spring gasoline crack spreads spent much of December establishing a base. The spread for April RBOB ranged from $18 to $19 or so during that time. Prices have since advanced, trying $19.60 per daily barrel. Powerhouse expects gasoline prices to rally, supporting the spring crack spread if demand tracks the strength experienced last year.

Supply/Demand Balances

Supply/demand data in the United States for the week ending Dec. 20, 2019, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell by 10.2 million barrels during the week ending Dec. 20, 2019.

Commercial crude oil supplies in the United States decreased by 5.5 million barrels from the previous report week to 441.4 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down 1.1 million barrels to 10.0 million barrels

PADD 2: Down 1.1 million barrels to 126.3 million barrels

PADD 3: Down 1.9 million barrels to 230.4 million barrels

PADD 4: Down 0.7 million barrels to 23.4 million barrels

PADD 5: Down 0.7 million barrels to 51.3 million barrels

Cushing, Oklahoma inventories fell 2.4 million barrels from the previous report week to 40.2 million 37.8 barrels.

Domestic crude oil production rose 100,000 barrels daily from the previous report week to 12.9 million barrels daily.

Crude oil imports averaged 6.809 million barrels per day, a daily increase of 230,000 barrels. Exports fell 236,000 barrels daily to 3.397 million barrels per day.

Refineries used 93.3 percent of capacity, up 2.7% from the previous report week.

Crude oil inputs to refineries increased 418,000 barrels daily; there were 16.980 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 514,000 barrels daily to reach 17.547 million barrels daily.

Total petroleum product inventories fell 15.7 million barrels from the previous report week.

Gasoline stocks increased 2.0 million barrels daily from the previous report week; total stocks are 239.3 million barrels.

Demand for gasoline fell 109,000 barrels per day to 9.303 million barrels per day.

Total product demand decreased 4.85 million barrels daily to 21.312 million barrels per day

Distillate fuel oil stocks decreased 0.2 million barrels from the previous report week; distillate stocks are at 124.9 million barrels. EIA reported national distillate demand at 4.214 million barrels per day during the report week, an increase of 94,000 barrels daily.

Propane stocks decreased 2.6 million barrels from the previous report week; propane stocks are 88.4 million barrels. The report estimated current demand at 1.851 million barrels per day, an increase of 177,000 barrels daily from the previous report week.

Natural Gas

According to EIA:

Working gas in storage was 3,250 Bcf as of Friday, December 20, 2019, according to EIA estimates. This represents a net decrease of 161 Bcf from the previous week. Stocks were 518 Bcf higher than last year at this time and 69 Bcf below the five-year average of 3,319 Bcf. At 3,250 Bcf, total working gas is within the five-year historical range.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.