- Crude oil stocks reach 500 million barrels

- Refinery use falls to 69 percent

- Crude storage limit in sight

- Natural gas end heat season with more than 2,000 Bcf stored

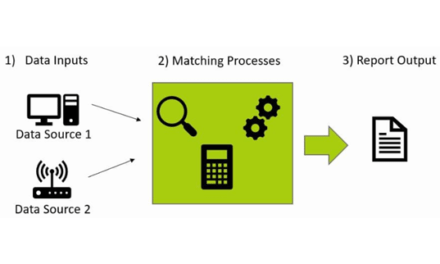

The Matrix

Crude oil stocks in the United States are streaking upwards. Reduced demand from refineries for feed stock is reflected in a 69.1 refinery utilization rate reported in the EIA U.S. Petroleum Balance Sheet for the week ending April 10, 2020. Increases in crude oil stocks could bring total inventory to about 525 million barrels in a few weeks – a level around the five-year average high.

Supplies at such high levels is raising concerns about our national ability to store so much crude oil. If the country really runs out of storage, the implications for price are very bearish.

One analysis starts with EIA estimates of total commercial working storage availability of 653 million barrels (in September 2019.) Working stocks should not exceed eighty percent of this, allowing for effective operation of the supply system. This provides about 522 million barrels of storage, very close to our five-year average top. The problem was eased to some degree by use of the Strategic Petroleum Reserve to hold some of the excess oil.

Details aside, such an overhang of crude oil stock weighed heavily on price.

Steps to stem the flow of oil toward tank tops include use of the SPR. Moreover, the OPEC+ agreement, for all its uncertainties should take a measurable amount of crude oil off the market. Shut-ins should, however, bear the brunt of balancing supply and demand in the short term.

Some estimates of reduced supply go as high as two million barrels daily in the United States. U.S. production for the week ending April 10, 2020 was put at 12.3 million barrels per day. As recently as March 27, output was reported at 13 million barrels per day.

Supply/Demand Balances

Supply/demand data in the United States for the week ending April 10, 2020, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose by 27.2 million barrels during the week ending April 10, 2020.

Commercial crude oil supplies in the United States increased by 19.2 million barrels from the previous report week to 503.6 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Fell 0.7 million barrels to 11.3 million barrels

PADD 2: Plus 5.6 million barrels to 147.4 million barrels

PADD 3: Plus 10.2 million barrels to 263.4 million barrels

PADD 4: Plus 1.3 from the previous report week t0 24.1 million barrels

PADD 5: Plus 2.7 million barrels to 57.4 million barrels

Cushing, Oklahoma inventories were up 5.8 million barrels from the previous report week to 49.2 million barrels.

Domestic crude oil production was fell 0.1 million barrels per day from the previous report week to 12.3 million barrels daily.

Crude oil imports averaged 5.680 million barrels per day, a daily decrease of 194,000 barrels. Exports rose 603,000 barrels daily to 3.436 million barrels per day.

Refineries used 69.1 percent of capacity, down 6.5% from the previous report week.

Crude oil inputs to refineries decreased 969,000 barrels daily; there were 12.665 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 1.103 million barrels daily to reach 13.113 million barrels daily.

Total petroleum product inventories rose 8.0 million barrels from the previous report week.

Gasoline stocks increased 4.9 million barrels daily from the previous report week; total stocks are 262.2 million barrels.

Demand for gasoline rose 17,000 barrels per day to 5.081 million barrels per day.

Total product demand decreased 640,000 barrels daily to 13.797 million barrels per day.

Distillate fuel oil stocks increased 6.3 million barrels from the previous report week; distillate stocks are at 129.0 million barrels. EIA reported national distillate demand at 2.757 million barrels per day during the report week, a decrease of 1.049 million barrels daily.

Propane stocks decreased 2.2 million barrels from the previous report week; propane stocks are 56.8 million barrels. The report estimated current demand at 754,000 barrels per day, a decrease of 256,000 barrels daily from the previous report week.

Natural Gas

Natural gas supplies ended the 2019-2020 heating season with two thousand Bcf in storage. This was nearly twenty per cent more than the five -year average. Such a large amount of underground-stored natural gas reflects strong production and lower demand because of mild weather. Futures prices, however, continue to trade in a tight range supported around $1.50.

Natural gas supplies ended the 2019-2020 heating season with two thousand Bcf in storage. This was nearly twenty per cent more than the five -year average. Such a large amount of underground-stored natural gas reflects strong production and lower demand because of mild weather. Futures prices, however, continue to trade in a tight range supported around $1.50.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this memo helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2020 Powerhouse, All rights reserved.