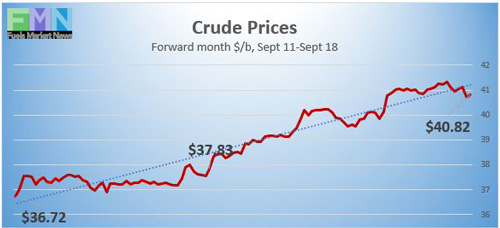

Oil prices rebounded this week, buoyed by Hurricane Sally, an unexpected crude stock drawdown, and an OPEC+ meeting that assured markets of the group’s active engagement, and notably, of Saudi Arabia’s determination to support market stability. OPEC+ committed to production cuts for as long as COVID-19 continues to depress demand. Saudi Arabia’s Energy Minister also made sterner-than-usual warnings against speculating in the oil market. To promote group unity, overproducers were given extra time through the end of December to make “compensation cuts.” WTI crude prices regained the $40 a barrel level and are hovering around $41 a barrel currently. This is a significant recovery, given that last week’s prices finished at around $37 a barrel, pulled down by widespread market weakness and slumping stock markets. Yesterday’s upward price momentum has flattened, but the oil complex remains on track for a finish in the black this week.

Initial weekly unemployment claims fell by 33,000 during the week ended September 12, coming in at 860,000. The prior week’s figure was revised up by 9,000 to 893,000. Initial weekly claims have been below the one-million mark for three weeks, but job formation is slower than desired. Consumer spending has slowed as fiscal stimulus fades. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 26 weeks since U.S. states began to issue shelter-in-place orders, over 61 million Americans have filed initial jobless claims.

The Federal Reserve met this week and, as expected, kept interest rates unchanged at near-zero levels. Fed Chair Jerome Powell stated that more fiscal support was likely to be needed. Congress and the White House remain far from agreement on the next stimulus bill.

The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have now passed the 30 million mark, reaching 30,211,680, with 946,710 deaths. Confirmed cases in the U.S. have risen to 6,676,410. U.S. deaths attributed to the disease have reached 197,655. The expression “grim milestone” has been used too frequently, yet these are the numbers.

WTI crude futures prices opened at $40.97 a barrel today, a strong recovery of $3.96 a barrel (10.7%) from last Friday’s open of $37.01 a barrel. Two weeks ago, Hurricane Laura stimulated buying interest, and prices surged. Weak demand and the collapse of the stock market dragged oil prices down thereafter. This week brought Hurricane Sally, a crude stock drawdown, and an OPEC+ meeting to bolster prices. WTI futures prices are hovering around $41 a barrel. Prices are heading for a finish in the black. Our weekly price review covers hourly forward prices from Friday, September 11 through Friday, September 18. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

Gasoline Prices

Gasoline futures prices opened at $1.2236 a gallon today on the NYMEX, compared with $1.0884 a gallon last Friday. This was a major rebound of 13.52 cents (12.4%). March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline fell 2.8 cents to average $2.183/gallon during the week ended September 14. Retail prices reclaimed the territory above $2 per gallon during the first week of June. Gasoline futures are trading in the range of $1.21/gallon to $1.23/gallon. The week is heading for a finish in the black. The latest price is $1.2217/gallon.

Source: Prices as reported by DTN Instant Market

Diesel Prices

Diesel opened on the NYMEX today at $1.1611/gallon, up significantly by 8.39 cents, or 7.8%, from last Friday’s open of $1.0771/gallon. U.S. average retail prices for diesel fell by 1.3 cents per gallon during the week ended September 14 to average $2.422/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. This week, prices have rebounded. The week is heading for a finish in the black. Currently, diesel is trading mainly in the range of $1.143–$1.171/gallon. The latest price is $1.1525/gallon.

Source: Prices as reported by DTN Instant Market

WTI Crude Prices

WTI crude forward prices opened on the NYMEX today at $40.97 a barrel, compared with $37.01 a barrel last Friday. This was a substantial recovery of $3.96 a barrel (10.7%.) Prices rose in response to Hurricane Sally, a successful OPEC+ meeting, and an unexpected decline in crude oil inventories. Prices are now hovering around $41 a barrel. The week is headed for a finish in the black. WTI crude is trading in the $40.30–$41.50 a barrel range currently. The latest price is $41.01 a barrel.

PRICE MOVERS THIS WEEK: BRIEFING

Oil prices rebounded this week, buoyed by Hurricane Sally, an unexpected crude stock drawdown, and an OPEC+ meeting that assured markets of the group’s active engagement, and notably, of Saudi Arabia’s determination to support market stability. OPEC+ committed to production cuts for as long as COVID-19 continues to depress demand. Saudi Arabia’s Energy Minister also made sterner-than-usual warnings against speculating in the oil market. To promote group unity, overproducers were given extra time through the end of December to make “compensation cuts. WTI crude prices regained the $40 a barrel level and are hovering around $41 a barrel currently. This is a significant recovery, given that last week’s prices finished at around $37 a barrel, pulled down by widespread market weakness and slumping stock markets. Markets today appear calmer relative to the trading sessions earlier this week. Yesterday’s upward price momentum has flattened, but the oil complex remains on track for a finish in the black this week.

Initial weekly unemployment claims fell by 33,000 during the week ended September 12, coming in at 860,000. The prior week’s figure was revised up by 9,000 to 893,000. Initial weekly claims have been below the one-million mark for three weeks, but job formation is slower than desired. Consumer spending has slowed as fiscal stimulus fades. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 26 weeks since U.S. states began to issue shelter-in-place orders, over 61 million Americans have filed initial jobless claims.

The Federal Reserve met this week and, as expected, kept interest rates unchanged at near-zero levels. Fed Chair Jerome Powell stated that more fiscal support was likely to be needed. This was a mixed bag: comfort that the Fed would leave interest rates at near-zero levels and disappointment that the Fed had no magic wand to wave at economic woes. Congress and the White House remain far from agreement on the next stimulus bill.

The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have now passed the 30 million mark, reaching 30,211,680, with 946,710 deaths. Confirmed cases in the U.S. have risen to 6,676,410. U.S. deaths attributed to the disease have reached 197,655. The expression “grim milestone” has been used too frequently, yet these are the numbers.

The U.S. Energy Information Administration (EIA) published official inventory data showing a drawdown of 4.389 million barrels (mmbbls) from crude oil inventories, plus a small drawdown of 0.381 mmbbls from gasoline inventories. This was partly offset by an addition of 3.461 mmbbls to diesel inventories. The EIA net result was a modest inventory drawdown of 1.309 mmbbls. Diesel inventories began to climb in April, and they have remained stubbornly high from June through the current week. Over 40 mmbbls have flowed into storage this year to date, and the EIA reports current inventory levels at 179.3 mmbbls.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. The current week ended September 11 showed Cushing stocks at 54,277 mmbbls.

During the week ended September 11, U.S. crude production rose to 10.9 mmbpd, up by 0.9 mmbpd from the prior week’s 10.0 mmbpd. Two weeks ago, Hurricane Laura shut down numerous oil platforms in the Gulf, contributing to a production drop of 1.1 mmbpd. This week, approximately 0.5 mmbpd was shut in to prepare for Hurricane Sally, and the dip in output will be reflected in next week’s data. As of Thursday of this week, work crews were returning to oil platforms in the Gulf. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd. Production during the first two weeks of September has averaged 10.45 mmbpd.