By John Eichberger

The Honda Insight—the first hybrid vehicle to make its debut in the United States—arrived 22 years ago. The Toyota Prius entered the market the following year, and the hybrid market began to accelerate. By 2007, sales eclipsed 350,000 units from just 13 models, and some were predicting that more than 100 hybrid models would soon be available for sale in the U.S. Those forecasts were never realized, and year after year sales hovered at or below 3%, setting a record of 3.2% of sales in 2013 before slipping to less than 2% just three years later. Recent data indicate that automobile manufacturers have not given up on this technology, maybe due to Obama-era CAFE standards. In the first quarter of 2021, hybrids clawed up to 4.5% of sales. What has changed, and what can we learn from the experience of hybrid vehicles?

Market Penetration

It took seven years (2006) before the market offered more than 10 hybrid models from which consumers could select. Their popularity, however, was growing, and a rapid expansion was set to occur in the coming years. Early on, the policy cards were being stacked to support their growth.

By 2010, hybrids were moving closer to mainstream. Model availability had dramatically improved with 29 hybrids offered for sale in the U.S. Yet, sales volume did not grow in parallel. In fact, only 274,000 were sold in 2010, compared with 352,000 sold in 2007 when less than half as many models (13) were available. Choice was better, but sales did not follow suit. Granted, the end of the decade experienced the Great Recession, which affected everything.

In 2013, nearly 500,000 hybrid vehicles were sold, and consumers could choose from 46 different models. Hybrids represented 3.2% of light-duty vehicles sold and edged out diesel-equipped vehicles to become the second most popular powertrain in America. Following that year’s performance, though, sales slipped.

Downturn

Why were hybrids seemingly forgotten as a choice among consumers? For that, I think it is helpful to look at consumer preferences.

In 2018, the Fuels Institute published “Driving Vehicle Sales—Utility, Affordability and Efficiency,” a review of more than 15 years of vehicle sales data and vehicle attributes. We concluded that people buy vehicles largely based upon what they need (i.e., a large family is not purchasing a compact sedan as their primary vehicle), what they can afford (purchase price is critical) and vehicle efficiency (typically applied within the class of vehicle they have determined they need). These observations clearly apply to the hybrid market, and its history can provide insight into how newer vehicles (i.e., BEVs) may be considered by consumers.

Consider the market for hybrids in 2013 verse 2020 and the first quarter of 2021. Of the 46 hybrids sold in 2013, 33 (72%) were classified as “cars” versus 13 “light trucks.” Yet even back in 2013, light trucks represented more than 50% of all vehicles sold, and the trend toward truck-classified vehicles was gaining momentum. Hybrids were not following those trends.

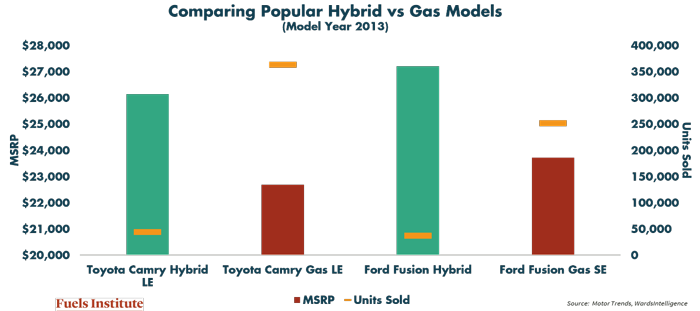

Price is another issue that may have limited hybrid market penetration, even during this strong year. The best-selling hybrids in 2013 that were also available in gasoline-only versions were the Toyota Camry and the Ford Fusion. When comparing the MSRP for these vehicles, price may have been a factor—the hybrid variants carried about a $4,000 premium and were quite a bit more expensive than the class-leading Prius.

One would think that the fuel economy advantages of the hybrids would help consumers overcome that price delta. Overall, hybrids on average were 83% more efficient that gasoline vehicles. It seems this did have an impact in 2013, when gasoline averaged $3.49 a gallon. Even so, the promise of reduced fuel expenditures over a future period of time seems difficult for consumers to embrace and incorporate into their purchase decision, especially when the vehicle purchase price is nearly 20% higher.

Turnaround

Fast forward eight years and the market for hybrids seems to have recovered. In 2018 hybrids accounted for less than 2% of sales from 36 different models. This could have been the result of several factors, including the enthusiasm for BEVs, coupled with a four-year period in which retail fuel prices averaged a low $2.41 per gallon. Model availability might have been an issue—of the 36 models available, 26 remained classified as cars.

Surprisingly, hybrids staged a comeback during the pandemic year of 2020. Of the 37 models sold last year, 23 (62%) still were cars. But the best-selling hybrids in 2020 were crossover vehicles, with the Toyota RAV4 hybrid accounting for 25% of all hybrid sales. Looking at the first quarter of 2021, only 18 (56%) of the 32 hybrid models sold were cars, and the top five models, accounting for 60% of all hybrid sales, were crossovers and one van.

Of those five, three have gasoline-only variants. The price delta between powertrains ranged from $2,000 to $5,000, with efficiency advantages close to 50%. The other two, which were previously offered with gasoline-only powertrains, were only available as hybrids, which likely helped boost their popularity. The availability of hybrid powertrains in popular models that consumers want to purchase appears to have influenced the sales performance of these vehicles.

There are lessons to be learned from the hybrid experience. Customers have certain decision-making processes and priorities. What they need and what they can afford are paramount in deciding what type of vehicle to consider. For new vehicle technologies entering the market, such as BEVs, I believe the same will hold true. The transition to positioning hybrid vehicles and BEVs within the context of consumer preferences has begun—let’s see if sales follow suit.

This is condensed from The Commute blog post “Hybrid Theory.” Read more at www.fuelsinstitute.org/Resources/The-Commute/Hybrid-Theory.

John Eichberger is executive director of The Fuels institute.

John Eichberger is executive director of The Fuels institute.

For more information, visit www.fuelsinstitute.org.