MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

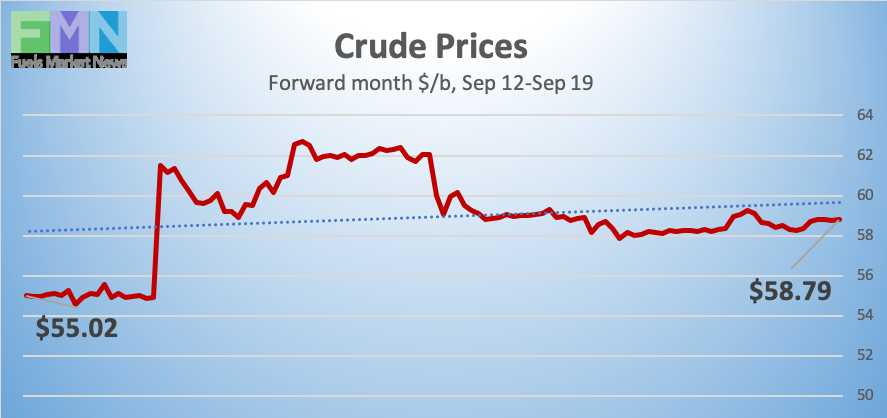

September 20, 2019: Prices spiked at market opening on Monday, in response to devastating attacks on Saudi Arabian oil facilities. WTI crude prices shot up by $6.33/b on Monday, a jump of nearly 11.5%. Prices were volatile during the week, responding to news bulletins concerning the attacks, the damage, and the Saudi and international response. Today, prices are stabilizing and appear to be hovering in the $59/b neighborhood. Our weekly price review covers hourly forward prices from Thursday September 12th through Thursday September 19th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

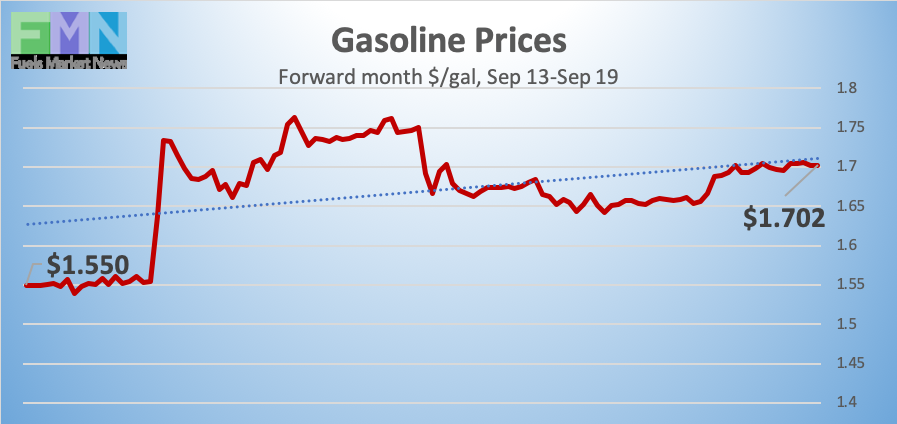

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.5555/gallon on Friday September 13th, and prices opened at $1.702/gallon on Friday September 20th. This was a major increase of 14.65 cents (9.4%.) U.S. average retail prices had edged up only slightly during the week ended September 16th, but retail fuel prices had not yet responded to the spike in crude prices. This week brought an inventory build, which softened prices midweek. Gasoline prices are trending up this morning, and the week appears to be heading for gains of approximately 14 cents/gallon. Trades are occurring mainly in the range of $1.70-$1.71/gallon. The latest price is $1.7053/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.8881/gallon on Friday September 13th and opened on Friday September 20th at $2.0129/gallon, a major increase of 12.48 cents (6.6%.) This week brought a build in diesel inventories, which helped soften prices midweek. Diesel forward prices have opened higher for six consecutive weeks. Prices this morning are hovering above $2/gallon. Contracts currently are trading in the $2.01-$2.02/gallon range. The latest price is $2.0188/gallon.

WEST TEXAS INTERMEDIATE PRICES

PRICE MOVERS THIS WEEK : BRIEFING

Attacks on Saudi Arabian oil facilities caused a price spike upon market opening on Monday. The strikes knocked out approximately 5.7 million barrels per day (MMBPD) of crude production capacity. It was reported that four of five processing lines at the Khurais oilfield were damaged. The Abqaiq crude oil stabilization plant also was damaged. Early reports indicated that some of the stabilization units would have to be rebuilt—a process requiring months, not weeks. The plant’s desulfurization towers were damaged also. Prices went up and down this week with each piece of new information about the potential schedule for repairs and restoration of capacity. Saudi Arabia also stated that it would use oil from storage to meet its contractual obligations. In the U.S., President Donald Trump announced that crude oil from the nation’s Strategic Petroleum Reserve could also be released to quell prices. The U.S. has attributed the attacks to Iran, though Iran denies responsibility.

The attacks on Saudi Arabia eclipsed other developments this week. Bearish news about oil inventories came Tuesday from the American Petroleum Institute (API.) The API reported a small addition of 0.6 million barrels (mmbbls) to crude inventories. Market experts expected a 2.5-mmbbl stock draw. The API also reported additions of 1.6 mmbbls to gasoline inventories and 2.0 mmbbls to diesel inventories. The API’s net inventory build was 4.2 mmbbls.

Official statistics from the Energy Information Administration (EIA) largely corroborated the API data, though the additions were smaller, coming in at 1.058 mmbbls of crude, 0.781 mmbbls of gasoline, and 0.437 mmbbls of diesel. The net inventory build was 2.276 mmbbls.

The EIA also reported that during the week ended September 13th, U.S. crude oil production remained flat at 12.4 million barrels per day (mmbpd.) The EIA still foresees growth in output in the coming year.