Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices continued to rise at today’s market opening, but prices are now flattening. WTI (West Texas Intermediate) crude forward prices opened at $57.00/b today, up by $1.05 (1.88%) from yesterday’s opening price of $55.95/b. Gasoline and diesel futures prices also rose at today’s market opening, and they appear to be stabilizing currently. Prices received support from bullish oil inventory data and the U.S.-North Korea nuclear talks in Vietnam yesterday. The talks were quickly curtailed with no agreement, and global stocks fell.

The U.S. Department of Commerce just released 4th quarter 2018 data on U.S. GDP growth. The agency reported that U.S. GDP increased at a 2.6% annualized rate in the 4th quarter, after expanding at 3.4% in the 3rd quarter. In total, the U.S. economy grew 2.9% in 2018, the highest growth since 2015. Although the 4th quarter rate of 2.6% missed the administration’s target of 3%, still it exceeded what many economists had predicted.

Oil prices received a boost yesterday when the American Petroleum Institute (API) reported that U.S. crude oil inventories fell by 4.2 million barrels (mmbbls) during the week ended February 22nd. Gasoline inventories were estimated to have fallen by 3.8 mmbbls, and diesel inventories rose by 0.4 mmbbls. The net was a drawdown of 7.6 mmbbls from oil inventories. In contrast, industry experts had predicted a build of 2.8 mmbbls crude and drawdowns of 1.7 mmbbls gasoline and 2 mmbbls diesel, for a net drawdown of 0.9 mmbbls.

The Energy Information Administration (EIA) then released official statistics showing an even more significant drain from inventories: 8.647 mmbbls of crude, 1.906 mmbbls of gasoline, and 0.304 mmbbls of diesel, for a total stock draw of 10.857 mmbbls. During the eight weeks of 2019, crude inventories have been drawn down only once before, and this week’s draw of 8.65 mmbbls was by far the largest.

The oil inventory data supported oil prices, as did global market optimism over the U.S.-North Korea nuclear talks. However, the talks were curtailed, and President Trump left, leading market watchers to conclude that the talks were mainly theater. Global markets also fell upon the release of Chinese manufacturing data for February, which showed a third month of contraction in the purchasing manager’s index.

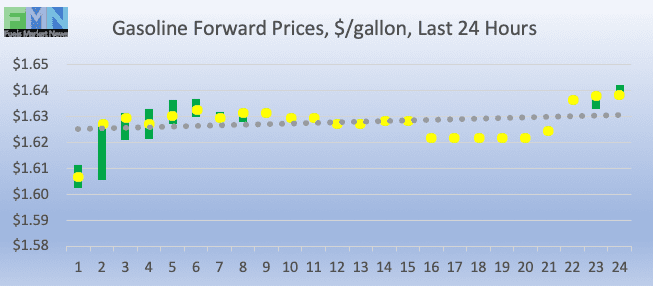

GASOLINE

Gasoline opened on the NYMEX at $1.6298/gallon today, up by 3.13 cents (1.91%) from yesterday’s opening price of $1.5985 cents/gallon. Prices last week were the highest since mid-November, but prices subsided to their pre-rally levels on Monday, and have been recovering since then. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices rose by 3.0 cents (1.86%.) Gasoline forward prices currently are trending up, trading between $1.62-$1.65/gallon. The latest price is $1.6339/gallon.

DIESEL

Diesel opened on the NYMEX at $2.0248/gallon today, up by 1.64 cents (0.81%) from yesterday’s opening price of $2.0084/gallon. Until last week, diesel forward prices had not been steadily above the $2/gallon level since mid-November. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices eased slightly by 0.16 cents (0.08%.) Diesel prices regained the territory above $2/gallon, and prices are remaining in the range of $2.00-$2.03/gallon. The latest price is $2.0270/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $57.00/b today, up by $1.05 (1.88%) from yesterday’s opening price of $55.95/b. Prices had been hitting highs of over $57.50/b on Monday before plunging nearly as low as $55/b. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices rose by $0.33 (0.58%.) Currently, crude prices are stable, holding in the vicinity of $57/b. The latest price is $57.07/b.