Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

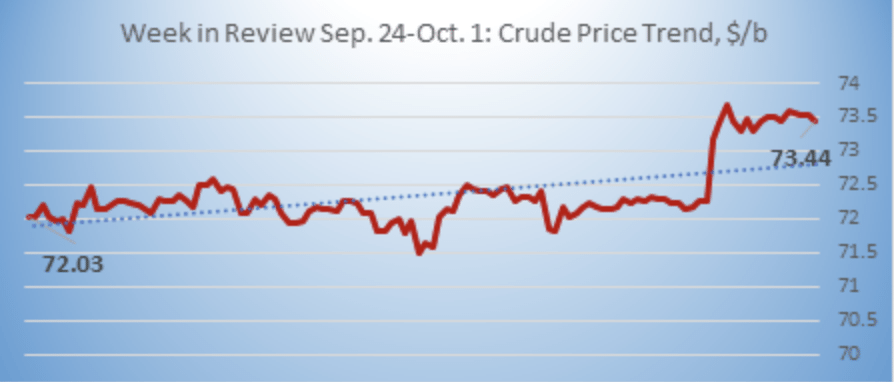

Crude oil prices began to ease yesterday, after gaining multi-year highs. WTI (West Texas Intermediate) crude prices in today’s trading session opened at $75.12/b, down by $0.30 from yesterday’s opening. Yesterday’s opening price was the highest since November 2014, and it remains to be seen if data on supply and demand keep prices above the $75/b mark. Gasoline and diesel prices also opened slightly lower today, following crude.

The American Petroleum Institute (API) reported that U.S. crude oil inventories appear to have risen by 0.907 million barrels during the week ended September 28th, but that gasoline inventories fell by 1.7 mmbbls and diesel inventories fell by 1.2 mmbbls, for a net drawdown of approximately 1.993 mmbbls. This was substantially more bullish than industry survey expectations. The Energy Information Administration (EIA) will release official statistics later today.

Oil prices should be stabilizing soon, if logic prevails. Although sanctions against Iran will not formally take effect until November 4th, Iranian supplies for the most part already are being taken off the market, since purchasers already have scheduled their November deliveries. Therefore, October should be the month of adjustment.

This morning, Reuters released an exclusive news bulletin reporting that Saudi Arabia and Russia had privately made a deal in September to raise oil production and begin easing prices. The U.S. Secretary of Energy, Rick Perry, was aware of this via individual meetings with Saudi Energy Minister Khalid al-Falih and Russian Energy Minister Alexander Novak. U.S. President Trump continued with OPEC-bashing, which is viewed as pleasing to much of his constituency. According to one of Reuters’ sources: “The Russians and the Saudis agreed to add barrels to the market quietly with a view not to look like they are acting on Trump’s order to pump more.” Saudi Arabia quietly planned to raise output by 200,000 to 300,000 bpd. Russian output rose by 150,000 bpd, growing from 11.21 mmbpd in August to 11.36 mmbpd in September. Russia plans to raise output in October also.

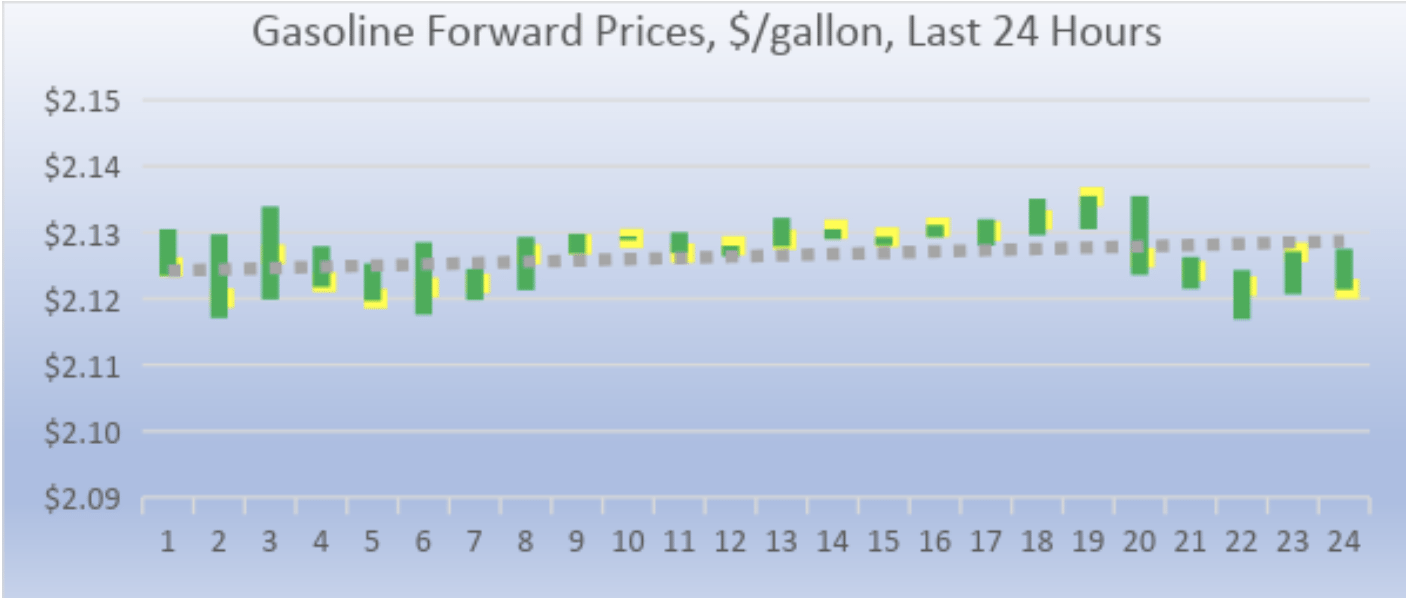

GASOLINE

Gasoline opened on the NYMEX at $2.1273 today, down by 0.62 cents (0.29%) from yesterday’s opening. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices declined slightly by 0.16 cents/gallon (0.08%.) Currently, the upward trend has flattened, and gasoline prices are easing slightly. The latest price is $2.1171/gallon.

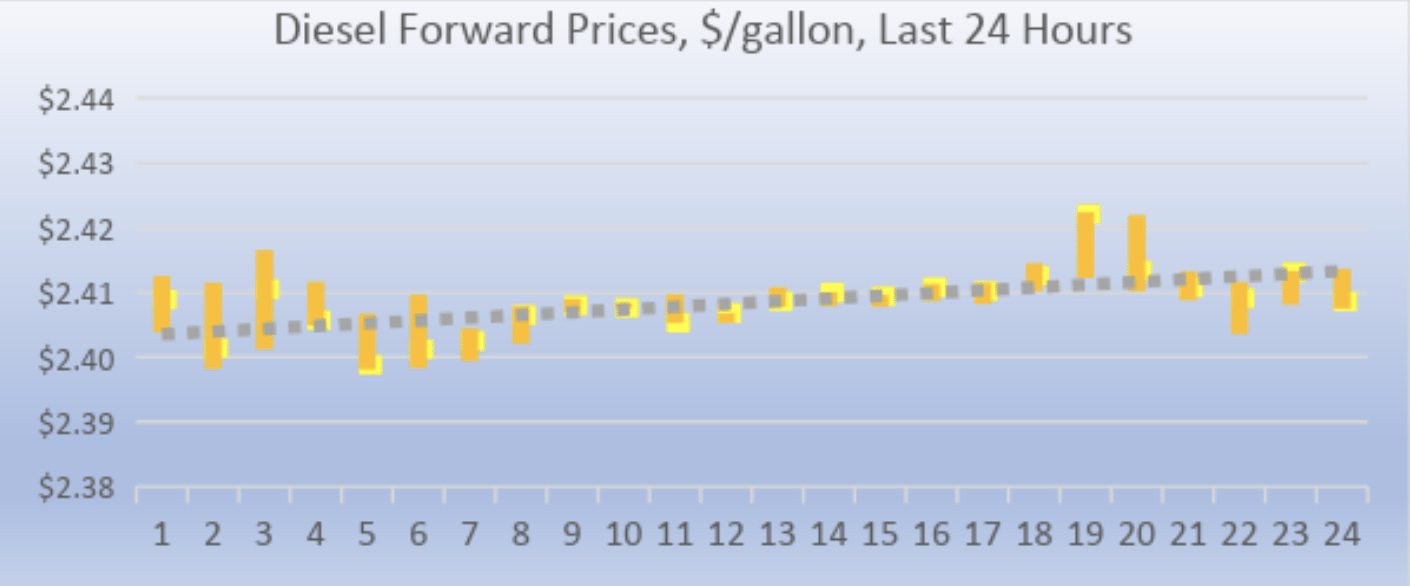

DIESEL

Diesel opened on the NYMEX at $2.4075/gallon today, down slightly by 0.27 cents (0.11%) from yesterday’s opening. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices rose by 0.54 cents/gallon (0.22%.) Currently, the upward surge has flattened, and prices are working to maintain gains and remain above the $2.40/gallon level. The latest price is $2.4041/gallon.

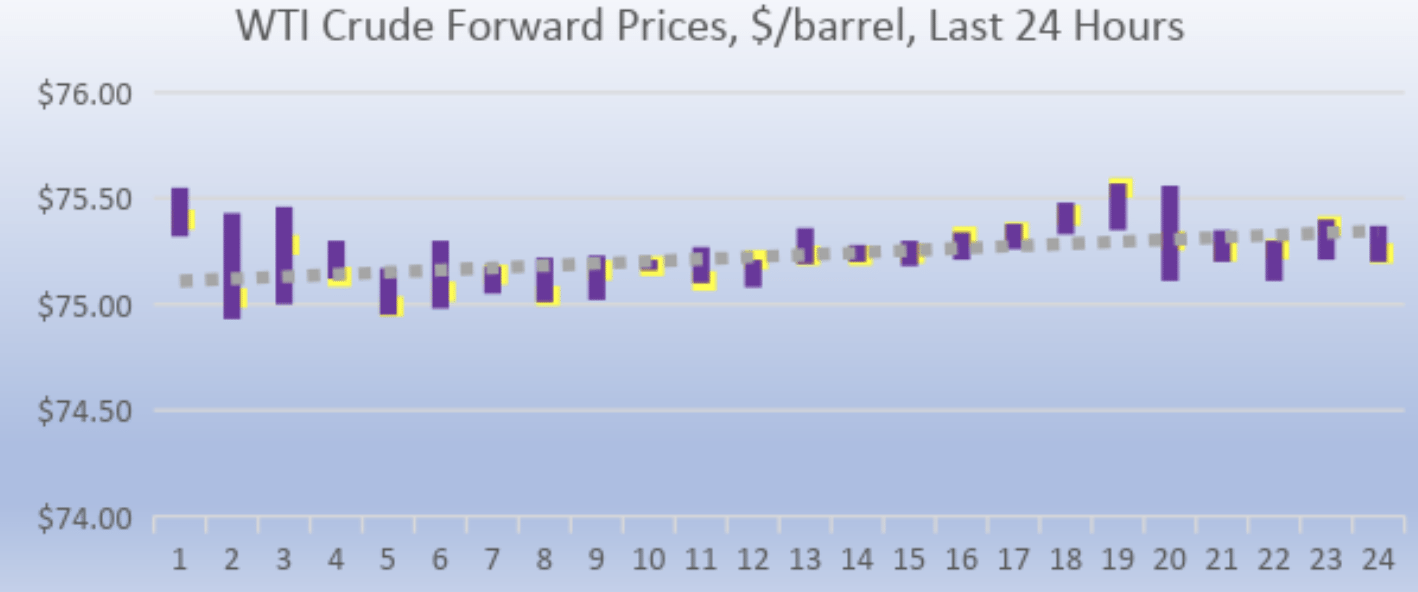

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $75.12/b, down by $0.30 (0.4%) from yesterday’s opening. Over the last 24-hour period from 9AM EST to 9AM EST, crude prices declined by $0.15 (0.2%.) Crude prices appear to be stabilizing in the range of $75.00/b-$75.30/b. The latest price is $75.15/b.