Analysis by Dr. Nancy Yamaguchi

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended June 24, 2019. Gasoline prices fell for the seventh week in a row. Diesel prices fell for the fifth week in a row, and they have fallen for six of the past seven weeks. On a national average basis, retail prices for gasoline declined by 1.6 cents/gallon for the week. National average prices for gasoline were 17.9 cents/gallon below where they were in the same week one year ago. On a national average basis, retail prices for diesel decreased by 2.7 cents/gallon. National average prices for diesel were 17.3 cents/gallon lower than they were in the same week last year.

Futures Prices and Retail Price Outlook

During the week June 17-June 21, 2019, West Texas Intermediate (WTI) crude futures jumped by $4.55/b (8.6%.) Gasoline futures prices rose by 5.1 cents/gallon (2.9%.) Diesel futures prices rose significantly by 8.8 cents/gallon (4.792%.) Oil prices began to rise as tensions rose between the U.S. and Iran over conflicts near the Strait of Hormuz, including tanker attacks, the downing of a U.S. drone, and U.S. threats of military attack. Although the relationship between futures market prices and retail prices is not immediate and one-for-one, the most recent trend in futures prices suggests that the recent easing of gasoline and diesel retail prices is over, and that retail prices will rise in the coming week. Moreover, a catastrophic fire and explosion on Friday the 21 at the Philadelphia Energy Solutions (PES) 335,000 bpd refinery destroyed the alkylation unit. This will cut the refinery’s ability to produce summer grade gasoline. There is no timetable for the construction of a new alkylation unit, and gasoline shipments immediately started heading for the East Coast upon the news.

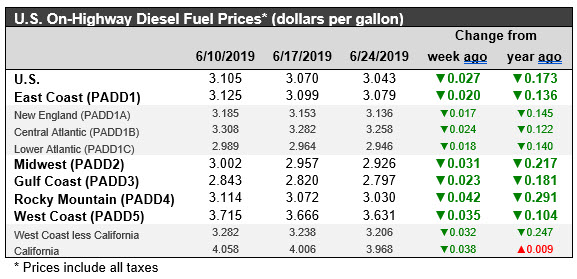

Retail Diesel Prices

For the current week ended June 24, retail diesel prices fell by 3.5 cents to settle at an average price of $3.070/gallon. Between mid-October and late-January, retail diesel prices fell for fourteen consecutive weeks. During those fourteen weeks, the price decline totaled 42.9 cents/gallon. From February through April, diesel prices crept back up by 20.4 cents/gallon. The month of May brought a modest reversal in the upward trend in diesel prices. During the four weeks of June, diesel prices have fallen more substantially, declining by 10.8 cents/gallon since the last week of May. For the current week ended June 24, diesel prices fell in all PADDs. The national average price for the week was 17.3 cents/gallon below where it was during the same week last year.

In the East Coast PADD 1, diesel prices fell by 2.0 cents to arrive at an average price of $3.079/gallon. Within PADD 1, New England prices fell by 1.7 cents to average $3.136/gallon. Central Atlantic diesel prices declined by 2.4 cents to average $3.258/gallon. Lower Atlantic prices fell by 1.8 cents to reach an average price of $2.946/gallon. PADD 1 prices were 13.6 cents/gallon below their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 3.1 cents to average $2.926/gallon. Prices were 21.7 cents/gallon below their level for the same week last year. PADD 2 joined PADD 3 last week in having diesel prices below $3/gallon.

In the Gulf Coast PADD 3, retail diesel prices fell by 2.3 cents to average $2.797/gallon. PADD 3 typically has the lowest diesel prices among the PADDs. Until the price drop in PADD 2 last week, PADD 3 was the only PADD where retail diesel prices were below the $3/gallon mark. Prices were 18.1 cents lower than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices dropped by 4.2 cents to settle at an average of $3.030/gallon. This was the largest price decrease among the PADDs. PADD 4 prices were 29.1 cents lower than for the same week in the prior year.

In the West Coast PADD 5 market, retail diesel prices fell by 3.5 cents to average $3.631/gallon. PADD 5 prices were 10.4 cents below their level from last year. Prices excluding California decreased by 3.2 cents to arrive at an average of $3.206/gallon. This price was 24.7 cents below the retail price for the same week last year. California diesel prices fell by 3.8 cents to arrive at an average price of $3.968/gallon. Until this week’s report, California had been the only major market where prices were above $4/gallon. California diesel prices had remained above the $4/gallon mark for nine weeks. California diesel prices were only 0.9 cents higher than they were at the same week last year.

Retail Gasoline Prices

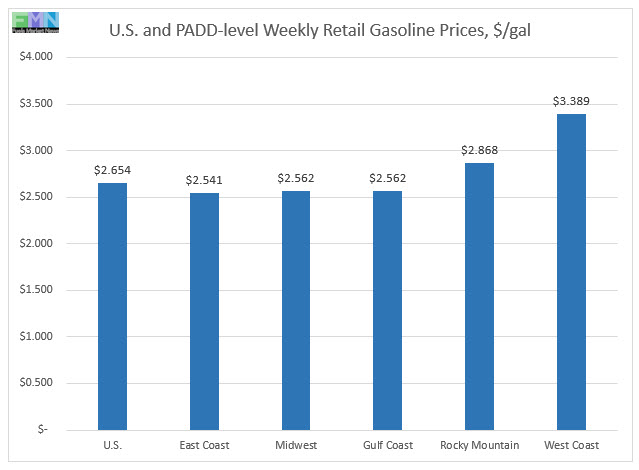

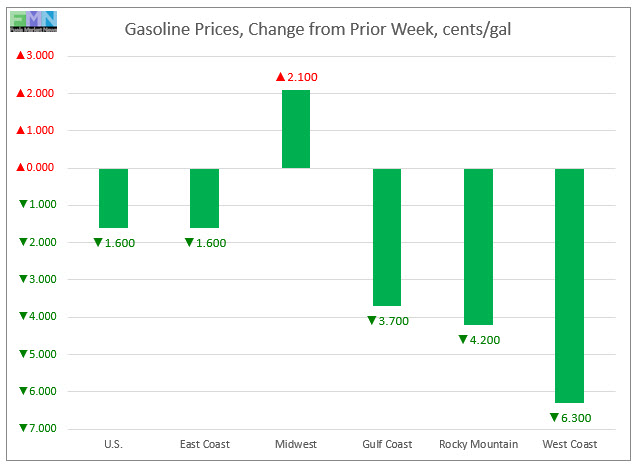

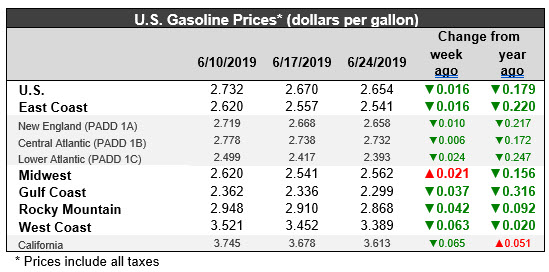

U.S. retail gasoline prices declined by 1.6 cents to average $2.654/gallon during the week ended June 24. Prices fell in all PADDs except for the Midwest PADD 2. Retail prices for the current week were 17.9 cents per gallon lower than they were one year ago. Gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for fourteen weeks in a row, shedding a total of 66.6 cents per gallon. In the next seventeen weeks, prices marched back up by 66.0 cents/gallon. Prices came very close to the peak they hit in early October, before the months of May and the June brought an easing of prices. Gasoline prices in May and June thus far have retreated by 23.3 cents per gallon.

For the current week ended June 24, East Coast PADD 1 retail prices for gasoline declined by 1.6 cents to average $2.541/gallon. The average price was 22.0 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices fell by 1.0 cent to average $2.658/gallon. Central Atlantic market prices decreased by 0.6 cents to average $2.732/gallon. Prices in the Lower Atlantic market fell by 2.4 cents to average $2.393/gallon.

In the Midwest PADD 2 market, retail gasoline prices rose by 2.1 cents to arrive at an average price of $2.562/gallon. This was the only price increase among the PADDs. PADD 2 prices for the current week were 15.6 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices declined by 3.7 cents to average $2.299/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Prices for the week were 31.6 cents lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices fell by 4.2 cents to arrive at an average price of $2.868/gallon. This week’s prices were 9.2 cents lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices dropped by 6.3 cents to arrive at an average of $3.389/gallon. This was the largest price drop among the PADDs. PADD 5 continues to have the highest gasoline prices among the five PADDs. However, with this week’s price decline, PADD 5 joined the rest of the PADDs in having retail prices fall below their levels from one year ago. Prices were 2.0 cents below last year’s level. Excluding California, West Coast prices fell by 6.1 cents to average $3.121/gallon. This price was 9.8 cents lower than at the same time last year. In California, pump prices dropped by 6.5 cents to average $3.613/gallon. California prices were 5.1 cents per gallon above their levels from the same week last year.