Carbon reduction for MHDVs requires taking multiple approaches.

By John Eichberger

We have all seen the bumper stickers—“Without trucks, America stops.” And it’s true. According to American Trucking Associations (ATA), 72% of the nation’s freight is moved by trucks. The data available about this critical industry is incredible, as is the contribution trucks make to the nation’s economy.

At the same time, as the industry and the nation consider strategies to reduce carbon emissions from the transportation sector, these vehicles must be a focus of our efforts. They account for 24% of U.S. transportation greenhouse gas emissions. In doing so, we also must recognize the complexity and unique characteristics of medium and heavy-duty vehicles (MHDV) to find solutions that balance environmental progress with economic activity.

What Is at Stake?

Some may think the slogan above is an exaggeration, but if you drive down any major interstate the magnitude of what this industry achieves is tangible. Of course, none of us likes to be surrounded by big rigs while driving, but when we get to our destinations, we are grateful to find the store shelves full of options. But to really understand the market, it is important to put it into context. The following data again comes from ATA:

- Gross freight revenues from trucking were valued at $875.5 billion in 2021, 80.8% of the nation’s total freight bill. This is equal to 4% of the U.S. gross domestic product.

- Commercial trucks paid $48.46 billion in federal and state highway-user taxes in 2020 (a pandemic year). This accounts for 24% of all government spending on roadways.

- There were 38.9 million trucks registered and used for business purposes in 2020.

- Registered trucks drove 302.14 billion miles in 2020 (again, a pandemic year) and consumed 44.8 billion gallons of fuel.

- 7% of for-hire carrier companies on file with the Federal Motor Carrier Safety Administration operate 10 or fewer trucks.

- 99 million people were employed in jobs related to trucking in 2021, excluding those who were self-employed.

In other words, there are a lot of components associated with this segment of the market and a lot of people directly and indirectly affected.

Because this sector is extremely diverse, reducing emissions will require a multifaceted approach that applies customized solutions to different vehicle types and use applications. According to a Fuels Institute report published in April, 94% of commercial vehicles sold are deployed in 17 different use-case applications, each of which carries with it unique operating characteristics and energy requirements. These vehicles are produced in smaller unit volumes than are light duty vehicles, which are much more homogenous in structure and design and benefit from similar architectures.

Market Share of Alternative MHDVs Is Limited

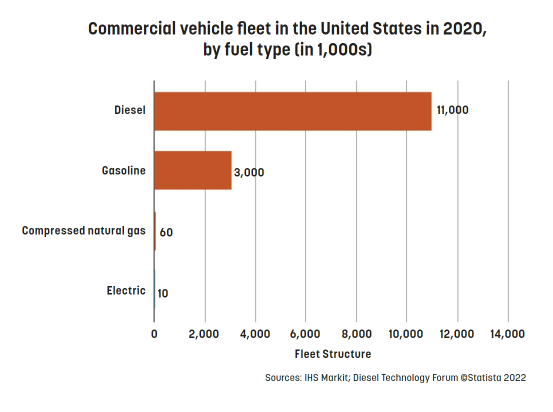

The demands of the commercial vehicle space are such that investment in alternative powertrains has been limited in the past. According to data provided by Statista, 99.5% of commercial vehicles in the U.S. in 2020 were powered by diesel or gasoline-fueled engines. And despite growing discussions about electrification of the MHDV market, forecasts for market penetration remains relatively anemic. Statista reports that by 2026, there will be about 324,000 electric-powered trucks on the road globally.

Comparing this to the approximately 22 million commercial vehicles that are sold globally each year confirms the market share is quite small. The primary reason for the slow rate of adoption is price. Statista reports that electric-powered medium duty trucks in 2025 will cost twice as much as comparable diesel vehicles, while heavy-duty electric trucks will cost more than 2.5 times as much.

Electric powertrains are gaining market share in the light duty vehicle market, but the slow rate of adoption among commercial vehicles globally indicates that additional strategies must be available for many vehicle applications. For some applications, such as parcel delivery vehicles that travel a consistent range and return to a base each night and school buses that have prolonged downtime throughout the day, electrified powertrains are attractive for both emissions and economic reasons. Other segments of the MHDV market, however, do not present the same opportunities for electrification.

More Options Available for MHDV Market

The diversity of vehicle type and duty cycle within the MHDV market makes application of some decarbonization strategies more challenging than within the light-duty market, but it also creates opportunities for more options that may not be viable with passenger vehicles. For example, incorporating more biodiesel and renewable diesel into the fuel supply can dramatically reduce the carbon intensity of the fuel these vehicles burn. In fact, these fuels represent a 68% reduction in carbon intensity compared with straight diesel fuel and can be blended in higher concentrations (thereby improving the associated carbon benefits) than most light-duty vehicles can accommodate with gasoline-ethanol blends.

MHDVs are also capable of running on a wide variety of gaseous fuels, like natural gas, which can lower carbon emissions. When renewable natural gas is used in these vehicles, the carbon intensity has the potential to be negative due to the nature of renewable gas.

In an era where decarbonizing transportation has been identified as a key objective, addressing the MHDV sector is critical. However, to successfully reduce carbon emissions, it is essential to understand the complexities that exist within this market and the unique characteristics of the applications to which vehicles are dedicated. There are strategies that will fit certain use-case applications but not others. Recognition of this reality is important, especially when considering public policy initiatives.