NOAA Declares a La Nina Event, More HDDs Coming?

- Covid-19 uncontained, ULSD impact unclear

- All oil inventories falling; still very high

- Propane supplies rising; an exception

- LNG exports seen as bullish

Alan Levine—Chairman, Powerhouse

(202) 333-5380

The Matrix

Energy prices have always had a political component. This year is not different. If anything, political considerations loom large in determining the direction of prices this winter. The Covid-19 pandemic has not been contained globally and the prospect of even greater damage from a new round of cases may yet be ahead.

More traditional measures of supply and demand do not offer any clear picture of price. Much is being made of the recent reduction in overall inventories. Stocks of crude oil and products in the United States reached 2.1 billion barrels in July, far and away the highest level since at least 1990.

Supplies have fallen 50.7 million barrels since then, almost all in crude oil. Inventories remain substantial nonetheless. Domestic crude oil stocks accounted for 46.3 million barrels of the drop.

Distillate fuel oil supplies reached 180 million barrels during the week ending July 31, 2020. Inventories have since fallen by only four million barrels. Such oversupply could inhibit prices this winter season, except that a La Nina weather system just declared by NOAA introduces the possibility of colder than anticipated temperatures and higher heating degree days. (See our discussion below at Natural Gas.)

Propane is a notable exception to the overall decline in petroleum inventories. Stocks for the week ending September 18 stood at 97.9 million barrels, the highest seen in recent years.

Traders are anticipating expanded volatility in financial markets as the presidential election unfolds over the next few months. Option traders have observed that volatility, measured by the VIX index, is not indicating a strong rise prior to the election. Rather, VIX suggests that “volatility will jump at Election Day, and remain high thereafter.”

Oil prices tend to mirror activity in broader markets. If the VIX accurately reflects expectations, wide-ranging prices in oil futures could be ahead. Long hedgers should consider adding put protection in light of these considerations.

Supply/Demand Balances

Supply/demand data in the United States for the week ended September 18, 2020, were released by the Energy Information Administration.

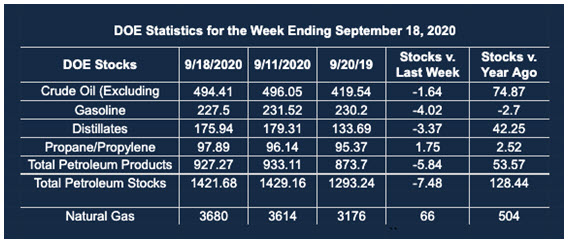

Total commercial stocks of petroleum fell by 7.5 million barrels during the week ended September 18, 2020.

Commercial crude oil supplies in the United States decreased by 1.6 million barrels from the previous report week to 496.0 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Fell 0.1 million barrels from to 1.1 million barrels

PADD 2: UNCH from the previous report week at 140.5 million barrels

PADD 3: Fell 1.6 million barrels to 265.0 million barrels

PADD 4: Fell 0.3 million barrels to 23.8 million barrels

PADD 5: Plus 1.2 million barrels to 54.3 million barrels

Cushing, Oklahoma inventories were unchanged from the previous report week at 54.3 million barrels.

Domestic crude oil production was fell 200,000 barrels per day from the previous report week to 10.7 million barrels daily.

Crude oil imports averaged 5.168 million barrels per day, a daily increase of 160,000 barrels. Exports increased 427,000 barrels daily to 3.022 million barrels per day.

Refineries used 74.8% of capacity, down 1.0% from the previous report week.

Crude oil inputs to refineries decreased 118,000 barrels daily; there were 13.370 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 192,000 barrels daily to reach 13.931 million barrels daily.

Crude oil imports averaged 5.168 million barrels per day, a daily increase of 160,000 barrels. Exports increased 427,000 barrels daily to 3.022 million barrels per day.

Refineries used 74.8 percent of capacity, down 1.0% from the previous report week.

Total petroleum product inventories fell 5.9 million barrels from the previous report week.

Gasoline stocks decreased 4.0 million barrels daily from the previous report week; total stocks are 227.5 million barrels.

Demand for gasoline rose 37,000 barrels per day to 8.515 million barrels per day.

Total product demand increased 1.412 million barrels daily to 18.439 million barrels per day.

Distillate fuel oil stocks decreased 3.4 million barrels from the previous report week; distillate stocks are at 175.9 million barrels. EIA reported national distillate demand at 3.959 million barrels per day during the report week, an increase of 1.150 million barrels daily.

Propane stocks increased 1.7 million barrels from the previous report week; propane stocks are 97.9 million barrels. The report estimated current demand at 1.049 million barrels per day, a decrease of 429,000 barrels daily from the previous report week.

Natural Gas

Natural gas futures gained about seventy cents as the November contract became spot. And with this increase, the prospect of prices with a $3 handle through the winter becomes a factor that cannot be ignored.

As we have noted several times, falling production has been a general feature of the natural gas markets. The growth of LNG exports has persisted through the year. These are bullish features of gas pricing.

Moreover, NOAA has declared a La Nina weather pattern has been established. La Nina has bullish implications for the remainder of the hurricane season and for winter weather throughout the country.

According to the EIA:

Natural gas futures gained about seventy cents as the November contract became spot. And with this increase, the prospect of prices with a $3 handle through the winter becomes a factor that cannot be ignored.

As we have noted several times, falling production has been a general feature of the natural gas markets. The growth of LNG exports has persisted through the year. These are bullish features of gas pricing.

Moreover, NOAA has declared a La Nina weather pattern has been established. La Nina has bullish implications for the remainder of the hurricane season and for winter weather throughout the country.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2020 Powerhouse Brokerage, LLC, All rights reserved