Oil prices sank back into the doldrums this week, unable to maintain last week’s rally. The stock market continued to slide, carrying oil along and sinking it below $40 a barrel. Last week, crude prices managed to recover nearly $4 a barrel, supported by Hurricane Sally, an inventory drawdown, and strong commitments from the OPEC+ group. WTI crude prices regained the $41 a barrel level. This week, however, prices are struggling to maintain $40 a barrel. On the supply side, Libya intends to revive crude exports, which will worsen the glut. Libya is not a participant in the OPEC+ cut agreement, and Libyan production could rise to 300,000-500,000 barrels per day within a matter of months. On the demand side in the U.S., gasoline demand has been flat, and diesel demand has weakened. Political divisiveness has worsened, setting the odds against federal stimulus to aid economic recovery. Coronavirus infections and deaths continue to rise. The oil complex appears to be heading for a finish in the red this week.

Wall Street is opening lower this morning, possibly heading for its fourth consecutive week of losses. The stock market may be entering a new period of volatility. Investors would like to call the recent downturn a “healthy correction,” but experts acknowledge that it may be more than that. The stellar performance of Wall Street has been driven by tech stocks, led by the five “FAAMG” stocks Facebook, Apple, Amazon, Microsoft, and Google’s parent company Alphabet. The NASDAQ index is tech-heavy, and it officially dropped into correction territory this week by falling 10% below its September 2 peak. The Federal Reserve Bank has more than once spoken on the need for more federal stimulus, but Congress and the White House remain far from an agreement on the issue. The House of Representatives is drafting a new stimulus bill worth approximately $2.4 trillion, but the Senate is not expected to support this level of spending. Political tension and divisiveness have increased with the death of Justice Ruth Bader Ginsberg this week.

The employment situation had a setback this week. Initial weekly unemployment claims rose by 4,000 during the week ended September 19, coming in at 870,000. Moreover, the prior week’s figure was revised up by 6,000 from 860,000 to 866,000. Initial weekly claims have been below the one-million mark for the last four weeks, but this week’s numbers went in the wrong direction. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 27 weeks since U.S. states began to issue shelter-in-place orders, over 61.9 million Americans have filed initial jobless claims. As COVID-19 supplemental benefits fade away, consumer spending is expected to decline.

The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have now passed the 32 million mark, reaching 32,273,576, with 983,751 deaths. Confirmed cases in the U.S. are approaching 7 million, having risen to 6,980,104. U.S. deaths attributed to the disease have reached 202,827.

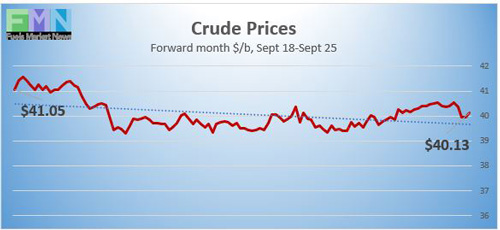

WTI crude futures prices opened at $40.15 a barrel today, a loss of $0.82 a barrel (2.0%) from last Friday’s open of $40.97 a barrel. Price support has come from hurricanes and disasters, plus OPEC+ intervention. Weak demand, rising coronavirus cases, and the collapse of the stock market dragged oil prices down. WTI futures prices are hovering slightly above $40 a barrel. Prices appear to be heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, September 18 through Friday, September 25. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

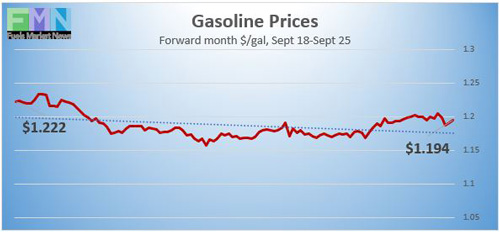

Gasoline Prices

Gasoline futures prices opened at $1.1933 a gallon today on the NYMEX, compared with $1.2236 a gallon last Friday. This was a decline of 3.03 cents (2.5%). March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline fell 1.5 cents to average $2.168/gallon during the week ended September 21. Retail prices reclaimed the territory above $2 per gallon during the first week of June. Gasoline futures are trading in the range of $1.185/gallon to $1.204/gallon. The week is heading for a finish in the red. The latest price is $1.1953/gallon.

Source: Prices as reported by DTN Instant Market

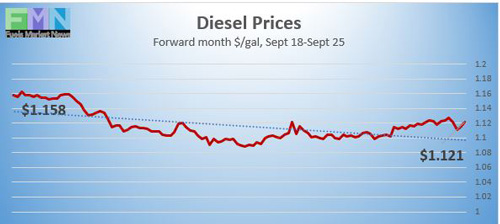

Diesel Prices

Diesel opened on the NYMEX today at $1.112/gallon, down significantly by 4.9 cents, or 4.2%, from last Friday’s open of $1.161/gallon. U.S. average retail prices for diesel fell by 1.8 cents per gallon during the week ended September 21 to average $2.404/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. The week is heading for a finish in the red. Currently, diesel is trading in the range of $1.1095-$1.1281/gallon. The latest price is $1.1188/gallon.

WTI Crude Prices

Source: Prices as reported by DTN Instant Market

WTI crude forward prices opened on the NYMEX today at $40.15 a barrel, compared with $40.97 a barrel last Friday. This was a decline of $0.82 a barrel (2.0%.) Prices sagged alongside stocks. Coronavirus cases continue to rise, job formation is slower than expected, political divisiveness has worsened, and global oil supplies may expand as demand languishes. Prices are now hovering around $40 a barrel. The week appears to be headed for a finish in the red. WTI crude is trading in the $39.75–$40.60 a barrel range currently. The latest price is $39.95 a barrel.

Source: Prices as reported by DTN Instant Market

PRICE MOVERS THIS WEEK: BRIEFING

Oil prices sank back into the doldrums this week, unable to maintain last week’s rally. The stock market continued to slide, carrying oil along and sinking it below $40 a barrel. Last week, crude prices managed to recover nearly $4 a barrel, supported by Hurricane Sally, an inventory drawdown, and strong commitments from the OPEC+ group. WTI crude prices regained the $41 a barrel level. This week, however, prices are struggling to maintain $40 a barrel. On the supply side, Libya intends to revive crude exports, which will worsen the glut. Libya is not a participant in the OPEC+ cut agreement, and Libyan production could rise to 300,000-500,000 barrels per day within a matter of months. On the demand side in the U.S., gasoline demand has been flattish, and diesel demand has weakened. Political divisiveness has worsened, setting the odds against federal stimulus to aid economic recovery. Coronavirus infections and deaths continue to rise. The oil complex appears to be heading for a finish in the red this week.

Wall Street is opening lower this morning, possibly heading for its fourth consecutive week of losses. The stock market may be entering a new period of volatility. Investors would like to call the recent downturn a “healthy correction,” but experts acknowledge that it may be more than that. The stellar performance of Wall Street has been driven by tech stocks, led by the five “FAAMG” stocks—Facebook, Apple, Amazon, Microsoft, and Google’s parent company Alphabet. The NASDAQ index is tech-heavy, and it officially dropped into correction territory this week by falling 10% below its September 2 peak. The Federal Reserve Bank has more than once spoken on the need for more federal stimulus, but Congress and the White House remain far from an agreement on the issue. The House of Representatives is drafting a new stimulus bill worth approximately $2.4 trillion, but the Senate is not expected to support this level of spending. Political tension and divisiveness have increased with the death of Justice Ruth Bader Ginsberg this week.

The employment situation had a setback this week. Initial weekly unemployment claims rose by 4,000 during the week ended September 19, coming in at 870,000. Moreover, the prior week’s figure was revised up by 6,000 from 860,000 to 866,000. Initial weekly claims have been below the one-million mark for the last four weeks, but this week’s numbers went in the wrong direction. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 27 weeks since U.S. states began to issue shelter-in-place orders, over 61.9 million Americans have filed initial jobless claims. As COVID-19 supplemental benefits fade away, consumer spending is expected to decline.

The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have now passed the 32 million mark, reaching 32,273,576, with 983,751 deaths. Confirmed cases in the U.S. are approaching 7 million, having risen to 6,980,104. U.S. deaths attributed to the disease have reached 202,827.

The U.S. Energy Information Administration (EIA) published official inventory data for the week ended September 18. The EIA reported across-the-board reductions in inventories of 1.639 million barrels (mmbbls) from crude oil inventories, 4.025 mmbbls from gasoline inventories, and 3.364 mmbbls from diesel inventories. The EIA net result was a significant inventory drawdown of 9.028 mmbbls. This bullish news was insufficient to move oil prices up against the stock market downturn.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. The current week ended September 18 showed Cushing stocks at 54,281 mmbbls.

During the week ended September 18, U.S. crude production declined by 0.2 mmbpd, falling to 10.7 mmbpd from 10.9 mmbpd the prior week. Approximately 0.5 mmbpd of production had been shut in to prepare for Hurricane Sally. Production was quickly restored, and next week’s data should reflect this. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd. Production during the first three weeks of September has averaged 10.53 mmbpd.