Tight Distillate Fuel Oil Stocks Could Ease with New Sources of Crude Oil

- Distillate fuel oil price action has been muted

- Refiners increasing diesel production

- New supply coming from Venezuela

- Natural gas storage and price action bearish for winter

Sincerely,

Alan Levine, Chairman

Powerhouse

(202) 333-5380

The Matrix

Price action for distillate fuel oils has been range-bound following an initial reaction to the latest Middle East fighting. On October 6th, ULSD spot futures bottomed at $2.8336. Hamas invaded Israel the next day.

Prices added only $0.0658 when NYMEX next traded, settling at $2.9666. By October 16, distillate fuel oil prices reached $3.2515, and have been range-bound since. Prices settled last week at $3.1566.

Oil observers have commented on ULSD’s muted action, comparing it to hectic volatility in previous Middle East occurrences. The explanation is complicated by other factors bearing on price determination, not least is the expansion of distillate fuel oil output by refiners as winter approaches.

Refiners produced 4.443 million barrels daily of distillate fuel oil in January 2023. Most recently, output has risen to 4.761 million barrels per day. This gain reflects the efforts of refiners to restore inventory for next winter. But this has not improved the situation.

The United States has 28.7 days’ supply of distillates, perilously near the low 25.4 days’ supply over the past five years. It is well below the average level of 32.0 days’ supply typically available.

Global events are impacting ULSD’s supply and price too. Russia had banned exports of diesel fuel previously imposed in response to the EU’s sanctions in response to the Ukrainian invasion. The ban has been partially lifted, and Russian diesel could pressure prices.

New supply should also be coming from Venezuela. Sanctions, imposed on that country in 2017, have been eased in exchange for more open elections. Venezuela was producing 2.4 million barrels daily of crude oil at that time. Today, less than a third of that is produced. Recovery of supply should provide additional barrels of heavy crude oil in the Western Hemisphere.

Early reports say that oil production in the United States reached record highs in October, moving above 13.2 million barrels daily in the first week of the month. This is a good sign for American energy independence.

Supply/Demand Balances

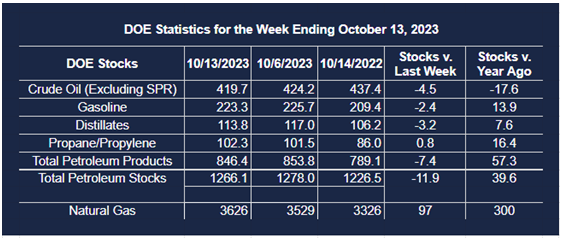

Supply/demand data in the United States for the week ended October 13, 2023, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 11.9 million barrels to 1.2661 billion barrels during the week ended October 13, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 4.5 million barrels from the previous report week to 419.7 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.8 million barrels to 7.6 million barrels

PADD 2: Down (⬇) 0.5 million barrels to 101.9 million barrels

PADD 3: Down (⬇) 2.9 million barrels to 242.8 million barrels

PADD 4: Down (⬇) 0.2 million barrels to 23.3 million barrels

PADD 5: Down (⬇) 1.4 million barrels to 44.3 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.8 million barrels from the previous report week to 21.0 million barrels.

Domestic crude oil production was unchanged (=) at 13.2 million barrels daily.

Crude oil imports averaged 5.942 million barrels per day, a daily decrease (⬇) of 387,000 barrels. Exports increased (⬆) 2.234 million barrels daily to 5.301 million barrels per day.

Refineries used 86.1% of capacity; 0.4 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 193,000 barrels daily; there were 15.396 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 73,000 barrels daily to 15.735 million barrels daily.

Total petroleum product inventories decreased (⬇) by 7.4 million barrels from the previous report week, up to 846.4 million barrels.

Total product demand increased (⬆) 2.232 million barrels daily to 21.897 million barrels per day.

Gasoline stocks decreased (⬇) 2.4 million barrels from the previous report week; total stocks are 223.3 million barrels.

Demand for gasoline increased (⬆) 362,000 barrels per day to 8.943 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 3.2 million barrels from the previous report week; distillate stocks are at 113.8 million barrels. EIA reported national distillate demand at 4.416 million barrels per day during the report week, an increase (⬆) of 746,000 barrels daily.

Propane stocks increased (⬆) by 0.8 million barrels from the previous report week to 102.3 million barrels. The report estimated current demand is at 1.493 million barrels per day, an increase (⬆) of 906,000 barrels daily from the previous report week.

Natural Gas

The United States is likely to start this year’s withdrawal period with hefty stocks. With this week’s natural gas storage report, EIA’s estimate of stocks at the end of October grew to 3.8 Bcf, 175 Bcf higher than the average of the past five years.

Spot futures prices have fallen hard over the past two weeks. Prices topped at $3.471 on October 9th. They reached $2.880 last Friday intraday, before settling at $2.899. Significant support is around $2.70.

Substantial domestic storage may not be enough to keep pushing prices lower. Natural gas is now part of global trade. Price and availability are not immune to events like those now occurring in the Middle East. Markets overseas have already shown volatility.

Ninety-seven Bcf were added to underground stocks of natural gas in the week ended October 13. This was well above expectations. It includes an addition of 40 Bcf in the South-Central region which includes Texas. The inability to develop above-normal Heating Degree Days appears to have offset global concerns.

The Climate Prediction Center provides data on HDDs. The United States has developed 141 HDDs since July 1, 2023. This is 55 HDDs fewer than normal, and 16 HDDs less than last year. Each region has failed to reach normal this year.

El Nino remains another wild card this winter. It usually creates a warmer winter, but new research has raised questions about this year’s impact.

According to the EIA:

- Net injections into storage totaled 97 Bcf for the week ended October 13, compared with the five-year (2018–2022) average net injections of 85 Bcf and last year’s net injections of 113 Bcf during the same week. Working natural gas stocks totaled 3,626 Bcf, which is 175 Bcf (5%) more than the five-year average and 300 Bcf (9%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 75 Bcf to 102 Bcf, with a median estimate of 84 Bcf.

- The average rate of injections into storage is 6% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 8.0 Bcf/d for the remainder of the refill season, the total inventory would be 3,770 Bcf on October 31, which is 175 Bcf higher than the five-year average of 3,595 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2023 Powerhouse Brokerage, LLC, All rights reserved