Oil Demand Surges; Supply, Not So Much

- Gasoline futures typically top at Memorial Day

- Demand for transportation fuels growing

- Crude oil storage pressure eases

- Natural gas production falls.

The Matrix

Memorial Day is typically an important date for the petroleum industry. Futures prices for gasoline often reach a top about now. They start a slow retreat to winter lows and the beginning of a new annual price cycle.

It’s risky to talk about typical behavior in this year of the coronavirus. The range of potential challenges to normality is enormous.

Demand is surging as drivers return to the roads and businesses reopen. Supply cuts in crude oil have their supportive effect as refiners return to more typical supply patterns. The loss of crude oil supply reflects shuttering production globally.

One estimate puts the global loss of crude oil supply at 17 million barrels per day. OPEC+ has completely reversed its position. Saudi Arabia has stopped massive production, leading the group to bullish lower output. North American oil production has faltered. EIA has estimated output at 11.5 million barrels daily for the week ending May 15. Another 100,000 barrels per day weekly output decline supports the bull case.

Bearish concern that crude oil stocks could overwhelm available storage has largely eased. EIA published data on crude oil storage in the United States. Stocks of crude oil, net of pipeline fill and stocks in transit, came to 400 million barrels at May 15. Working storage capacity was estimated at 653 million barrels. The United States was using 61% of available storage.

The May crude oil futures contract recorded negative prices at expiration. June futures traded in the low $30s, a far more realistic price that suggests the end of the May crude oil futures was largely an overreaction to reports of storage tightness.

Traders could turn to the refinery situation as an indicator of price trends. Facilities are running at 69.4% of capacity, a minor increase over recent low utilization of 69.1%. Refinery demand for crude oil should expand with demand for gasoline recovering. One caution for price bears is that refiners have deferred maintenance. Problems with logistical barriers in the CD-19 environment including adding workers have reduced the window for facilities repairs and replacement. One estimate puts deferred maintenance taking about half of renewed throughput. Traders expect this to present as bullish to gasoline crack spreads.

Supply/Demand Balances

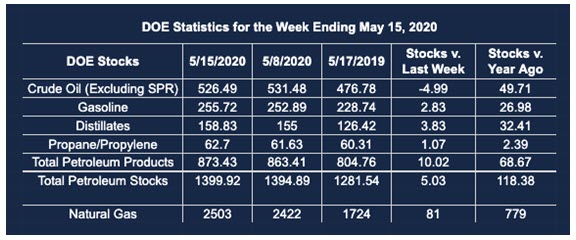

Supply/demand data in the United States for the week ending May 15, 2020, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose by 5.0 million barrels during the week ending May 15, 2020.

Commercial crude oil supplies in the United States decreased by 5.0 million barrels from the previous report week to 526.5 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down 0.9 million barrels to 12.3 million barrels

PADD 2: Down 5.8 million barrels to 147.5 million barrels

PADD 3: Plus 2.4 million barrels to 284.9 million barrels

PADD 4: Plus 0.5 from the previous report week to 24.7 million barrels

PADD 5: Down 1.1 million barrels to 57.1 million barrels

Cushing, Oklahoma inventories were down 5.5 million barrels from the previous report week to 56.9 million barrels.

Domestic crude oil production fell 0.1 million barrels per day from the previous report week to 11.5 million barrels daily.

Crude oil imports averaged 5.197 million barrels per day, a daily decrease of 194,000 barrels. Exports fell 286,000 barrels daily to 3.239 million barrels per day.

Refineries used 69.4 percent of capacity, plus 1.5% from the previous report week.

Crude oil inputs to refineries increased 520,000 barrels daily; there were 12.903 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 294,000 barrels daily to reach 13.177 million barrels daily.

Total petroleum product inventories rose 10.0 million barrels from the previous report week.

Gasoline stocks increased 2.8 million barrels daily from the previous report week; total stocks are 255.7 million barrels.

Demand for gasoline fell 608,000 barrels per day to 6.790 million barrels per day.

Total product demand decreased 228,000 barrels daily to 16.586 million barrels per day.

Distillate fuel oil stocks increased 3.8 million barrels from the previous report week; distillate stocks are at 158.8 million barrels. EIA reported national distillate demand at 3.668 million barrels per day during the report week, a decrease of 150,000 barrels daily.

Propane stocks increased 1.1 million barrels from the previous report week; propane stocks are 62.7 million barrels. The report estimated current demand at 1.073 million barrels per day, an increase of 205,000 barrels daily from the previous report week.

Natural Gas

Natural gas availability is likely to decline, reflecting reduced production. At the same time, LNG exports fell during the week ending May 20, 2020; only 37 Bcf left the United States. This was the least volume exported since October 17, 2019. On balance, natural gas prices remain range bound.

According to EIA:

The net injections into [natural gas] storage totaled 81 Bcf for the week ending May 15, compared with the five-year (2015–19) average net injections of 87 Bcf and last year’s net injections of 101 Bcf during the same week. Working natural gas stocks totaled 2,503 Bcf, which is 407 Bcf more than the five-year average and 779 Bcf more than last year at this time.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2020 Powerhouse, All rights reserved.