Product Supply at Risk on East Coast

- Cyberattack shuts Colonial Pipeline

- Impact on supply is uncertain

- Imports in New York Harbor could cushion any loss

- Natural gas storage lags last year

Alan Levine—Chairman, Powerhouse

(202) 333-5380

The Matrix

The Colonial Pipeline has been shut; a safety measure initiated because a cyber-attack has been launched against the Company’s business computer systems. It is ironic that an attack on computer systems that are not part of the equipment that moves oil can nonetheless bring operations to a halt, because of the high degree of integration in industrial applications and its implications for petroleum supply.

The possibility of failed delivery of petroleum products to the East Coast has raised concern that product shortages could ensue. Colonial is reportedly the “largest refined products pipeline in the United States.” It carries 2.5 million barrels daily. This comes to 45% “of all fuel consumed on the East Coast.” The line carries gasoline, diesel, jet fuel, and heating oil.

There are other sources that could cushion the loss of Colonial product, such as imports into New York Harbor. Buckeye Pipeline carries product, with distribution in the East and Midwest. Buckeye has announced the uninterrupted continuation of its operations.

Some analysts have suggested that current supply in the Northeast could be adequate for a day or so. Beyond that, retail prices could react if drivers start hoarding gasoline.

The Colonial pipeline shutdown comes at the end of a week where EIA reported a decline in commercial crude oil storage of eight million barrels. Most of the drop occurred on the Gulf Coast where maritime conditions allowed export. The United States reported crude oil exports of 4.1 million barrels daily, 62% higher than during the prior week.

Supply/Demand Balances

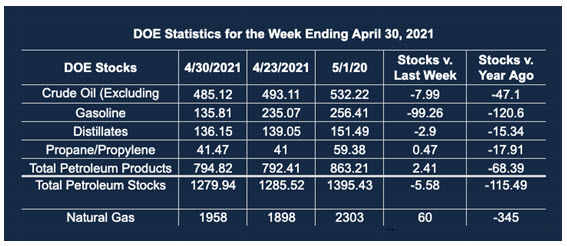

Supply/demand data in the United States for the week ended April 30, 2021, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell by 5.6 million barrels during the week ended April 30, 2021.

Commercial crude oil supplies in the United States decreased by 8.0 million barrels from the previous report week to 485.1 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down 1.1 to 8.4 million barrels

PADD 2: Plus 1.9 million barrels to 134.3 million barrels

PADD 3: Down 10.4 million barrels to 269.6 million barrels

PADD 4: Plus 0.1 million barrels to 24.9 million barrels

PADD 5: Plus 1.6 million barrels to 48.0 million barrels

Domestic crude oil production was unchanged from the previous report week at 10.9 million barrels daily.

Domestic crude oil production was down 0.1 million barrels per day from the previous report week to 10.9 million barrels daily.

Crude oil imports averaged 5.451 million barrels per day, a daily decrease of 1.164 million barrels. Exports increased 1.581 million barrels daily to 4.122 million barrels per day.

Refineries used 86.5% of capacity, 1.1 percentage points higher than the previous report week.

Crude oil inputs to refineries increased 225,000 barrels daily; there were 15.243 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 211,000 barrels daily to 15.698 million barrels daily.

Total petroleum product inventories rose 3.0 million barrels from the previous report week.

Gasoline stocks rose 0.7 million barrels from the previous report week; total stocks are 235.8 million barrels.

Demand for gasoline fell 12,000 barrels per day to 8.864 million barrels per day.

Total product demand decreased 704,000 barrels daily to 19.691 million barrels per day.

Distillate fuel oil stocks fell 2.9 million barrels from the previous report week; distillate stocks are at 136.2 million barrels. EIA reported national distillate demand at 4.125 million barrels per day during the report week, a decrease of 205,000 barrels daily.

Propane stocks rose 0.5 million barrels from the previous report week; propane stocks to 41.5 million barrels. The report estimated current demand at 1.353 million barrels per day, an increase of 204,000 barrels daily from the previous report week.

Natural Gas

Natural gas reached $3.00 in its most recent rally and has since fallen. $3.00 is well below expected objectives of $3.12 to $3.16 and could become the seasonal top before the shoulder season asserts itself.

According to the EIA:

The net [natural gas] injections into storage totaled 60 Bcf for the week ending April 30, compared with the five-year (2016–2020) average net injections of 81 Bcf and last year’s net injections of 103 Bcf during the same week. Working natural gas stocks totaled 1,958 Bcf, which is 61 Bcf lower than the five-year average and 345 Bcf lower than last year at this time.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2021 Powerhouse Brokerage, LLC, All rights reserved