Oil Prices March Higher

- Dollar Index losing value

- Weak dollar contributes to oil price strength

- Oil stocks declining

- Natural gas storage losing ground vs. 5-year average

Sincerely, Alan Levine, Chairman of Powerhouse (202) 333-5380

The Matrix

Trading in the March, 2018 Dollar Index futures contract opened at 101.039 early in March, 2017. This was its high that week and has been its high ever since. With only a brief rally centered in October last year, the index has steadily lost ground, touching 88.255 on January 25, an all-time low for the March contract.

A “weak” dollar may ring negatively to the political ear, but a weak dollar can do positive things for an international economy like the United States. A weak dollar occurs when the U.S. dollar is worth less relative to foreign currencies. In global oil trading, it typically means that oil prices will rise because oils are priced and traded in dollars. Moreover, a currently strong global economy is boosting demand.

Price strength has also been supported by physical activity. Notably, domestic stocks have been declining since August of 2016 when the U.S. carried 1.4 billion barrels of all oils in storage. Currently, stocks are at 1.2 billion barrels, a reduction of twelve percent in supply. The decline has appeared across the full range of petroleum. Crude oil inventories fell nearly 17 per cent and products dropped by ten per cent. The decline represents the growth of export trade and affirmation of the U.S. as a major supplier to the western hemisphere. Domestic demand is now running over twenty million barrels daily.

There are also factors working to pressure prices lower. High prices encourage a supply response. The most recent data from the Energy Information Agency show domestic crude oil production fast approaching the ten million barrels-per-day level. Thus far, however, this has not materially interfered with the upward trajectory of price.

Supply/Demand Balances

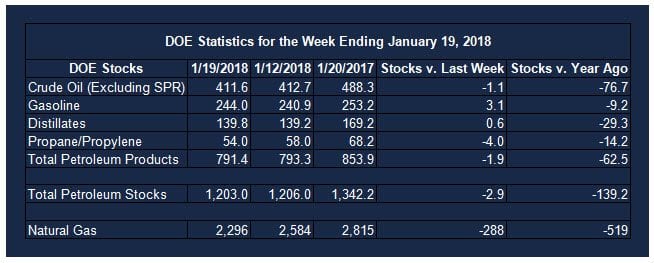

Supply/demand data in the United States for the week ending January 19, 2018 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 2.9 million barrels during the week ending January 19, 2018.

Builds were reported in stocks of gasoline, fuel ethanol, distillates, and residual fuel. Draws were reported in stocks of K-jet fuel, propane, and other oils.

Commercial crude oil supplies in the United States decreased to 411.6 million barrels, a draw of 1.1 million barrels.

Crude oil supplies decreased in three of the five PAD Districts. PAD District 1 (East Coast) crude oil stocks fell 0.4 million barrels, PADD 2 (Midwest) stocks declined 3.7 million barrels, and PADD 4 (Rockies) stocks decreased 0.1 million barrels. PADD 3 (Gulf Coast) stocks rose 2.3 million barrels and PADD 5 (West Coast) stocks increased 0.8 million barrels.

Cushing, Oklahoma inventories decreased 3.2 million barrels from the previous report week to 39.2 million barrels.

Domestic crude oil production increased 128,000 barrels daily to 9.878 million barrels per day from the previous report week.

Crude oil imports averaged 8.041 million barrels per day, a daily increase of 91,000 barrels. Exports rose 162,000 barrels daily to 1.411 million barrels per day.

Refineries used 90.9 per cent of capacity, a decrease of 2.1 percentage points from the previous report week.

Crude oil inputs to refineries decreased 392,000 barrels daily; there were 16.483 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 389,000 barrels daily to 16.820 million barrels daily.

Total petroleum product inventories saw a decrease of 1.8 million barrels from the previous report week.

Gasoline stocks rose 3.1 million barrels from the previous report week; total stocks are 244.0 million barrels.

Demand for gasoline increased 29,000 barrels per day to 8.697 million barrels daily.

Total product demand decreased 173,000 barrels daily to 20.636 million barrels per day.

Distillate fuel oil supply rose 0.6 million barrels from the previous report week to 139.8 million barrels. National distillate demand was reported at 3.847 million barrels per day during the report week. This was a weekly decrease of 892,000 barrels daily.

Propane stocks decreased 4.0 million barrels from the previous report week to 54.0 million barrels. Current demand is estimated at 1.770 million barrels per day, an increase of 227,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Working gas deficit to the five-year average grew by 124 Bcf. Net withdrawals from storage totaled 288 Bcf for the week ending January 19, compared with the five-year (2013–17) average net withdrawal of 164 Bcf and last year’s net withdrawals of 137 Bcf during the same week. Working gas stocks total 2,296 Bcf, which is 486 Bcf less than the five-year average and 519 Bcf less than last year at this time. Working gas stocks are 59 Bcf less than the 5-year range for this period.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]