Oil Prices Go Flat

- Market forces keep prices in place

- OPEC + plans production constraint

- Venezuelan crude oil operations and exports face formidable challenges

- Cold produced record natural gas demand as January ended.

The Matrix

Oil markets are experiencing a time of serious geopolitical uncertainty. Threats to international trade growth cast a bearish pall over the price outlook. At the same time, plans from the OPEC + consort to reduce output are bullish. Recently imposed sanctions on Venezuela’s oil industry by the United States threaten global supply.

This tension between bulls and bears has shown as a consistently narrow price range in WTI crude oil and related products since early in January. WTI crude oil futures have traded in a range less than five dollars and shown little inclination to leave that range. One result of such tight price ranges is a loss of volatility. It is a tenet of trading that a long period of low volatility should be followed by a rapid expansion of volatility. One problem on which all traders agree is that an expansion will almost certainly occur; in which direction it goes is another matter.

Currently, bullish factors offer the more serious challenge. In particular, Venezuelan sanctions are the focus of much analysis. Crudes from Venezuela are particularly valuable to U.S. refiners because they have heavier components conducive to refining distillate fuels. Such crude oil is backing up into domestic storage. The current government is having problems finding buyers because U.S. sanctions directs payments away from President Maduro to the opposition. Moreover, many workers are leaving and the diluent needed to allow heavy crude to flow are in short supply. Payment problems are also inhibiting other tankerage. And if Venezuela’s oil does not move, the impact on global markets grows.

Producer companies in the country are allowed to continue operations under the sanctions regime and may continue to transact with PDVSA. Production may continue to fall if oil service companies determine to leave the country.

Supply/Demand Balances

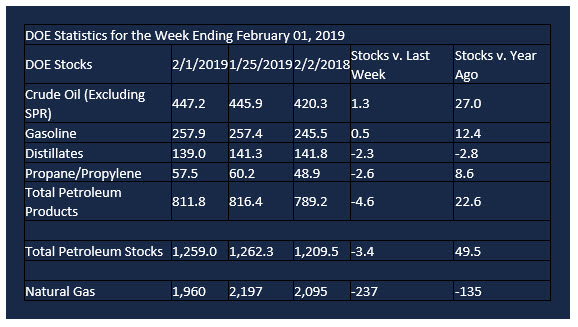

Supply/demand data in the United States for the week ending February 1, 2019 were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased 3.4 million barrels during the week ending February 1, 2019.

There were draws in stocks of K-jet fuel, distillates, propane, and other oils. There were builds in stocks of gasoline and residual fuel oil. Stocks of fuel ethanol were unchanged from the previous report week.

Commercial crude oil supplies in the United States increased 1.3 million barrels from the previous report week to 447.2 million barrels.

Crude oil supplies increased in two of the five PAD Districts. PADD 1 (East Coast) stocks rose 0.5 million barrels and PADD 2 (Midwest) stocks grew by 1.5 million barrels. PADD 3 (Gulf Coast) stocks fell 0.3 million barrels and PADD 4 (Rockies) crude oil stocks declined 0.6 million barrels. PADD 5 (West Coast) stocks were unchanged from the previous report week.

Cushing, Oklahoma inventories increased 1.4 million barrels from the previous report week to 42.6 million barrels.

Domestic crude oil production was unchanged from the previous report week at 11.9 million barrels per day.

Crude oil imports averaged 7.146 million barrels per day, a daily increase of 63,000 barrels per day. Exports rose 926,000 barrels daily to 2.870 million barrels per day.

Refineries used 90.7 per cent of capacity, an increase of 0.6 percentage points from the previous report week.

Crude oil inputs to refineries increased 170,000 barrels daily; there were 16.633 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased 105,000 barrels daily to 16.864 million barrels daily.

Total petroleum product inventories fell 4.7 million barrels from the previous report week.

Gasoline stocks increased 0.5 million barrels from the previous report week; total stocks are 257.9 million barrels.

Demand for gasoline decreased 491,000 barrels per day to 9.073 million barrels per day.

Total product demand increased 1.023 million barrels daily to 21.838 million barrels per day.

Distillate fuel oil stocks decreased 2.3 million barrels from the previous report week; distillate stocks are at 139.0 million barrels. National distillate demand was reported at 4.673 million barrels per day during the report week. This was a weekly increase of 551,000 barrels daily.

Propane stocks decreased 2.6 million barrels from the previous report week; propane stock are 57.5 million barrels. Current demand is estimated at 1.985 million barrels per day, an increase of 373,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Cold weather and a polar vortex* blanketed much of the Lower 48 states from January 29–31, resulting in record natural gas consumption in the United States. Estimated total natural gas demand posted a new single-day record on January 30, topping the previous record set on January 1, 2018. Total estimated consumption by the power, industrial, and residential/commercial sectors and total estimated natural gas exports—by pipeline and as feedstock to liquefied natural gas (LNG) facilities—reached 145.9 billion cubic feet (Bcf) on January 30, compared with the previous record of 143.9 Bcf set in 2018, according to data from PointLogic Energy.

Net withdrawals from storage totaled 237 Bcf for the week ending February 1, compared with the five-year (2014–18) average net withdrawals of 150 Bcf and last year’s net withdrawals of 116 Bcf during the same week. Working gas stocks totaled 1,960 Bcf, which is 415 Bcf lower than the five-year average and 135 Bcf lower than last year at this time.

* The polar vortex is a large area of low pressure and cold air surrounding the Earth’s North and South poles. The term vortex refers to the counter-clockwise flow of air that helps keep the colder air close to the poles. Often during winter in the Northern Hemisphere, the polar vortex will become less stable and expand, sending cold Arctic air southward over the United States with the jet stream. The polar vortex is nothing new – in fact, it’s thought that the term first appeared in an 1853 issue of E. Littell’s Living Age.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.