Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

Crude oil and refined product futures prices sank on Friday, and prices remained low upon the opening of today’s market session. WTI (West Texas Intermediate) crude forward prices opened at $51.25/b today, a drop of $1.58 (2.99%) from Friday’s opening price of $58.83/b. Gasoline and diesel also opened lower this morning. The downward price trend appears to have ended, and prices for crude and products are holding flat this morning, awaiting news. A continued selloff in equities markets could pull oil prices back down today. President Trump is threatening a government shutdown at the end of the week if Congress does not approve funding to build the U.S.-Mexico border wall.

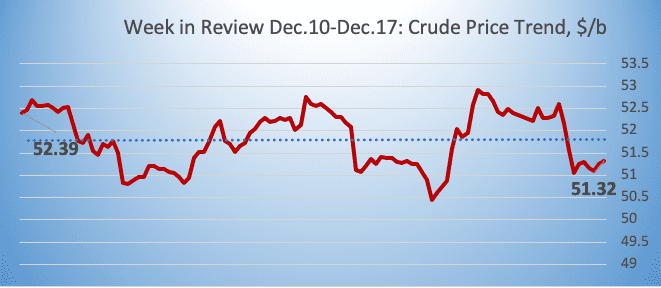

Last week, crude oil, gasoline, and diesel all showed a price pattern that alternated up on Monday, down on Tuesday, up on Wednesday, down on Thursday, and up on Friday. Friday’s prices were essentially back to where they had been on Monday. But prices sagged on Friday, and the oil complex finished the week in the red. WTI crude opened on Monday at $52.03/b and closed on Friday at $51.20/b, a drop of $0.83 (1.6%.) Diesel forward prices opened on Monday at $1.8786/gallon and closed on Friday at $1.8453/gallon, a loss of 3.33 cents/gallon (1.8%.) Gasoline forward prices opened on Monday at $1.464/gallon and closed on Friday at $1.4343/gallon, a drop of 2.97 cents/gallon (2.0%.)

The decline in oil prices is being felt in the U.S. as well as in producing countries within OPEC and elsewhere. In the U.S., the active oil and gas rig count climbed to a high of 1082 during the week ended November 16th. The count has gently declined over the four weeks since then, settling at 1071 active rigs during the week ended December 14th. Crude production declined from 11.7 million barrels per day (mmbpd) to 11.6 mmbpd. Note that even with the small decline in the rig count over the past month, the current rig count of 1071 remains at its highest level since March 2015. The U.S. Energy Information Administration (EIA) expects U.S. crude production to rise from an average of 10.88 mmbpd in 2018 to 12.06 mmbpd in 2019. This increase in domestic production is expected to be achieved despite a relatively low forecast of WTI crude spot prices of $54.17/b in 2019, versus an average spot price of $65.06/b in 2018.

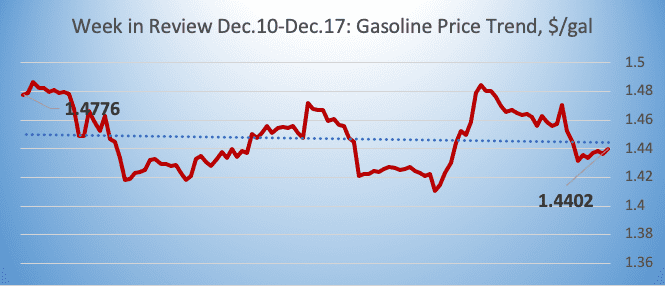

GASOLINE

Gasoline opened on the NYMEX at $1.4362/gallon today, a drop of 4.39 cents (2.96%) from Friday’s opening price of $1.4801 cents/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices fell by 2.36 cents/gallon (1.61%.) Currently, gasoline prices appear to be trending back up, and they are in the range of $1.44-$1.46/gallon. The latest price is $1.4467/gallon.

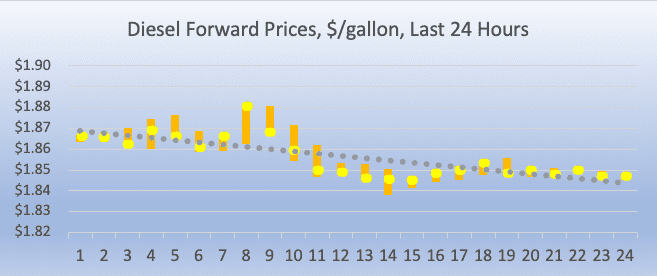

DIESEL

Diesel opened on the NYMEX at $1.8453/gallon today, down by 3.86 cents (2.05%) from Friday’s opening price of $1.8838/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices fell by 1.88 cents/gallon (1.01%.) Currently, diesel prices have pulled out of the downward trend, and they are stabilizing in the range of $1.84-$1.86/gallon. The latest price is $1.8563/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $51.25/b today, a drop of $1.58 (2.99%) from Friday’s opening price of $52.83/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures prices fell by $1.10/b (2.10%.) WTI crude oil prices so far have managed to stay above the $51/b mark. The price decline appears to have flattened this morning, and prices currently are stable. The latest price is $51.41/b.