Oil Price Decline Moderates; Global Economy Moderates Too?

- Product inventory situation improves

- Evidence of global economic slowdown has emerged

- Natural gas futures price performance has been rangebound

Sincerely,

Alan Levine, Chairman

Powerhouse

(202) 333-5380

The Matrix

Oil prices continued to weaken last week. All principal oil futures prices made new lows as the week of December 9 ended. WTI printed $70.08, barely holding round number support. ULSD fell to $2.77 and RBOB bottomed at $2.03.

Notably, diesel prices traced about the same low for three days, suggesting that further deterioration in price might be abating. RBOB acted similarly, and on Friday, traded a doji candlestick pattern, displaying uncertainty among the trading community.

Fundamental supply has improved dramatically over the past few weeks. POWERHOUSE’s chart of Distillate Fuel Oil Days of Supply has recovered from well below even the low of the past five years to where it is now about the same as the average level of that time. National demand can safely be supported at 31.9 days’ supply. Regional shortfalls may present different challenges, especially in the Northeast.

The supply outlook was supported by a reversal of DOE projections of crude oil from shale oil fields. Expectations that output could fall as producers focused on returning capital to shareholders over new exploration initiatives have eased, in part because oil rig counts have risen by 30% in 2022.

Output is expected to reach 12.34 million barrels daily in 2023. This would top 12.315 million barrels per day, achieved in 2019.

Anxiety over a possible economic turndown has become stronger as evidence of global slowdown has emerged. The economics profession has really earned its title as the “Dismal Science” in this observation about the situation, from Bloomberg News:

“Prices at the pump, as measured by the American Automobile Association, are now below their level on the eve of Russia’s invasion of Ukraine. This reduces headline inflation, but also possibly increases pressure on other prices by releasing money from household budgets to be spent on something else. But the critical point is that one of the biggest one-time upward pressures on inflation is in abeyance for now.”

There is no good news without bad.

Are gasoline prices down? Inflationary pressures remain persistently stubborn.

Global economic demand eases: at the same time, supply chain pressures also ease.

The Federal Reserve is committed to containing inflation, highlighted by consecutive three-quarter point rate increases. But service-sector wage increases of 6.2% have frustrated the Fed’s efforts, blunting expectations of slower rate increases in the future.

Confusing? There’s plenty of room for you at the table.

Contradictory data point to a downturn in next year’s economy. But a serious hit seems unlikely because the economic infrastructure has been strengthened. Dodd-Frank has produced banks with stronger balance sheets better able to withstand financial adversity.

The petroleum sector will not be insulated from a softer economy as many expect in the first half of 2023. The industry will participate in the inevitable recovery when it occurs.

Supply/Demand Balances

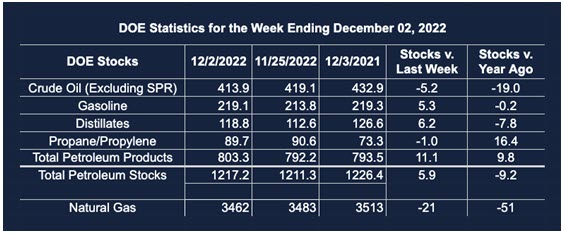

Supply/demand data in the United States for the week ended December 2, 2022, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 5.9 million barrels to 1.217 billion barrels during the week ended December 2, 2022.

Commercial crude oil supplies in the United States decreased (⬇) by 5.2 million barrels from the previous report week to 413.9 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.8 million barrels to 7.2 million barrels

PADD 2: Down (⬇) 0.7 million barrels to 105.8 million barrels

PADD 3: Down (⬇) 3.6 million barrels to 226.5 million barrels

PADD 4: Down (⬇) 0.4 million barrels to 24.6 million barrels

PADD 5: Plus (⬆) 0.4 million barrels to 49.8 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.4 million barrels from the previous report week to 23.9 million barrels.

Domestic crude oil production was up (⬆) 100,000 barrels daily from the previous report week at 12.2 million barrels daily.

Crude oil imports averaged 6.012 million barrels per day, a daily decrease (⬇) of 24,000 barrels. Exports decreased (⬇) 1.518 million barrels daily to 3.430 million barrels per day.

Refineries used 95.5% of capacity; 0.3 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 53,000 barrels daily; there were 16.585 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose (⬆) 56,000 barrels daily to 17.162 million barrels daily.

Total petroleum product inventories rose (⬆) by 11.1 million barrels from the previous report week, rising to 803.3 million barrels.

Total product demand decreased (⬇) 91,000 barrels daily to 19.626 million barrels per day.

Gasoline stocks increased (⬆) 5.3 million barrels from the previous report week; total stocks are 219.1 million barrels.

Demand for gasoline increased (⬆) 41,000 barrels per day to 8.358 million barrels per day.

Distillate fuel oil stocks increased (⬆) 6.2 million barrels from the previous report week; distillate stocks are at 118.8 million barrels. EIA reported national distillate demand at 3.550 million barrels per day during the report week, a decrease (⬇) of 106,000 barrels daily.

Propane stocks decreased (⬇) by 1.0 million barrels from the previous report week to 89.7 million barrels. The report estimated current demand at 1.293 million barrels per day, an increase (⬆) of 383,000 barrels daily from the previous report week.

Natural Gas

Withdrawals from underground storage of natural gas were thin in the last EIA report. They translated into a modest gain in spot Henry Hub futures, just enough to close an existing gap, settling last week at $6.245 per MMBtu.

Futures price performance has been range-bound between $5.38 and $7.60/MMBtu. Concerns that supported prices since mid-October have largely abated for now. A blast of cold Canadian air may boost prices near-term, but without sustained winter cold, the path for price remains under pressure,

Expectations that domestic supplies would be reduced by renewed exports from Freeport, LA have been deferred. The facility will not be permitted until approved by the Pipeline and Hazardous Materials Safety Administration. This is not expected to occur until well into the first quarter of 2023.

This chain of events is likely to boost domestic supply and, all things being equal, dampen further price advances. Should futures prices soften and break below $5.38, further tests of $5 and $4.70 may be in play.

According to the EIA:

Net [natural gas] withdrawals from storage totaled 21 Bcf for the week ended December 2, compared with the five-year (2017–2021) average net withdrawals of 49 Bcf and last year’s net withdrawals of 59 Bcf during the same week. Working natural gas stocks totaled 3,462 Bcf, which is 58 Bcf (2%) lower than the five-year average and 51 Bcf (1%) lower than last year at this time.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2022 Powerhouse Brokerage, LLC, All rights reserved