Crude Oil Action Sends a Bearish Message

- First negative NYMEX WTI futures price in history

- Crude oil price could continue to weaken

- Futures market performs as expected

- More loss of crude oil rigs forecasts loss of associated natural gas

The Matrix

The erosion of energy prices reached a spectacular nadir on April 20, 2020, as the May WTI crude oil settled at negative $37.63. This price level startled many marketers. It was the first time in history that WTI crude futures printed a minus value. It raised the question of what a negative price meant for crude oil.

Price is a measure of value. And value describes the worth of a commodity in commerce. A negative value tells us that crude oil is costing its owner more than the commodity is worth.

In the crude oil market, a negative value tells us that it would be cheaper for the owner to pay someone to take the oil away than to store it. Elaine Levin, President of Powerhouse, put it this way in an OPIS interview, “It’s like when you call 1-800-GOT JUNK and you pay them to take your stuff out of your basement. This is the same thing,”

In straightforward economic terms, a negative price says supply is overwhelming demand – at least at that moment. The negative price arose during the final moments of the life of the May WTI Crude Oil contract.

Subsequently, the June contract, now spot, did not go negative. We do not know if it will. The main lessons to be taken from this incident are that negative prices do exist and that they perform an important task: reminding us that they are a measure of the market – currently oversupplied and subject to further weakness.

Regular users of futures markets know a hard truth: futures markets do what they are designed to do even if the result may be painful to individual traders. The NYMEX exchange weighed in on this as well:

CME Group said its markets worked as designed, with crude oil futures reflecting the unprecedented series of impacts from the coronavirus pandemic, including decreased demand for crude, global oversupply and tightening storage space.

“CME Group accommodated negative futures prices … on April 20 so that clients could manage their risk amid dramatic price moves, while also ensuring the convergence of futures and cash prices,” a CME Group spokesman said, noting that the exchange had issued advisories in early April about such a possibility.

Supply/Demand Balances

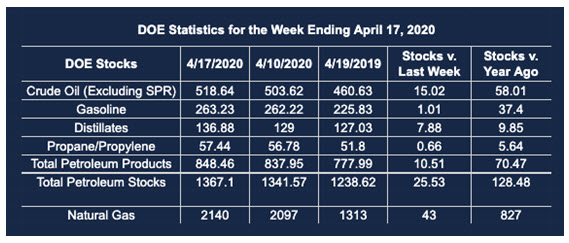

Supply/demand data in the United States for the week ending April 17, 2020, were released by the Energy Information Administration.

Total commercial stocks of petroleum rose by 25.5 million barrels during the week ending April 17, 2020.

Commercial crude oil supplies in the United States increased by 15.0 million barrels from the previous report week to 518.6 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Plus 0.3 million barrels to 11.6 million barrels

PADD 2: Plus 4.8 million barrels to 152.2 million barrels

PADD 3: Plus 9.8 million barrels to 273.2 million barrels

PADD 4: Plus 0.5 from the previous report week to 24.6 million barrels

PADD 5: Down 0.4 million barrels to 57.0 million barrels

Cushing, Oklahoma inventories were up 4.7 million barrels from the previous report week to 59.7 million barrels.

Domestic crude oil production was fell 0.1 million barrels per day from the previous report week to 12.2 million barrels daily.

Crude oil imports averaged 4.937 million barrels per day, a daily decrease of 743,000 barrels. Exports fell 546,000 barrels daily to 2.890 million barrels per day.

Refineries used 67.6 percent of capacity, down 1.5% from the previous report week.

Crude oil inputs to refineries decreased 209,000 barrels daily; there were 12.456 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 288,000 barrels daily to reach 12.825 million barrels daily.

Total petroleum product inventories rose 10.5 million barrels from the previous report week.

Gasoline stocks increased 1.0 million barrels daily from the previous report week; total stocks are 263.2 million barrels.

Demand for gasoline rose 230,000 barrels per day to 5.311 million barrels per day.

Total product demand increased 306,000 barrels daily to 14.103 million barrels per day.

Distillate fuel oil stocks increased 7.9 million barrels from the previous report week; distillate stocks are at 136.9 million barrels. EIA reported national distillate demand at 3.128 million barrels per day during the report week, an increase of 371,000 barrels daily.

Propane stocks increased 0.7 million barrels from the previous report week; propane stocks are 57.4 million barrels. The report estimated current demand at 943,000 barrels per day, an increase of 189,000 barrels daily from the previous report week.

Natural Gas

The number of active U.S. rigs drilling for oil fell by 60 units for the week ending April 24, 2020. There were 378 oil rigs still at work. The decline was the sixth consecutive drop in availability. This should translate into lower oil production and less associated natural gas.

The loss of producing wells has taken domestic natural gas to being the most expensive globally as demand overseas has slowed in response to COVID-19. Cancellations of orders for now-expensive U.S. natural gas seem now to be inevitable.

According to EIA:

Net injections into storage totaled 43 Bcf for the week ending April 17, compared with the five-year (2015–19) average net injections of 49 Bcf and last year’s net injections of 92 Bcf during the same week. Working natural gas stocks total 2,140 Bcf, which is 364 Bcf more than the five-year average and 827 Bcf more than last year at this time.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2020 Powerhouse, All rights reserved.