MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

April 24, 2020: This was a week for the record books, as Monday brought the first-ever negative closing price for WTI crude. Perceptions of oil futures were forever changed this week. The world watched with astonishment the closing price of May delivery WTI drop to -$37.63/b. Although a negative value for a WTI crude contract was theoretically possible, it had never been seen since trading began on the NYMEX in 1983. The market had lost liquidity as May contracts switched to June contracts, and most outstanding contracts already had been rolled to the forward month. Buyers were few and standoffish, and remaining sellers sold at any price, which was far in the negative territory. The COVID-19 pandemic has caused such a massive contraction of demand, without concomitant cuts in crude production, that global storage capability is being stretched. U.S. markets sagged midweek on news of another gigantic addition to crude and product inventories: 15.022 mmbbls of crude, 1.017 mmbbls of gasoline, and 7.876 mmbbls of diesel, totaling 23.915 mmbbls. Crude prices strengthened somewhat on rising hostilities between the U.S. and Iran, yet the week is heading for another finish in the red.

The COVID-19 pandemic has not yet been contained. Global cases have risen to 2,729,274, with 191,614 deaths attributed to the virus. The U.S. remains the center of the pandemic. U.S. cases have climbed to 869,172, with a death toll of 49,963, though European cases are growing as well. There is guarded optimism that U.S. states will begin to satisfy criteria for economic re-opening in the coming month. WTI crude futures prices (June forward month contracts) dipped to a low of $6.50/b on Tuesday and remained weak on Wednesday upon news of another addition to U.S. oil inventories. Thursday and Friday, prices rose on heightened U.S.-Iran hostilities. WTI opened at $16.78/b Friday morning. This week is heading for a finish in the red.

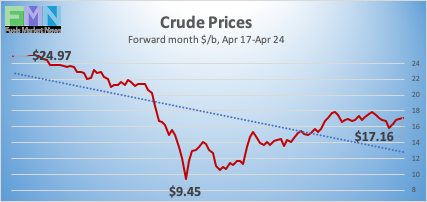

WTI (West Texas Intermediate) crude forward prices for June delivery opened on the NYMEX on Friday, April 17, at $26.42/b. Prices fell through midweek, hitting bottom at $6.50/b on Tuesday. Prices began to recover and opened at $16.78/b on Friday, April 24. Our weekly price review covers hourly forward prices from Friday, April 17th, through Friday, April 24th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $0.7135/gallon on Friday, April 17, and prices weakened to open at $0.6337/gallon on Friday, April 24. This was a significant drop of 7.98 cents (11.2%). It was a readjustment of thinking, since prices had been slowly recovering after the month of March brought a crippling collapse of nearly 87 cents per gallon. U.S. average retail prices for gasoline fell by 4.1 cents/gallon during the week ended April 20th. Gasoline futures prices are strengthening today in anticipation that various states soon will begin to relax shelter-in-place rules, combined with a bump-up in crude prices caused by heightened U.S.-Iran hostilities in the Persian Gulf. Gasoline futures prices are trading in the range of $0.60/gallon to $0.65/gallon. The latest price is $0.6368/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $0.9619/gallon on Friday, April 17, and opened on Friday, April 24 at $0.7223/gallon, a major collapse of 23.96 cents (24.9%). U.S. average retail prices for diesel fell by 2.7 cents/gallon during the week ended April 20th. Retail prices for diesel have fallen for fifteen consecutive weeks. Diesel futures prices fell sharply midweek as crude prices collapsed, and on news of another week of significant additions to inventories. Currently, diesel is trading in the range of $0.69-$0.73/gallon. The latest price is $0.7014/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices for June delivery opened on the NYMEX on Friday, April 17, at $26.42/b, falling to an open of $16.78/b on Friday, April 24. This was a major drop of $9.64/b (36.5%). As discussed, prices for May contracts had opened at $20/b on Friday, April 17, and Monday, April 20, brought the largest-ever collapse of WTI futures prices. The market for May contracts closed at -$37.63/b—a daily drop of $55.36/b. Although June contract prices were more continuous, they still slid dramatically through midweek. Thursday and Friday brought a revival in prices when U.S.-Iran hostilities rose in the Persian Gulf, though the rally currently has flattened. WTI prices are trading in the $16.00-$18.00/b range currently. The latest price is $17.77/b.

PRICE MOVERS THIS WEEK : BRIEFING

Perceptions of oil futures were forever changed this week, as the world watched with astonishment the closing price of May delivery WTI drop to -$37.63/b. Although a negative value for a WTI crude contract was theoretically possible, it has never been seen since trading began on the NYMEX in 1983. A negative price in a commodity market is rare, but it may happen when infrastructure constraints are severe and transaction costs are high. The market had lost liquidity as May contracts switched to June, and most outstanding contracts already had been rolled to the forward month. This included a large volume by a single seller, which cut market liquidity. Buyers were few and standoffish, and remaining sellers sold at any price, which was far in the negative territory.

Most contract holders sell their interest ahead of contract expiration (in this case, April 21st) because they have no intention or capability to accept physical delivery of crude. Roughly 99% of transactions are of this type, and only 1% are physically settled. Cushing, Oklahoma, is the delivery point. The EIA reports that crude oil in storage at Cushing has risen from 35,501 thousand barrels during the week ended January 3, 2020, to 59,741 thousand barrels during the week ended April 17, 2020, an increase of 23,419 thousand barrels. This is the highest level of inventory at Cushing since November 2017. The amount of oil storage at Cushing is approximately 90 mmbbls, but the remaining capacity is at a premium, and some market participants fear that readily available storage will be full in the coming month. Some surplus crude will be stored in May and June in the National Strategic Petroleum Reserve (SPR).The U.S. government has announced that it plans to take advantage of low prices and support the oil industry by purchasing up to 11.3 mmbbls of sweet crude and up to 18.7 mmbbls of sour crude for the SPR. This is not necessarily domestic crude. The delivery date is between May 1, and June 30. Current SPR stocks are 634.987 mmbbls. WTI futures for May contracts opened on Monday, April 20 at $17.73/b and closed at -$37.63/b, a mind-expanding drop of $55.36/b in a single day. Prices had dipped as low as $40.32/b that day. On Tuesday, April 21, WTI May opened at -$14/b, and closed out at $10.01/b. June contracts opened at $21.32 that day.

The COVID-19 pandemic has not been contained. Global cases have risen to 2,729,274, with 191,614 deaths attributed to the virus. The U.S. remains the center of the pandemic. U.S. cases have climbed to 869,172, with a death toll of 49,963. The White House guidelines for “Opening up America Again” include a “robust testing program in place for at-risk healthcare workers” at hospitals. The guidelines call for a two-week downward trajectory in symptoms and cases. Many states believe that they will be able to meet these criteria, though some of the hardest hit already acknowledge that they are not yet there.

WTI crude futures prices (June forward month contracts) dipped to a low of $6.50/b on Tuesday and remained weak on Wednesday upon news of another massive addition to U.S. oil inventories. Prices then revived somewhat when U.S. President Trump announced that he had given order to the U.S. Navy to “Shoot Down and Destroy” Iranian gunboats if they harassed U.S. ships. WTI opened at $16.78/b Friday morning. In a balanced market, this type of geopolitical risk would no doubt have caused a price spike. But in today’s overflowing market, the week is heading for a finish in the red.

Oil storage capability remains at the forefront of oil industry requirements. Reducing oil production is not a simple matter, so production has been declining at a slow pace when compared to the massive amount of demand destruction. The American Petroleum Institute (API) released information on Tuesday showing yet another huge crude inventory build, amounting to 13.2 mmbbls. The API also reported a build of 3.4 mmbbls of gasoline and 7.6 mmbbls of diesel. The API’s net inventory build was a massive 24.2 mmbbls. Market analysts had predicted across-the-board inventory additions similar to the API’s, and even closer to EIA’s, with a total addition to inventories of 22.3 mmbbls.

U.S. Energy Information Administration (EIA) official statistics were close to the API’s, with a larger crude build and a smaller gasoline build. The addition to crude stocks was 15.022 mmbbls, building on last week’s addition of 19.248 mmbbls. The addition to gasoline stocks was 1.017 mmbbls, and the addition to distillate stockpiles was 7.876 mmbbls. The EIA net result was a huge inventory build of 23.915 mmbbls. Crude oil inventories have expanded in 14 of the 16 weeks so far this calendar year. In total, an incredible 91.68 mmbbls of crude oil has flowed into storage, with no end in sight.

U.S. crude production now is in decline, but at a slow pace as of the week ended April 17th. The EIA reported that U.S. crude production during the week ended April 17th, fell to 12.2 mmbpd, down 0.1 mmbpd from the prior week’s level of 12.3 mmbpd. According to this weekly data series, U.S. crude production averaged 13.025 mmbpd in February 2020, the highest total ever. April is bringing a decline.