Excerpted from This Week in Petroleum

Release date: March 6, 2019

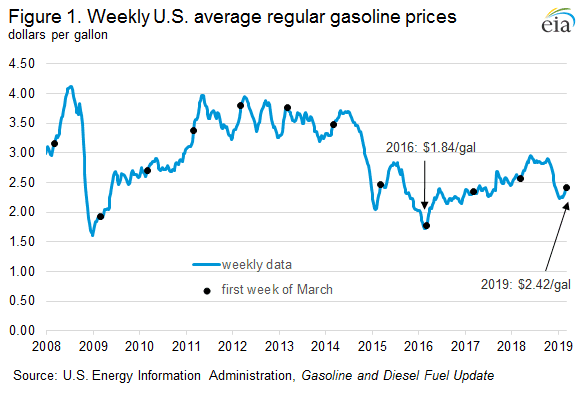

The U.S. average retail price for regular gasoline on March 4, 2019, was $2.42 per gallon (gal), an increase of 11 cents/gal from the February average of $2.31/gal and 14 cents/gal lower than the price at the same time last year (Figure 1). Most of the fluctuation is the result of changes in crude oil prices.

Retail gasoline prices tend to be lowest in the winter months (December–-February) before increasing in the spring. This trend occurs, in part, because refineries begin producing summer-grade gasoline, which is more expensive to manufacture, in February and March after they have produced enough winter-grade gasoline to last through the winter driving season. During the 2018–19 winter driving season, the lowest weekly average price of retail gasoline was in the first week of January at $2.24/gal. The lowest average price in the past decade occurred in mid-February 2016, when low crude oil prices contributed to retail gasoline prices hitting a low of $1.72/gal.

Large gasoline inventories also put downward pressure on gasoline prices in February 2019. High refinery runs (driven by increased distillate demand) combined with lower demand for gasoline contributed to high gasoline inventory levels, which have been near or greater than their recent five-year (2014–18) highs since August 2018 (Figure 2). High levels of U.S. gasoline production in 2018 and early 2019 have outpaced gasoline consumption, leading to inventories in the last week of February 2019 that were 3 million barrels (1.2%) higher than at the same time in 2018, although about 950,000 barrels (0.4%) lower than in the last week of February 2017.

Although refining seasonality and gasoline inventory levels contribute to gasoline price fluctuations, crude oil has the largest cost share for producing gasoline, and movements in the crude oil price—along with changes in gasoline market conditions—drive changes in wholesale and retail gasoline prices. The U.S. Energy Information Administration (EIA) estimates that, currently, the refinery acquisition cost of crude oil accounts for about half of the price of gasoline at the pump. Because a barrel of oil contains 42 gallons, each dollar per barrel of sustained price change in crude oil and gasoline wholesale margins translates to an average change of about 2.4 cents/gal in petroleum product prices. When the price of crude oil increases, the price of wholesale gasoline adjusts to reflect the increased refinery input cost, other market factors being equal.

As of March 4, the international benchmark Brent crude oil spot price, which is more important than the West Texas Intermediate (WTI) spot price as a determinant of U.S. gasoline prices, was $64.44/per barrel (b), about $1/b lower than the price at the same time last year and about $1/b lower than the five-year average for the same day.

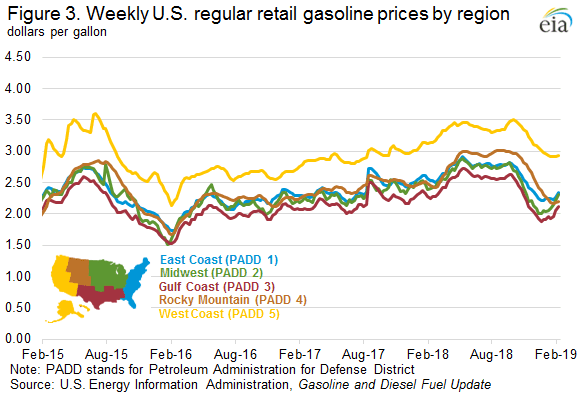

Retail gasoline prices vary significantly within the United States because of regional supply and demand balances, gasoline specification requirements, and taxes (Figure 3). The U.S. Gulf Coast, Petroleum Administration for Defense District (PADD) 3, typically has the lowest retail gasoline prices in the country because it is home to approximately 50% of U.S. refining capacity and produces more gasoline than it consumes. As of March 4, average Gulf Coast gasoline prices were 24 cents/gal lower than the national average, while West Coast (PADD 5) prices were 52 cents/gal higher.

West Coast retail gasoline prices are typically higher than the average U.S. price because of several factors. The region has a tight supply and demand balance, and it is geographically isolated from other U.S. refining centers—such as the Gulf Coast—because of very limited gasoline transportation infrastructure. The West Coast also has gasoline specifications that are more costly to manufacture. Since August 28, 2017, weekly West Coast regional gasoline prices have consistently exceeded $2.90/gal. Although state-level gasoline taxes and fees in California and Washington each approach 50 cents/gal, state-level gasoline taxes and fees across the West Coast average 29 cents/gal, which is less than 1 cent higher than the national average.

U.S. regular gasoline prices averaged $2.31/gal from December 2018 through February 2019. In 2019, EIA expects that the monthly average price of U.S. regular gasoline will peak in June at $2.57/gal and anticipates that prices will remain relatively flat in the third quarter before decreasing slightly in the fourth quarter to account for the seasonality of gasoline grades and driving seasons. EIA forecasts that U.S. regular gasoline prices will average $2.47/gal in 2019 and $2.56/gal in 2020 (Figure 4).