By Dr. Nancy Yamaguchi

Is diesel undervalued in the United States of America? The popular culture of the U.S. includes cars, cars and more cars. Classic Hollywood films include Ford Model Ts and Mustangs, Chevy Bel Airs and Corvettes, Willys Jeeps and other iconic cars. Most of these vehicles use gasoline, and most passenger cars are gasoline-fueled. There is always a role for diesel trucks, cars, locomotives, farm equipment, barges and tankers, but these more work-a-day vehicles never seem as romantic and alluring.

Consumers may recall the days when diesel-powered passenger cars did not seem as quiet, clean, sporty or luxurious as gasoline-powered cars. Some of these stereotypes seem to remain in memory, even though the technology has advanced dramatically. Recent years have brought more sophisticated, efficient and low-emission diesel vehicles. They are making “inroads” into the U.S. market, though diesel-fueled passenger cars are not expected to supplant gasoline-fueled cars for the ordinary consumer.

However, the U.S. Energy Information Administration (EIA) forecasts that the vehicle miles traveled (VMT) by trucks will grow at rates more than twice the rate forecast for light-duty vehicles. According to the EIA, the VMT for commercial light trucks will grow at 1.4% per year from 2018 to 2050, and the VMT for freight trucks of over 10,000 pounds will grow at 1.3% per year from 2018 to 2050. In contrast, the VMT growth rate for light duty vehicles is forecast at only 0.6% per year. At these rates of growth, the demand for commercial light trucks will grow from 97 billion VMT in 2017 to 156 billion VMT in 2050. The demand for freight trucks of over 10,000 pounds will grow from 290 billion VMT in 2017 to 445 billion VMT in 2050.

There are many experts who believe that demand for petroleum-based fuels will decline sharply before the year 2050. Given the length of the forecasting time period, anything is possible. Perhaps it is safer to say that demand for transport and the role of trucks will increase, regardless of the fuel they use. In the near term, that fuel will be mainly diesel. This article focuses on the U.S. diesel market: demand, pricing, production and quality and trade. The past three decades have brought enormous change, and the coming decades could bring even more momentous change.

Diesel Demand in the U.S.

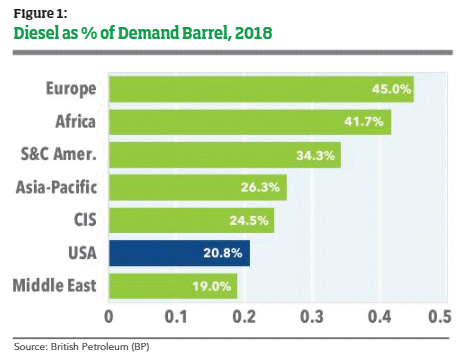

When compared to many other world regions, diesel in the U.S. appears underutilized. Diesel currently accounts for 21% of U.S. fuel demand, while gasoline accounts for 47.9%. Figure 1 compares the percentage of diesel in the demand barrels of the U.S. versus other world regions. Only the Middle East, where fuel oil still occupies a large share of the demand barrel, has a lower percentage share of diesel. Europe’s demand barrel is heavily weighted toward diesel, at 45% of demand. Africa relies on diesel for 42% of its oil-based fuel requirement.

Pricing policy plays a role in the shape of demand. In countries where fuel prices are subject to high taxes or are directly administered by the government, diesel’s share can grow disproportionately large. Some government policies have encouraged diesel use at the expense of gasoline use—the rationale being that diesel is a constructive fuel. Diesel may be considered a “productive fuel,” contributing to economic growth and activity, whereas gasoline may be viewed as a consumer fuel, a luxury, or a fuel that contributes to traffic congestion. Diesel may also be relied upon for electric power generation when power grids are inadequate.

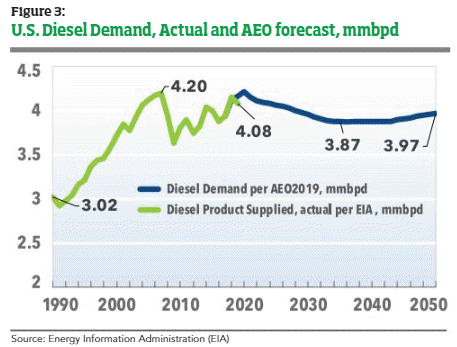

Diesel’s role in the demand pattern has changed significantly, as shown in Figure 2. The oil price shocks of the 1970s cut first into demand. Diesel’s share stabilized at 18 – 19% of demand during the 1980s until the year 2000. From 2000 until 2007, diesel demand grew at an average rate of 1.7% per year, and diesel’s share of demand also recovered to the neighborhood of 20 – 21%. The year 2008 brought the Great Recession and fuel demand collapsed. Between 2007 and 2009, diesel demand dropped by 565,000 barrels per day. The share of diesel in the demand pattern fell from 21.2% in 2007 to 20.2% in 2009, and its share is currently in the vicinity of 21%.

In the decade after the Great Recession, most, but not all, diesel demand was restored. According to the EIA, diesel demand dropped from 4.196 million barrels per day (mmbpd) in 2007 to 3.631 mmbpd in 2009. Demand climbed back gradually, and it averaged 4.076 mmbpd during the first three quarters of 2019. Figure 3 extends the historic data on diesel use with the official long-term forecast by the EIA, published in the Annual Energy Outlook (AEO) 2019. The EIA forecasts that diesel demand will decline slowly between 2020 and 2034, when it will level off at 3.87 mmbpd. After the year 2042, demand is forecast to grow modestly once again, reaching 3.97 mmbpd in the year 2050. Over the long term, the diesel market is forecast to shrink at 0.1% per year. However, the EIA forecasts that demand for motor gasoline will decline at the much-faster rate of 0.8% per year during the same period. Therefore, the EIA forecast indicates that diesel’s role in the fuel mix will increase relative to gasoline over the next three decades.

Over three-quarters (approximately 77%) of U.S. distillate is used for transportation. The industrial sector is the second-largest end user, at 13%. This is followed by the residential sector (6%) and the commercial sector (4%).