Release Date: Feb. 6, 2024

Forecast Overview

- Natural gas production. Because of disruptions in mid-January related to cold weather across the central United States, we estimate that U.S. dry natural gas production fell from a monthly record of 106 billion cubic feet per day (Bcf/d) in December to 102 Bcf/d in January. The January average was 3 Bcf/d lower than we had forecast in last month’s STEO. We forecast that U.S. natural gas production will increase in February and reach 105 Bcf/d by March as the weather-related disruptions subside and will stay close to that level for the rest of the year. Dry natural gas production averages 104 Bcf/d for all of 2024 in our forecast, almost 1 Bcf/d less than we forecast in last month’s STEO. We expect production will increase in 2025 to average more than 106 Bcf/d.

- Natural gas consumption. We estimate that more than 118 Bcf/d of natural gas was consumed in the United States in January, a new monthly record, driven by the electric power sector. Although our forecast assumes that the United States will see milder weather with 4% fewer heating degree days than is typical during February and March, we forecast that U.S. natural gas consumption will increase by 5% in the first quarter of 2024 (1Q24) compared with 1Q23, which was one of the warmest first quarters on record.

- Natural gas storage. In January, increased natural gas consumption and reduced production resulted in a withdrawal of almost 920 Bcf from storage for the month, the third-most ever. However, because January began with 13% more natural gas in storage than average over the past five years, inventories remain above the five-year (2019–2023) average. We expect U.S. natural gas inventories in February and March will fall by less than the five-year average because of milder-than-normal weather. We forecast inventories will end this winter heating season (November–March) at about 1,910 Bcf, which would be 15% more than the five-year average.

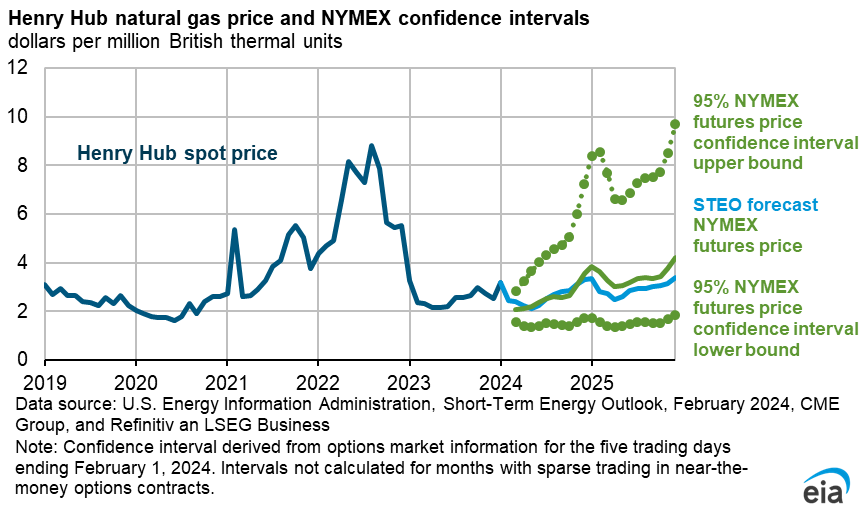

- Natural gas prices. The Henry Hub spot price averaged $3.18 per million British thermal units (MMBtu) in January. However, spot prices were volatile, rising sharply to $13.20/MMBtu on Friday January 12 in anticipation of severely cold weather for the coming weekend. After the weekend, prices quickly fell and continued to decrease until January 23, when the price hit the monthly low of $2.15/MMBtu. We forecast that mild weather for the remainder of 1Q24 will keep the average Henry Hub spot price near $2.40/MMBtu during February and March. But volatility could return if severely cold weather emerges, even for a short period.

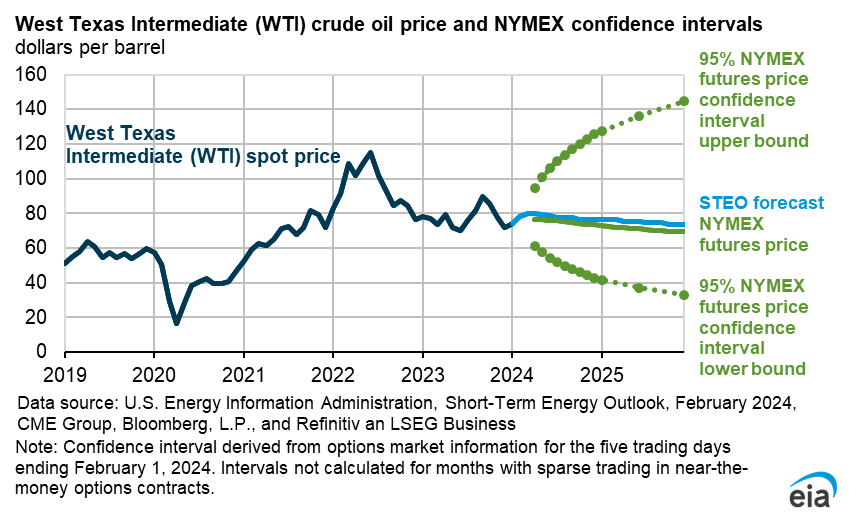

- Crude oil prices. The Brent crude oil spot price increased in January, averaging $80 per barrel (b) because of heightened uncertainty about global oil shipments as attacks to vessels in the Red Sea intensified. Although we expect crude oil prices will rise into the mid-$80/b range in the coming months, we expect downward price pressures will emerge in 2Q24 as global oil inventories generally increase through the rest of our forecast. However, ongoing risks of supply disruptions in the Middle East create the potential for crude oil prices to be higher than our forecast.

- U.S. crude oil production. We estimate that U.S. crude oil production reached an all-time high in December of more than 13.3 million barrels per day (b/d). However, crude oil production fell to 12.6 million b/d in January because of shut-ins related to cold weather. We forecast production will return to almost 13.3 million b/d in February but then decrease slightly through the middle of 2024 and will not exceed the December 2023 record until February 2025.

- Electricity generation. Generation from renewable sources will likely grow in every region of the United States in 2024, driven by our forecast of a 36-gigawatt increase in solar generating capacity. We forecast U.S. solar generation will rise by 43% in 2024 and wind generation will rise by 6%. However, we revised our forecast generation from renewable sources down slightly in 2025 from last month’s STEO because of lower reported capacity additions from generators in recent months. That factor, along with slightly more total generation in 2025, increased our forecast of coal-fired electricity generation in 2025 in this month’s outlook.