By Nancy Yamaguchi, PhD

In our Winter issue, we presented Part 1 of “Reversal of (Mis)Fortune: Oil in the U.S.” This continuation develops further our theme. Reversing the downward slide in U.S. oil production was a mighty feat, displacing a massive chunk of imports and converting the U.S. into a major oil exporter as well. This is not wholly good fortune when considered from abroad. This article focuses on the change in oil flows and the impact on neighboring oil producers, chiefly Venezuela, Mexico and Canada.

Impacts on Regional Crude Exporters: Canada, Mexico and Venezuela

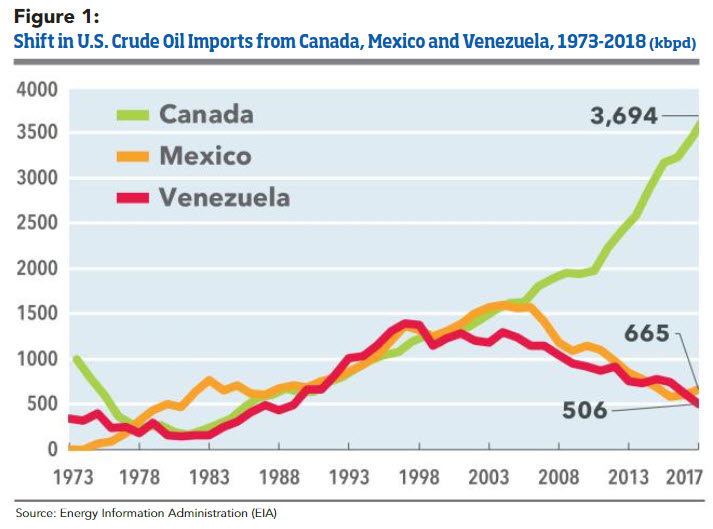

The massive reduction in U.S. crude import requirements is having profound impacts on neighboring crude exporters. Figure 1 shows the huge shift in U.S. crude imports from Canada, Mexico and Venezuela from 1973 through 2018. From the 1970s through the late 1990s, all three countries were important and growing sources of crude for the U.S. Their exports to the U.S. were roughly comparable in volume, at approximately 1 mmbpd each in the year 1993, growing to around 1.2 to 1.3 mmbpd in 1997. Thereafter, their paths began to diverge—dramatically, after the year 2000.

Venezuelan crude exports to the U.S. began to slump after 1998, after Hugo Chavez took over as the country’s president. Venezuelan crude production was nearly 3.5 mmbpd in 1998, and it has never regained this level since then. According to OPEC, Venezuela’s crude production had dwindled to 1.148 mmbpd in December 2018. Production averaged 1.339 mmbpd in 2018, a sharp drop of 0.572 mmbpd from 2017’s production level of 1.911 mmbpd.

In 1998, Venezuela exported 1.377 mmbpd of crude to the U.S. This plummeted to 0.506 mmbpd in 2018, an average rate of decline of 4.9% per year over the last twenty years.

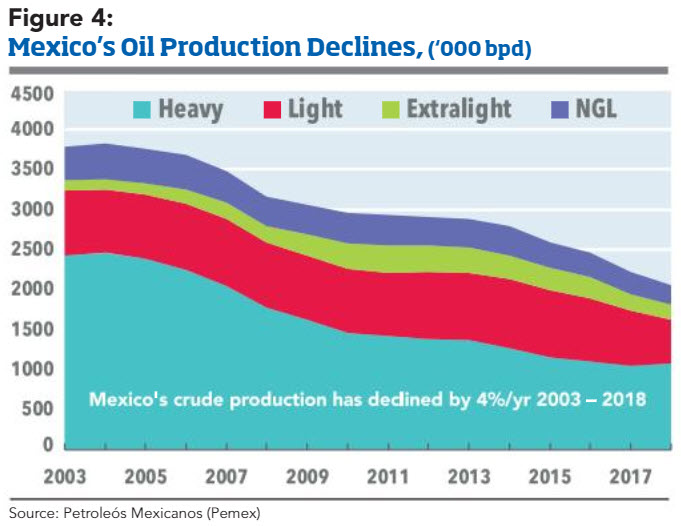

Mexican crude exports to the U.S. began to fall after the year 2004. Mexican production has fallen steadily as key offshore fields, including Cantarell, have begun to play out. In 2004, Mexican output was 3.825 mmbpd, according to Petróleos Mexicanos (Pemex), the national oil company. The Mexican government took steps in 2014 to revive the industry by enacting constitutional reforms that ended the 75-year monopoly held by Pemex. Production has continued to fall, however. Licensing rounds have been disappointing, and the current global supply-demand balance has not encouraged additional exploration and investment. Pemex reported that crude production was 2.788 mmbpd in 2014 and that this fell to an estimated 2.071 mmbpd in 2018, a drop of 0.717 mmbpd. Production is forecast to decline again in 2019.

In 1998, Mexico exported 1.321 mmbpd of crude to the U.S. This fell to 0.665 mmbpd in 2018, a rate of decline averaging 3.4% per year over the last twenty years.

In contrast, Canadian exports to the U.S. began to grow even more rapidly, in part filling the gap left by the declines in supply from Mexico and Venezuela. Canadian production of bitumen-based products from oilsands (diluted bitumens, or “dilbits,” and synthetic crudes) has grown enormously. Continued growth is expected, with an interruption in 2019 expected because of storage and pipeline constraints. The government of Alberta Province mandated a cut in output, effective January 2019. Most of Canada’s output is landlocked, with limited access to seaports to the east or west. Consequently, most Canadian crudes and oilsands products travel via pipeline or rail to the U.S., and they are priced at a discount to U.S. crudes.

In 1998, Canada exported 1.266 mmbpd of crude to the U.S. This nearly tripled to 3.694 mmbpd during the January – October period of 2018. The average rate of increase has been 5.5% for the past twenty years.

Crude Production Differences: Canada, Mexico, Venezuela

As Figure 1 illustrated, Mexico and Venezuela are exporting less crude to the U.S., while Canada is exporting more. Mathematically, this could simply mean that Mexico and Venezuela are exporting their crude to other markets. But instead, it is because their production has fallen. Canadian production has risen.

As Figure 2 illustrates, Canadian crude and condensate production have grown dramatically since the year 2000. In 2000, Canadian output was 2162 kbpd. This grew to 4578 kbpd in 2018, according to the Canadian National Energy Board (NEB). Production has grown at a rate averaging 4.3% per year for the past eighteen years.

In 2018, over one-half (50.5%) of Canada’s output was heavy crude, followed by 23.1% upgraded bitumen (also known as synthetic crude), 17.6% conventional light crude and 8.8% condensate. Alberta Province is the key producing region, accounting for close to three-quarters of domestic output. Alberta contains vast resources of oilsands, and it is the center of the synthetic crude industry. During the 2000 – 2018 period, production of conventional light and heavy crudes declined. Alberta’s production of upgraded bitumen has expanded at a rate averaging 7% per year, and production of non-upgraded bitumen has grown at 10.7% per year. Bitumen products are considered difficult feedstocks from a refining perspective, but essentially all U.S. refineries with pipeline access to these inexpensive feedstocks have made the investments necessary to process them.

Canada’s situation contrasts sharply with Mexico’s. Figure 4 shows the prolonged downward trend in Mexican oil production. Production dropped from 3.8 mmbpd in 2003 to 2.05 mmbpd in 2018. Heavy crudes account for 52% of Mexico’s production, light crudes account for 27%, extra-light crudes 9%, natural gas liquids (NGLs) 12%. Production has declined at 4% per year during the 2003 – 2018 period. The government set a goal of reviving the oil industry. It enacted constitutional reforms in 2014 that ended the monopoly of the national oil company, Petroleós Mexicanos (Pemex), and began to open the oil sector to private investment, but this has not arrested the downturn in production. From 2014 to 2018, production fell at a rate of 7.4% per year.

Venezuelan production also has been falling. Figure 5 illustrates the steep drop in output, which fell from 2375 kbpd in 2015 to 1336 kbpd in 2018, and to 1106 kbpd in January 2019. Between 2012 and January 2019, output has declined at a rate averaging 10.3% per year. Production is expected to fall even further in coming months, caused by the current social unrest and sanctions imposed by the U.S. Some estimates place Venezuelan production below 900 kbpd this year. The U.S. State Department expects it to fall as low as 500 kbpd by the end of the year under the weight of U.S. sanctions. President Nicolas Maduro defiantly claimed that he would “call upon investors from Arabic and Islamic countries to invest their money into developing the oil and gas industry,” and that he would increase crude production by 1 million bpd. Venezuela’s situation is at a critical juncture, discussed in more detail in the section following.

Venezuela in Crisis

At the time of this writing, the situation in Venezuela has reached crisis proportions. The country has been in a tumultuous state for years, but it appears that larger forces now are in motion that will move the country forward—but the direction is unknown. The country has two Presidents: the incumbent President Nicolas Maduro, who retains control over most of the military, and Interim President Juan Guaidó, the leader of the National Assembly who gained the support of the U.S. and many other countries when it appeared that Maduro’s re-election was heavily rigged.

Venezuela has the largest oil reserve in the world, estimated at 303 billion barrels. Venezuela was one of the founding members of OPEC, and it has played a major role in the group’s history. The national oil company, Petróleos de Venezuela, S.A. (PDVSA), grew to be a major force in the global oil market. As a national oil company, however, it was subject to competing political aims. President Hugo Chavez, who led Venezuela from 1998 until his death in 2013, promised that his Bolivarian Revolution would give power back to the people. Oil revenues provided the money for a wide array of social programs.

PDVSA’s payroll expanded, but its operations became less efficient as the money generated was channeled to other political projects rather than being reinvested in the oil and gas sector. In 2002, many PDVSA employees went on strike to protest the policies of President Chavez. He fired approximately 19,000 workers. This included the great majority of the research and development arm, Intevep (Instituto de Tecnología Venezolana para el Petróleo). PDVSA lost much of its ability to compete in the global marketplace. Some employees moved to foreign countries including Colombia and Canada, taking their expertise to the oil industries there, and this brain drain further crippled PDVSA.

In the years leading up to the Saudi-led oil price war, global oil prices were very high. Brent crude oil spot prices were over $100/b during the last three years of the Chavez regime, which gave the Venezuelan president a great deal of financial leeway. After 2013, however, prices began to fall and the incoming President, Nicolas Maduro, was unable to continue with the socialist system of subsidies and price controls. Venezuela’s economy was reported to be teetering on the brink of collapse—always teetering, but never actually collapsing. The general citizenry has proven extraordinarily resilient, but conditions have grown so dreadful that the collapse may finally be arriving. In December 2018, consumer prices in Venezuela skyrocketed 1,700,000 percent, up from a climb of 1,300,000 percent in November, according to the country’s opposition-led congress. This is the highest inflation rate ever recorded. Protests have been widespread and constant, as many Venezuelans have been unable to afford the basics of food, water and medicines.

In January 2019, the opposition party National Assembly Leader, Juan Guaidó, declared himself interim president of Venezuela, stating that the re-election of Nicolas Maduro was illegitimate. U.S. President Donald Trump was the first president to recognize Guaidó as the legitimate head of state. The U.S. president was joined by other Western Hemisphere countries including Canada, Brazil, Colombia, Ecuador, Peru, Argentina, Chile, Costa Rica, Guatemala and Paraguay. Australia also announced support for Guaidó. The European Union adopted the cautious stance of requesting that Maduro schedule new elections. When Maduro refused, most of them decided to back Guaidó as interim leader, believing that he will honor his promise to hold legitimate elections. The EU countries supporting Guaidó include Austria, Britain, Denmark, France, Germany, the Netherlands, Poland, Portugal and Spain.

Other countries remain behind Maduro, including Bolivia, Cuba and Russia. Maduro has sought aid from Russia and from OPEC during the current crisis. Maduro tweeted thanks for support from Russia, China and Turkey. Maduro also asked Pope Francis for “a dialogue.” Italy is divided on the issue.

Initially, oil markets took this news in stride, and there was little oil price movement. However, the U.S. then declared that it would issue sanctions on PDVSA on January 28th, stating that PDVSA personnel were plundering the company to engage in criminal activity. The sanctions are intended to isolate President Maduro and cut off the flow of revenue. PDVSA’s U.S. subsidiary, Citgo Petroleum Corporation, can process Venezuelan crude at its Houston, Texas, refinery, but the revenues are contained in blocked accounts. PDVSA still can export oil to other customers, but some of these exports are for debt repayment, and they do not provide hard currency to the Maduro administration.

The U.S. has directed that non-U.S. entities must wind down their purchases of Venezuelan oil by April 28th. The sanctions immediately affected tanker transport in the Gulf of Mexico, with an estimated seven million barrels of Venezuelan crude afloat without destinations. PDVSA scrambled to send cargoes on long-haul voyages to China, Russia and India. PDVSA subsequently declared a maritime emergency because of its inability to pay some of its tanker fleet operators. Some Venezuelan tankers have been seized for non-payment.

Adding to Venezuela’s economic woes, a World Bank arbitration panel recently ordered Venezuela to pay U.S.-based ConocoPhillips over $8 billion, finding that Venezuela violated international law by expropriating ConocoPhillips investments.

Venezuela suffered nationwide power outages in March 2019, which President Maduro blamed on cyberattacks by the U.S. During the blackouts, both presidents held rallies for their supporters. The situation is in flux, but global sentiment tipped more toward Guaidó during well-publicized attempts to deliver international humanitarian aid to Venezuela from neighboring Colombia. The U.S. Agency for International Development (USAID) estimates that 3.4 million Venezuelans have fled the country, with nearly 1.2 million going to Colombia. Venezuelan security forces blocked the delivery of humanitarian aid, and violent clashes at the border caused at least five fatalities.

Conclusion: A Reversal of (Mis)fortune

The U.S. oil market has gone through a major transformation. Instead of becoming an ever-growing market for other international oil producers, its import dependence has dropped, and it has become an important energy exporter.

The U.S. may become a major net exporter of energy when all forms are included, but the U.S. is not a net exporter of crude oil. In 2018, the U.S. produced 10.95 mmbpd of crude, exported 2.00 mmbpd of crude and imported 7.76 mmbpd of crude. Nonetheless, this is a huge shift from where the country might have been. The U.S Energy Information Administration (EIA) forecast in its Annual Energy Outlook 2005 (AEO2005) that crude imports would exceed 16 mmbpd in the year 2025. This projection was slashed to 6 mmbpd in the AEO2018 report.

Think of the U.S. as a customer who was expected to buy 10 mmbpd of crude and that this customer has left the market. The volume the U.S. will not buy is approximately as much as the largest producers (the U.S., Russia and Saudi Arabia) can produce. The volume the U.S. will not buy is twice as much as Canada, Mexico and Venezuela combined are exporting currently. Mexican and Venezuelan output has dwindled. Many of Mexico’s oilfields were mature and in decline already. Mexico is trying to reverse its decline by opening its market to competition, and its national oil company, Pemex, is no longer a monopoly.

Venezuela crippled its own industry over a period of decades, and it remains to be seen if true regime change and reform are underway. Even if Venezuela begins to repair its society and economy, the process could take years.

The presence of the U.S. as a massive market surely helped stimulate the development of oil export industries in neighboring Canada, Mexico and Venezuela. It cannot be said that the U.S. caused the declines in Mexico and Venezuela. But it is logical to assume that, if U.S. import requirements had continued to grow as forecast, other regional producers would have had a far easier time. Thus, we may continue with our theme that the resurgence of U.S. oil is a massive reversal of (mis)fortune. Interpreting it as good fortune or bad depends on who and where you are, and where you want to be.

Nancy is an author and petroleum industry expert specializing in the advanced analysis of energy markets. Dr. Yamaguchi is the President of Trans-Energy Research Associates, Inc. focusing on a wide spectrum of fuel related issues such as economics and the environment. She possesses a strong interest in global oil industry including supply, demand, trading trends as well as transport, refining, product blending, alternative and reformulated fuels, product quality and price behavior. Dr. Yamaguchi can be reached at [email protected]

Nancy is an author and petroleum industry expert specializing in the advanced analysis of energy markets. Dr. Yamaguchi is the President of Trans-Energy Research Associates, Inc. focusing on a wide spectrum of fuel related issues such as economics and the environment. She possesses a strong interest in global oil industry including supply, demand, trading trends as well as transport, refining, product blending, alternative and reformulated fuels, product quality and price behavior. Dr. Yamaguchi can be reached at [email protected]