Excerpted from This Week in Petroleum

Release Date: June 9, 2021

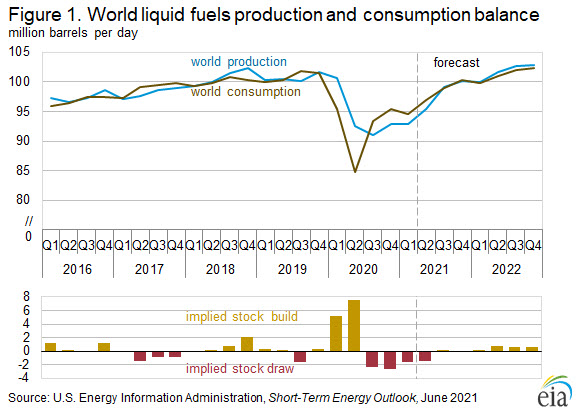

In the June Short-Term Energy Outlook (STEO), we forecast that increasing global production of petroleum and other liquid fuels (driven by OPEC, Russia, and the United States) will limit price increases for global crude oil benchmarks Brent and West Texas Intermediate (WTI). Although global consumption will likely increase through 2022, we forecast production will increase more rapidly, ending the large global stock draws seen in the first two quarters of 2021. We forecast global stocks will remain nearly flat in the second half of 2021 and then increase in 2022 (Figure 1). We expect the increasing global petroleum stocks will limit upward crude oil prices in the coming months and contribute to lower crude oil prices later this year and into 2022.

Scheduled increases in production targets contributed to OPEC crude oil production reaching 25.5 million barrels per day (b/d) in May 2021, the most monthly production since April 2020. As a result, global petroleum supply reached an estimated 95.0 million b/d compared with demand of 96.2 million b/d, resulting in global stock draws of about 1.2 million b/d. At its June 1 meeting, OPEC+ reaffirmed its commitment to continued production increases in the coming months. However, we assume that compliance with the production limits under this agreement will deteriorate in the second half of 2021 and that OPEC+ countries will not cut back production in response to increasing crude oil production from Iran. We expect OPEC crude oil production will increase, averaging 28.7 million b/d in the fourth quarter and 26.9 million b/d for all of 2021. We forecast that OPEC crude oil production will increase by 1.8 million b/d in 2022 and average 28.7 million b/d for that year.

We forecast that production of petroleum and other liquids in Russia, an OPEC+ participant, will increase by 190,000 b/d in 2021 and by 790,000 b/d in 2022, reaching an average of 11.5 million b/d in 2022.

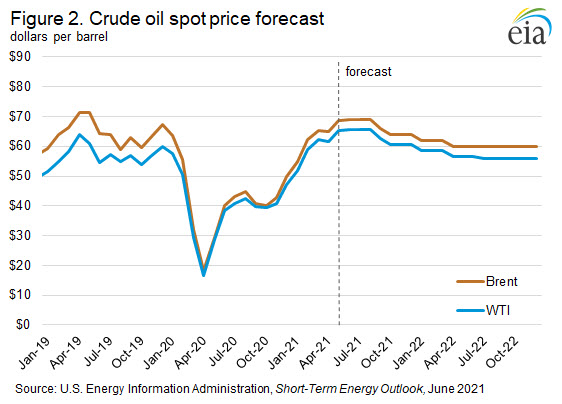

Our forecast has several notable risks. Relatively high crude oil prices over the next several months may encourage individual OPEC+ members to increase production more than stipulated by the current OPEC+ agreement. We forecast that Brent crude oil prices will average $69 per barrel (b) each month from June through August before declining to $64/b in December, and we expect WTI to average $66/b from June through August before declining to $61/b in December (Figure 2). In addition, our current forecast assumes that crude oil production in Iran will continue to increase this year. Even though sanctions that target Iran’s crude oil exports remain in place, crude oil exports from Iran have been rising since the end of 2020, driving up crude oil production, and may increase faster than we previously expected.

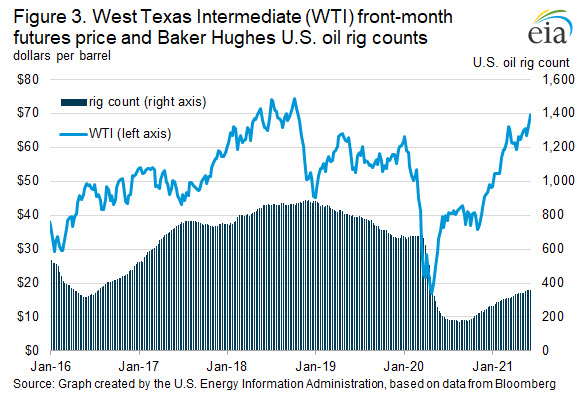

We expect crude oil production in the United States to increase each quarter through the forecast period, averaging 11.4 million b/d in the fourth quarter of 2021 (4Q21), the highest level since 1Q20, and 11.1 million b/d for all of 2021. We expect U.S. crude oil production will increase by 710,000 b/d in 2022 and average 11.8 million b/d for that year. Rising crude oil prices and rig counts are driving this production increase.

As the WTI crude oil price has increased, so has the U.S. crude oil rotary rig count, an indicator of active U.S. crude oil production capacity compiled by Baker Hughes. Since August 14, 2020, the Baker Hughes rig count has more than doubled, reaching 359 rigs as of June 4, 2021 (Figure 3). The pace at which crude oil producers deploy drilling rigs is an important driver of crude oil production in U.S. tight oil basins.

We expect that the U.S. crude oil-directed rig count is likely to continue rising in response to the WTI crude oil price, which reached a monthly average of $65/b in May and we forecast will remain above $65/b through August 2021. Changes in rig counts typically lag changes in the WTI price by three to six months, and production changes typically occur about two months after rig deployment. Assuming that other factors remain constant, recent crude oil price increases will likely continue to drive rig deployments through much of the rest of 2021. However, the recent changes in rig counts indicate operators, notably in the Permian region, could add fewer rigs at current crude oil prices than they previously added when prices were at similar levels. In the forecast, we have slightly adjusted the responsiveness of rig deployments in the Permian region to upward crude oil price movements.

Although U.S. crude oil producers have some incentive to remain cautious about deploying rigs and increasing production because of overall market uncertainty, if WTI crude oil prices remain near $65/b in the coming months, as we forecast, prices will continue to encourage producers to deploy additional rigs and increase production. Onshore U.S. crude oil production in the Lower 48 states during May 2021 averaged 8.9 million b/d, and we expect production to reach almost 9.3 million b/d by December 2021 with further increases into 2022.

The effects of higher crude oil prices and planned OPEC+ production increases contribute to our forecast that global petroleum supply will increase over the next several months, resulting in an essentially balanced market in the second half of 2021. We expect global stock builds in each quarter in 2022. Based on this global supply and demand forecast, we expect that the Brent crude oil price will stay near current levels for most of 3Q21, fall to $64/b in 4Q21, and decline further to average $60/b in 2022. However, the degree of adherence to the current OPEC+ production agreement and the volume of crude oil entering the market from Iran could push prices higher or lower. Similarly, if U.S. operators add fewer drilling rigs than expected, the result would be lower U.S. crude oil production in 2022, which would also affect prices.