The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended September 30, 2019. Prices for both fuels began to ease, responding to the restoration of Saudi Arabian crude oil supplies. Two weekends ago, attacks on Saudi Arabian oil facilities knocked approximately 5.7 million barrels per day (mmbpd) of supply off the market. Crude prices spiked immediately, then tapered back down as supplies normalized. On a national average basis, retail prices for gasoline declined by 1.2 cents/gallon for the week, though refinery issues in California are creating a localized price spike. National average prices for gasoline were 22.4 cents/gallon below where they were in the same week one year ago. On a national average basis, retail prices for diesel fell by 1.5 cents/gallon. National average prices for diesel were 24.7 cents/gallon lower than they were in the same week last year.

Futures Prices and Retail Price Outlook

During the week from September 23-September 27, 2019, West Texas Intermediate (WTI) crude futures prices fell by $2.74/barrel (4.6%.) Gasoline futures prices fell by 3.71 cents/gallon (2.2%.) Diesel futures prices fell by 6.49 cents/gallon (3.21%.) Two weekends ago, unmanned attacks on Saudi Arabian oil infrastructure shut in approximately 5.7 million barrels per day of crude. Houthi rebels in Yemen claimed credit for the attacks. Iranian involvement also was suspected, but the government denied this. Futures prices soared at market opening on Monday, September 16, hitting highs above $63/b—the highest prices seen in around four months. This week, Saudi Arabia announced that supplies had been restored, and also announced a partial cease fire with Yemen. Although the relationship between futures prices and retail prices is not immediate or one-for-one, retail prices are likely to ease in the coming week.

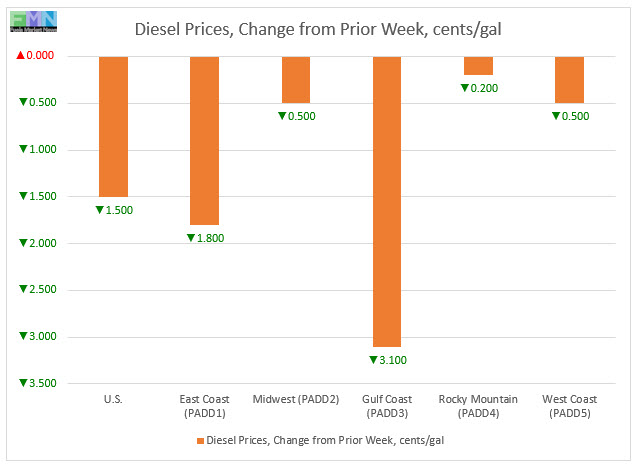

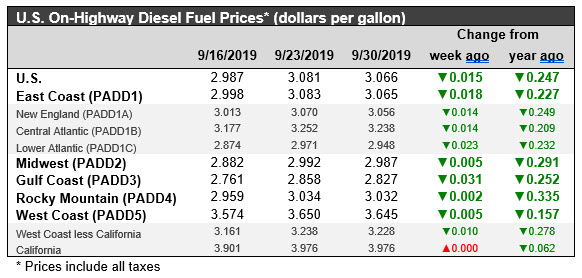

Retail Diesel Prices

For the current week ended September 30, retail diesel prices eased by 1.5 cents to arrive at an average price of $3.066/gallon. Retail diesel prices had been below the $3/gallon mark until the attacks on Saudi Arabia. Between mid-October and late-January, retail diesel prices fell for fourteen consecutive weeks. During those fourteen weeks, the price decline totaled 42.9 cents/gallon. From February through April, diesel prices crept back up by 20.4 cents/gallon. The month of May brought a modest reversal in the upward trend in diesel prices. During the five weeks of June including the week ended July 1st, diesel prices fell more substantially, declining by 10.9 cents/gallon. For the current week ended September 30, diesel prices fell in all PADDs. The national average price for the week was 24.7 cents/gallon below where it was during the same week last year.

In the East Coast PADD 1, diesel prices decreased by 1.8 cents to arrive at an average price of $3.065/gallon. Within PADD 1, New England prices fell by 1.4 cents to average $3.056/gallon. Central Atlantic diesel prices also declined by 1.4 cents to average $3.252/gallon. Lower Atlantic prices fell by 2.3 cents to settle at an average price of $2.948/gallon. PADD 1 prices were 22.7 cents/gallon below their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices declined by 0.5 cents to average $2.987/gallon. Prices were 29.1 cents/gallon below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17 in having diesel prices fall below $3/gallon. These two PADDs are the only ones with prices remaining below the $3/gallon mark.

In the Gulf Coast PADD 3, retail diesel prices fell by 3.1 cents to average $2.827/gallon. PADD 3 typically has the lowest diesel prices among the PADDs. Prices were 25.2 cents lower than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices edged down by 0.2 cents to average $3.032/gallon. PADD 4 prices were 33.5 cents lower than for the same week in the prior year. This is the largest year-on-year price drop among the PADDs.

In the West Coast PADD 5 market, retail diesel prices decreased by 0.5 cents to settle at an average of $3.645/gallon. PADD 5 prices were 15.7 cents below their level from last year. Prices excluding California fell by 1.0 cent to arrive at an average of $3.228/gallon. This price was 27.8 cents below the retail price for the same week last year. California diesel prices were unchanged at an average price of $3.76/gallon. Until the week ended June 24th, California had been the only major market where diesel prices were above $4/gallon, where they had remained for nine weeks. Prices are now quickly re-approaching the $4/gallon mark. California diesel prices were 6.2 cents lower than they were at the same week last year.

Retail Gasoline Prices

U.S. retail gasoline prices declined by 1.2 cents/gallon to reach an average of $2.642/gallon during the week ended September 30. Prices fell in PADDs 1, 2 and 3 while rising in PADDs 4 and 5. Retail prices for the current week were 22.4 cents per gallon lower than they were one year ago. Gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for fourteen weeks in a row, shedding a total of 66.6 cents per gallon. In the next seventeen weeks, prices marched back up by 66.0 cents/gallon. Prices came very close to the peak they hit in early October, before the months of May and the June brought an easing of prices. Gasoline prices in May and June retreated by 23.3 cents per gallon. The week ended July 1 reversed that downward trend and sent prices up once again.

During the first three weeks of July, gasoline prices rose by 12.5 cents/gallon. This outpaced the increases in crude oil and diesel prices mainly because of the explosion and fire at the 335,000-bpd, gasoline-maximizing Philadelphia Energy Systems (PES) refinery. Tropical Storm Barry then caused an uptick in prices. Subsequently, prices began to relax, and they fell for eight consecutive weeks beginning with the week of July 22, yielding a total price drop of 20.0 cents/gallon.

For the current week ended September 30, East Coast PADD 1 retail prices for gasoline fell by 3.4 cents to average $2.506/gallon. The average price was 28.8 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices edged down by 0.3 cents to average $2.553/gallon. Central Atlantic market prices fell by 2.4 cents to average $2.638/gallon. Prices in the Lower Atlantic market fell by 4.7 cents to settle at an average of $2.411/gallon.

In the Midwest PADD 2 market, retail gasoline prices plunged by 9.7 cents to settle at an average price of $2.488/gallon. This was the largest price drop among the PADDs, backtracking most of the prior week’s price spike of 12.9 cents. PADD 2 prices for the current week were 30.2 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices fell by 2.7 cents to average $2.326/gallon. PADD 3 continues to have the lowest average prices among the PADDs, currently 31.6 cents/gallon below the average U.S. price. Prices for the week were 26.7 cents lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices rose by 1.1 cents to reach an average price of $2.709/gallon. This week’s prices were 29.1 cents lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices spiked by 21.0 cents to hit an average of $3.547/gallon. Problems were reported at three key refineries in California: Valero’s Benicia refinery, Chevron’s El Segundo refinery, and PBF’s Torrance refinery. PADD 5 continues to have the highest gasoline prices among the five PADDs. It is the only PADD where retail prices continue to exceed $3/gallon. It also is the only PADD where prices are now higher than they were last year: This week’s prices were 13.5 cents above where they were during the same week in 2018. Excluding California, West Coast prices increased by 5.2 cents to average $3.057/gallon. This price was 9.2 cents lower than at the same time last year. In California, pump prices skyrocketed by 34.0 cents to average $3.953/gallon. California prices were 32.9 cents per gallon above their levels from the same week last year. It is the only major U.S. submarket where prices are higher than they were one year ago. During the current week ended September 30, Los Angeles retail prices averaged $3.987/gallon and San Francisco retail prices averaged $3.963/gallon, leaving consumers to wonder whether the unplanned refinery outages will cause prices to hit the $4/gallon level.