Oil markets are languishing today, having followed the stock market down. Oil prices are awaiting direction. Today’s indicators point to a cessation of the rapid selloff that slashed value from the stock market, and if this holds, crude prices also should strengthen. West Texas Intermediate (WTI) crude prices are hovering around $37–$37.50 a barrel, which are the lowest prices in three months. Crude and product prices appear to be stabilizing, but they are heading for a finish in the red this week.

Today is the 19-year anniversary of the 9/11 terrorist attacks. The attacks killed 2,977 people and injured over 25,000, many of whom suffered long-term health problems. Property damage was estimated at $10 billion.

Stock markets have suffered four losses in five trading days, and investors fear that the upside rally may have gone too far. The downward adjustment has been severe: The Dow Jones Industrial Average fell 3.7% between September 2 and September 10. The S&P 500 fell 4.7%. The tech-oriented Nasdaq fell 6.8%.

Market selling accelerated when the U.S. Senate voted on a scaled-down coronavirus relief bill, but it failed to get the 60 votes needed to pass a procedural hurdle.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have reached 28,208,576, with 910,292 deaths. Confirmed cases in the U.S. have risen to 6,397,851. U.S. deaths attributed to the disease have reached 191,803.

Initial weekly unemployment claims were unchanged during the week ended September 5, coming in at the same 884,000 as the prior week’s upward-revised figure. Last week brought a long-awaited achievement when initial claims fell significantly below the one-million mark, but progress stalled this week.

WTI crude futures prices opened at $41.25 a barrel today, down by $1.75 a barrel (4%) from last Friday’s open of $42.98 a barrel. Last week, Hurricane Laura stimulated buying interest, and prices surged. Prices had been easing already, but the collapse of the stock market dragged oil prices down more sharply. Today, prices are weak, and WTI futures prices are hovering around $37–$37.50 a barrel. Prices are heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, September 4 through Friday, September 11. This includes the Labor Day holiday. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

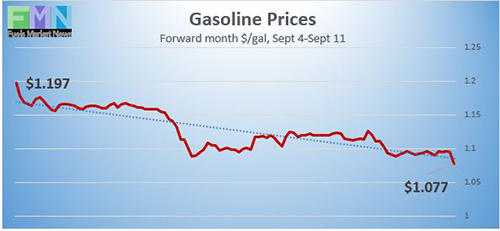

Gasoline Prices

Gasoline futures prices opened at $1.0884 a gallon today on the NYMEX, compared with $1.2049 a gallon on Friday September 4. This was a major loss of 11.65 cents (9.7%). March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline fell 1.1 cents to average $2.211/gallon during the week ended September 7. Retail prices reclaimed the territory above $2 per gallon during the first week of June. A holiday weekend such as Labor Day often strengthens gasoline prices, but this year did not bring price strength, and the driving season is coming to a close. Gasoline futures are trading in the range of $1.076/gallon to $1.101/gallon. The week is heading for a finish in the red. The latest price is $1.0935/gallon.

Source: Prices as reported by DTN Instant Market

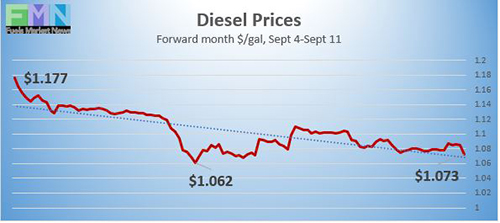

Diesel Prices

Diesel opened on the NYMEX today at $1.0771/gallon, down significantly by 8.73 cents, or 7.5%, from last Friday’s open of $1.1644/gallon. U.S. average retail prices for diesel declined by 0.6 cents per gallon during the week ended September 7 to average $2.435/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. This week, prices have followed crude prices down, which have followed stock markets down. The week is heading for a finish in the red. Currently, diesel is trading mainly in the range of $1.072-$1.094/gallon. The latest price is $1.0879/gallon.

WTI Crude Prices

Source: Prices as reported by DTN Instant Market

WTI crude forward prices opened on the NYMEX today at $37.01 a barrel, compared with $41.25 a barrel last Friday. This was a major loss of $4.24 a barrel (10.3%.) This week, stock markets continued to slide, and the oil complex followed. Until the past two weeks, WTI crude futures prices had risen for four consecutive weeks, capturing the territory above $41 a barrel and even rising above $43 a barrel, which had not happened for five months. Prices are now retreating, and WTI futures prices are hovering around $37 a barrel. The week appears headed for a finish in the red. WTI crude is trading mainly in the $36.75–$37.50 a barrel range currently. The latest price is $37.15 a barrel.

PRICE MOVERS THIS WEEK: BRIEFING

Oil markets are languishing today, having followed the stock market down over the past week. The oil complex is awaiting direction. Today’s indicators point to a cessation of the rapid selloff that slashed value from the stock market, and if this holds, crude prices should strengthen also. WTI crude prices are hovering around $37.00-$37.50 a barrel, which are the lowest prices in three months. The downward trend in crude and product prices appear to be stabilizing currently, but they are heading for a finish in the red this week.

Today is the 19-year anniversary of the 9/11 terrorist attacks. The attacks killed 2,977 people and injured over 25,000, many of whom suffered long-term health problems. Property damage was estimated at $10 billion.

Stock markets have suffered four losses in five trading days, and investors fear that the upside rally may have gone too far. The downward adjustment has been severe: The Dow Jones Industrial Average fell 3.7% between September 2 and September 10. The S&P 500 fell 4.7%. The tech-oriented Nasdaq fell 6.8%.

Market selling accelerated when the U.S. Senate voted on a scaled-down coronavirus relief bill, but it failed to get the 60 votes needed to pass a procedural hurdle. The parties, and the White House, remain at odds on the next phase of federal stimulus. There is no clear date for when and if an agreement will be made, but there is widespread agreement that the U.S. economy will need additional stimulus as the current round expires.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have reached 28,208,576, with 910,292 deaths. Confirmed cases in the U.S. have risen to 6,397,851. U.S. deaths attributed to the disease have reached 191,803.

Initial weekly unemployment claims were unchanged during the week ended September 5, coming in at the same 884,000 as the prior week’s upward-revised figure. Last week brought a long-awaited achievement when initial claims fell significantly below the one-million mark. There are hopes that job formation is on the mend, though this week’s results show a stalling. According to data collected by the Department of Labor, during the week of March 28, initial jobless claims hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. Four weeks ago, claims finally fell below one million, but they were not able to sustain the downward trend. During the 25 weeks since U.S. states began to issue shelter-in-place orders, 60.2 million Americans have filed initial jobless claims.

The U.S. Energy Information Administration (EIA) published official inventory data on Thursday, a day late in observance of Labor Day. EIA statistics showed an addition of 2.033 million barrels (mmbbls) to crude oil inventories. This bearish news was tempered by drawdowns of 2.954 mmbbls from gasoline inventories and 1.675 mmbbls from diesel inventories. The EIA net result was a modest inventory drawdown of 2.595 mmbbls.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. The current week ended September 4 brought Cushing stocks up to 54,351 mmbbls.

During the week ended September 4, U.S. crude production recovered to 10.0 mmbpd, up by 0.3 mmbpd from the prior week’s 9.7 mmbpd. Hurricane Laura shut down numerous oil platforms in the Gulf, causing a production drop of 1.1 mmbpd during the prior week. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd. The EIA reported that U.S. crude production fell 21.9% between December 2019 and May 2020.