Oil prices continued to slide this week. Demand fears continue. The seasonal downturn in gasoline demand is only being offset partially by a modest recovery in jet fuel use and in diesel use in the agricultural and home heating sectors. The alarming resurgence of COVID-19 infections will tamp down demand recovery in many key countries. On the supply side, Libya’s rival factions signed a permanent cease-fire that could stabilize its oil industry and restore a steady flow of oil to an already-oversupplied market. Investors starved for good news, however, may focus on the FDA approval of the antiviral remdesivir as the first approved treatment for the novel coronavirus disease in the U.S. Moreover, initial unemployment claims finally made a significant downward move this week. Wall Street should react favorably today. Nonetheless, the oil complex appears to be heading for a finish in the red this week.

For the first time since mid-March, initial weekly unemployment claims have fallen below 800,000. According to data collected by the Department of Labor, initial claims totaled 787,000 during the week ended October 17, down by 55,000 from the prior week’s downward-revised figure of 842,000. Last week’s preliminary number of 898,000 dismayed economists, who had expected claims to fall to 825,000. The revised number, though high, was closer to expectations. Initial weekly claims have been below the one-million mark for eight consecutive weeks, but they had been stuck stubbornly above 800,000 until just this week. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 31 weeks since U.S. states began to issue shelter-in-place orders, approximately 65.2 million Americans have filed initial jobless claims. Some are at the point where benefits are running out.

COVID-19 cases continue to rise, with curve-flattening being reversed in many areas. Deaths are approaching 1.14 million. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 stand at 41,809,596, with 1,138,802 deaths. Confirmed cases in the U.S. have risen to 8,411,294. U.S. deaths attributed to the disease have reached 223,061. There are worrisome new outbreaks in the U.S., showing yet another increase in the latest seven-day average of new confirmed cases. Yesterday, the seven-day average of deaths in the U.S. hit the highest in a month. Cases have ticked up visibly this week in 36 of the 50 states. Across the Atlantic, cases are rising in France, the U.K., Belgium, Italy, the Netherlands, Germany, Spain, Poland and Switzerland.

At last, however, the bad news about rising COVID-19 infections is being countered with good news on the treatment front: The U.S. Food and Drug Administration (FDA) approved Gilead Science’s remdesivir as an antiviral therapy. This is one of the drugs given to President Trump. It has been shown to reduce the length and severity of the disease (though statistically it does not reduce the risk of deaths). Remdesivir has been used in many other countries, and it already is in use for emergency treatment in the U.S. Now, its approval may increase its use among hospitalized patients, and hopefully it will reduce suffering and length of hospital stays.

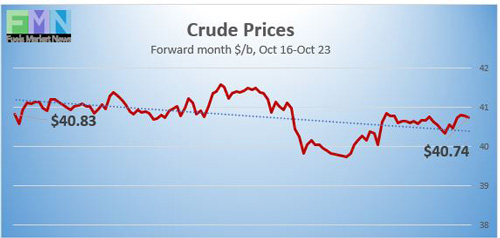

WTI crude futures prices opened at $40.61 a barrel today, down by $0.55 a barrel (1.3%) from last Friday’s open of $41.16 a barrel. WTI futures prices are in the neighborhood of $40.50 a barrel currently. Prices appear to be heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, October 16 through Friday, October 23. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Source: Prices as reported by DTN Instant Market

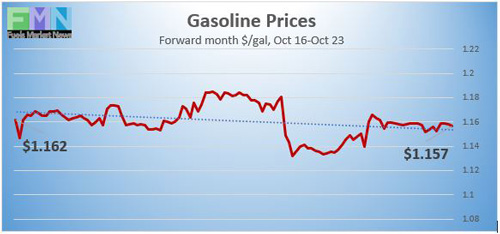

Gasoline Prices

Gasoline futures prices opened at $1.1585 a gallon today on the NYMEX, compared with $1.1803 a gallon last Friday. This was a decline of 2.18 cents (1.8%). March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline fell by 1.7 cents to average $2.150/gallon during the week ended October 19. Retail prices reclaimed the territory above $2 per gallon during the first week of June. Gasoline futures are trading in the range of $1.149/gallon to $1.1627/gallon. The week is heading for a finish in the red. The latest price is $1.1493/gallon.

Source: Prices as reported by DTN Instant Market

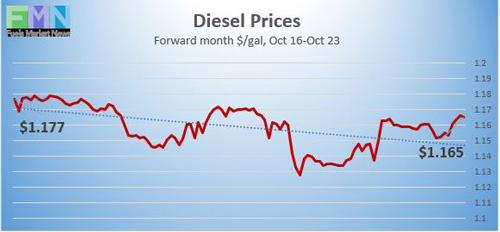

Diesel Prices

Diesel opened on the NYMEX today at $1.588/gallon, down by 2.59 cents, or 2.2%, from last Friday’s open of $1.1847/gallon. U.S. average retail prices for diesel fell by 0.7 cents per gallon during the week ended October 19 to average $2.388/gallon. Diesel prices generally have weakened this year, missing some of the price recovery seen in crude and gasoline markets. The week is headed for a finish in the red. Currently, diesel is trading in the range of $1.1501-$1.1694/gallon. The latest price is $1.1591/gallon.

Source: Prices as reported by DTN Instant Market

WTI Crude Prices

WTI crude futures prices opened at $40.61 a barrel today, down by $0.55 a barrel (1.3%) from last Friday’s open of $41.16 a barrel. Demand fears abound with the alarming increase in COVID-19 cases, at home and abroad. The first piece of good news arrived when the FDA approved the antiviral remdesivir for disease treatment. Remdesivir already has been in emergency use in hospitals, and its FDA approval may increase use and cut the severity and length of the disease. Futures prices are hovering in the neighborhood of $40.50 a barrel currently. The week appears to be headed for a finish in the red. WTI crude is trading in the $40.32–$40.92 a barrel range currently. The latest price is $40.46 a barrel.

PRICE MOVERS THIS WEEK: FULL BRIEFING

Oil prices continued to slide this week. Demand fears continue. The seasonal downturn in gasoline demand is only being offset partially by a modest recovery in jet fuel use and in diesel use in the agricultural and home heating sectors. The alarming resurgence of COVID-19 infections will tamp down demand recovery in many key countries. On the supply side, Libya’s rival factions signed a permanent cease-fire that could stabilize its oil industry and restore a steady flow of oil to an already-oversupplied market. Investors starved for good news, however, may focus on the FDA approval of the antiviral remdesivir as the first approved treatment for the novel coronavirus disease in the U.S. Moreover, initial unemployment claims finally made a significant downward move this week. Wall Street should react favorably today. Nonetheless, the oil complex appears to be heading for a finish in the red this week.

For the first time since mid-March, initial weekly unemployment claims have fallen below 800,000. According to data collected by the Department of Labor, initial claims totaled 787,000 during the week ended October 17, down by 55,000 from the prior week’s downward-revised figure of 842,000. Last week’s preliminary number of 898,000 dismayed economists, who had expected claims to fall to 825,000. The revised number, though high, was closer to expectations. Initial weekly claims have been below the one-million mark for eight consecutive weeks, but they had been stuck stubbornly above 800,000 until just this week. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the week of March 28, initial jobless claims skyrocketed to hit a peak of 6,867,000. From that peak, initial jobless claims fell for 15 weeks. July brought a setback, and claims rose again. During the week ended August 8, claims finally fell below one million, but they were not able to sustain the downward trend. During the 31 weeks since U.S. states began to issue shelter-in-place orders, approximately 65.2 million Americans have filed initial jobless claims. Some are at the point where benefits are running out.

COVID-19 cases continue to rise, with curve-flattening being reversed in many areas. Deaths are approaching 1.14 million. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 stand at 41,809,596, with 1,138,802 deaths. Confirmed cases in the U.S. have risen to 8,411,294. U.S. deaths attributed to the disease have reached 223,061. There are worrisome new outbreaks in the U.S., showing yet another increase in the latest seven-day average of new confirmed cases. Yesterday, the seven-day average of deaths in the U.S. hit the highest in a month. Cases have ticked up visibly this week in 36 of the 50 states. Across the Atlantic, cases are rising in France, the U.K., Belgium, Italy, the Netherlands, Germany, Spain, Poland and Switzerland.

At last, however, the bad news about rising COVID-19 infections is being countered with good news on the treatment front: The U.S. Food and Drug Administration (FDA) approved Gilead Science’s remdesivir as an antiviral therapy. This is one of the drugs given to President Trump. It has been shown to reduce the length and severity of the disease (though statistically it does not reduce the risk of deaths). Remdesivir has been used in many other countries, and it already is in use for emergency treatment in the U.S. Now, its approval may increase its use among hospitalized patients, and hopefully it will reduce suffering and length of hospital stays.

The U.S. Energy Information Administration (EIA) published official inventory data for the week ended October 16. The EIA reported a small drawdown from crude oil inventories of 1.002 million barrels (mmbbls) and a larger drawdown of 3.832 mmbbls from diesel inventories. Gasoline inventories rose by 1.895 mmbbls, contrary to industry expectations of an inventory draw. The EIA net result was a modest inventory drawdown of 2.939 mmbbls. This result fell short of the expectations of industry analysts and the American Petroleum Institute (API). The gasoline stock build in particular put downward pressure on prices.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26. However, the downward trend was reversed in July through early August, sending Cushing stocks back up to 53,289 mmbbls during the week ended August 7. Cushing stocks have trended up in September and October. The current week ended October 16 showed Cushing crude stocks at 60,417 mmbbls.

During the week ended October 16, U.S. crude production fell to 9.9 mmbpd, down by 0.6 mmbpd from the prior week. This reflected some of the production shut in from Hurricane Delta. According to the EIA, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production in July rose to an average of 11.04 mmbpd. In August, however, production fell to an average of 10.475 mmbpd before rising to 10.575 mmbpd in September. October production to data is averaging 10.467 mmbpd.