By Joe Petrowski

Investors and Petroleum Interests have been nervous about electric vehicles cutting into the demand for petroleum-based fuels while quietly, a revolution is underway in hydrogen production that over the longer term will see a rapid growth in hydrogen-powered vehicles and the infrastructure needed to fuel them.

Hydrogen power is not a new technology, and hydrogen vehicles have been around since the Ford Model A. Hydrogen fuel cells have been used for years by the military (for submarines and portable field power) and NASA (for the space station), and hydrogen is also used as a rocket fuel. Today, hydrogen is dominant in busses and forklifts, but there are only 300 hydrogen cars (mostly in California). There are only 48 retail fueling stations, of which 43 are in California (which has 70 percent of all electric vehicles).

This wouldn’t appear to be very optimistic. But things are changing with the price of hydrogen fuel, its production source and business model for transport fuel.

U.S. production of hydrogen is currently nine million metric tons (t) per year, or 20 billion pounds. A pound of hydrogen has 62,000 BTUs, or almost three times that of gasoline (21,000 BTUs per pound). So, from an energy standpoint we have a 60 billion gasoline-gallon equivalent (GGE), which is enough hydrogen to power 30 percent of all autos in the United States.

Of course, hydrogen has many applications including food processing, metal fabricating, fertilizer manufacturing and pharmaceuticals. It is a major component in desulfurization at petroleum refineries, which is why 90 percent of all hydrogen is today produced only in three states: Louisiana, Texas and California. Some 95 percent of this nine-million-ton production comes the steam reformation, which uses natural gas (CH4) to produce hydrogen and CO2. While natural gas is generally inexpensive and abundant, the CO2 byproduct is not climate-friendly.

Electrolysis is a less expensive and more environmentally responsible process where water is the feedstock and the H2O is split electrically into hydrogen and oxygen. Obviously, the efficiency of this approach is highly dependent on the cost of electricity, and that is the dramatic change going on in the industry. Power is extremely cheap and in certain locations at certain times often negative. For example, at night when the wind blows, and you have a grid with significant wind resources, it cannot put the power on the lines. So, “curtailment” payments are made to resource owners to interrupt production. Electrolysis allows this surplus power to make hydrogen, which is stored for later use on the grid during peak demand or windless and sunless hours. In fact, hydrogen produced from wind or solar power is eligible for renewable credits, further driving down hydrogen production costs.

Currently hydrogen costs $14/kilogram which is $5.6/GGE. With cheap power, and new membrane and production technology, that cost will fall to $5/kilogram, bringing the GGE to $2. Gasoline costs 10 cents/mile at $2.50/gallon. $5/kilogram of hydrogen is 10 cents/mile given the energy content and efficiency of hydrogen.

Consumers should welcome hydrogen cars in that they do not bring the range anxiety of electric nor the expense. Several manufacturers have announced plans for major U.S. hydrogen vehicle production including:

- Honda-Nexo

- Hyundai—Tucson

- Toyota—Mirai

- Mazda—Rx-8RE

- Nissan—unnamed

- BMW—unnamed

What hydrogen vehicle sellers are planning is to bundle five years of fuel at the time of vehicle purchase, with in-vehicle devices showing fueling locations and fuel balances.

Even Class 7 and 8 trucks that were never viable candidates for electric because of distance and torque issues are moving down the path to hydrogen, with Kenworth, Nikola, U.S. Hybrid and Toyota in the testing phase.

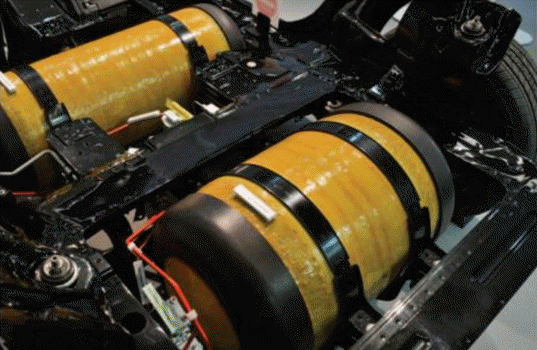

Of course, there are still hurdles in the way of hydrogen cars’ penetration of the U.S. market. Transporting hydrogen can be expensive. In liquid form, low temperatures and high compression is very expensive. Truck transport, as is most often the case, is always expensive. Hydrogen can be blended into existing natural gas pipelines but at a maximum blend of only 12 percent.

However, the major headwind for hydrogen acceptance as a passenger car fuel is the lack of fueling facilities. As noted earlier, there are only a handful of stations located in a single state. There are only 33 retail fueling stations, mostly in California.

The U.S. Energy Information Administration (EIA) estimates for every one million hydrogen cars, we will need 200 stations. If we reach 10 million hydrogen vehicles, which is the ambitious goal of original equipment manufacturers and Zero-Emission Vehicle (ZEV) state mandates, we will need 2,000 retail fueling stations which, excluding land, will cost $1.5 billion in capital expenditures.

For retailers, fueling a hydrogen car is five to seven minutes (same as gasoline) and a typical station can fuel 250 cars/day earning a retailer $1,000/day in retail fuel margin.

Now for electric.

Currently there are 13 ZEV states that have adopted the California ZEV standard program. Under the program, any manufacturer selling light-duty vehicles in the state must attain 3 percent of their sales in ZEV vehicles and when they do will receive credits that they can sell to those who do not attain that level or pay a penalty. ZEV credits have a value of over $1 billion, and Tesla alone is earning between $200 million to $500 million per year selling ZEV credits to non-compliant manufacturers. The average ZEV vehicle generates about $7,000 per credit with different vehicles having different credits assigned to them—from one to five credits per vehicle—depending on range and type of vehicle.

Twelve states have adopted the ZEV standard with four more having similar regulations more focused on low emissions. They are:

- California

- Colorado

- Connecticut

- Delaware

- Maine

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New York

- New Mexico

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Washington

These states have 22 percent of the 290 light duty million vehicles in the U.S. (65 million) and had four million new units purchased in 2018 subject to the 3 percent mandate. So, 120,000 ZEV vehicles will be added to the stock every year or Tesla will get an increasing share of their revenues from ZEV credit sales.

Mandates are interesting and make us feel good, but the free market, human ingenuity and technology moves the problem-solving needle throughout history. Currently, the broad free market favors hydrogen over electric.

Joe Petrowski has had a long career in international commodity trading, energy and retail management and public policy development. He currently serves as the fuel director of Yesway convenience stores and an adviser to their Chairman on Operations and Merchandising, as well as a director of Xebec, a Canadian manufacturer of Clean technology and Green Print, a carbon mitigation firm. Petrowski previously served as the president and CEO of Gulf Oil LP and was elected to the Gulf Oil LP Board of Directors and then as CEO of the now combined Gulf Oil and Cumberland Farms. He is Managing Director of Mercantor Partners, a private equity firm investing in convenience and energy distribution.