MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

May 15, 2020: Markets are tempering their optimistic view of the re-opening of economic activities this week. While oil prices are heading up for the third week in a row, Wall Street is backing off from its recent rally. Various states are proceeding with economic re-opening, with various levels of caution, and various levels of hope that COVID-19 does not take a more solid hold. Stock markets have been choppy, and the major stock indices are opening lower today. Stimulus efforts have promoted rallies and upticks, but the recent flattening of equities markets may signal that investors are settling in for a more prolonged downturn. Unemployment remains a key concern, with 2.98 million people seeking unemployment benefits this week, building upon the 3.1 million last week. There have been 36.5 million claims over the last eight weeks. Many of the jobs lost will not return. The Department of Commerce reported this morning that retail sales plummeted by 16.4% in April, following a revised drop of 8.3% in March.

Markets in general were supported this week by bullish news in oil markets. Gasoline demand rose again during the week ended May 8, as did diesel demand. Demand for jet fuel dropped once again. Moreover, U.S. crude oil stockpiles shrank slightly this week, ending a 15-week streak of inventory growth that threatened to overwhelm oil storage capability. Since the week ended January 24, crude inventories grew every week until the current week ended May 8. This has added 104.5 mmbbls to supply this calendar year to date.

The COVID-19 pandemic has not been contained, though there is evidence that some regions are succeeding in flattening the curve. The data are cyclical, however, and must be watched over time. For example, last week in the U.S., the average number of new cases per day was trending down using a 5-day moving average. Today, however, the trend is moving up. The Johns Hopkins Coronavirus Resource Center reports that global cases have risen to 4,444,670, with 302,493 deaths. Confirmed cases in the U.S. rose to 1,417,350, with 85,884 deaths attributed to the disease.

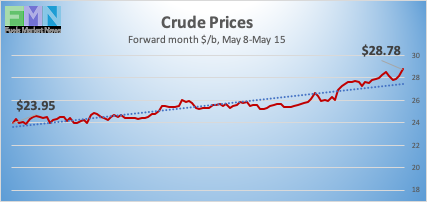

WTI (West Texas Intermediate) crude futures prices opened at $23.35/b on Friday, May 8, and rose to an open of $27.64 on Friday, May 15, an increase of $4.29/b (18.4%). This week appears to be heading for a finish in the black, the third in a row. Recall that just three to four weeks ago, oil prices were dipping below $10/b, and May delivery contracts famously had spent time in negative territory. Our weekly price review covers hourly forward prices from Friday, May 8, through Friday, May 15. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

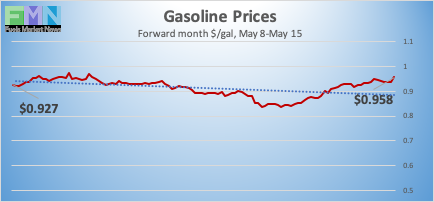

GASOLINE PRICES

Gasoline opened on the NYMEX at $0.9256/gallon on Friday, May 8, and prices strengthened to open at $0.9275/gallon on Friday, May 15. This was a modest increase of 0.19 cents (0.2%). The month of March brought a crippling collapse of nearly 87 cents per gallon, and prices gradually crept back in April. U.S. average retail prices for gasoline jumped by 6.2 cents/gallon during the week ended May 11, averaging $1.851/gallon at the national level. Gasoline futures prices had a down-and-up cycle this week, despite a drawdown from inventories, that is leaving the week flattish overall. Gasoline futures prices are trading in the range of $0.92/gallon to $0.96/gallon. This week could finish in the black if prices hold. The latest price is $0.9551/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $0.8364/gallon on Friday, May 8, and opened on Friday, May 15, at $0.903/gallon, a strong recovery of 6.66 cents (8.0%). U.S. average retail prices for diesel eased by 0.5 cents/gallon during the week ended May 11, averaging $2.394/gallon. Retail prices for diesel have fallen for eighteen consecutive weeks. Diesel futures prices have rallied this week, and they appear to be ready for a finish in the black. Currently, diesel is trading in the range of $0.90-$0.94/gallon. The latest price is $0.9080/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, May 8, at $23.35/b, rising to open at $27.64/b on Friday, May 15. This was a recovery of $4.29/b (18.4%), which built upon last week’s gain of $4.31/b. The week ended April 24 brought a major collapse of $9.64/b (36.5%). Prices strengthened midweek when the 15-week-long streak of growth in oil stockpiles finally was broken by a small stock drawdown. Futures crude prices are strong today, and they appear to be heading for a finish in the black. WTI prices are trading in the $27.50-$29.00/b range currently. The latest price is $28.74/b.

PRICE MOVERS THIS WEEK : BRIEFING

Markets are tempering their optimistic view of the re-opening of economic activities this week. While oil prices are heading up for the third week in a row, Wall Street is backing off from its recent rally. Various states are proceeding with economic re-opening, with various levels of caution, and various levels of hope that COVID-19 does not take a more solid hold in their communities. Stock markets have been choppy, and the major stock indices are opening lower today. This may spark some profit taking. The massive $2 trillion stimulus package passed by Congress in March promoted a solid rally, but the recent flattening of equities markets may signal that investors are settling in for a more prolonged downturn. The House of Representatives will vote on a new $3 trillion Covid-19 relief package today, but this effort lacks broad bipartisan support.

Unemployment remains a key concern, with 2.98 million people seeking unemployment benefits this week, building upon the 3.1 million last week. There have been 36.5 million claims over the last eight weeks. Many of the jobs lost will not return, including jobs in restaurants and retail outlets. March brought the steepest decline in retail sales since 1992. The Department of Commerce reported this morning that retail sales plummeted by 16.4% in April, following a revised drop of 8.3% in March. Economists had forecast that the drop would be 12%, so the actual data today was grimmer than expected. The National Retail Federation warns that the road to recovery for retail stores will be characterized by “fits and starts.” The Federal Reserve Bank issued a report this week revealing that nearly 40% of low-income workers lost their jobs in March.

Markets in general were supported by bullish news in oil markets. Gasoline demand rose again during the week ended May 8, as did diesel demand. Demand for jet fuel dropped once again. Moreover, U.S. crude oil stockpiles shrank slightly this week, ending a 15-week streak of inventory growth that threatened to overwhelm oil storage capability. Crude inventories had grown every week this year since the week ended January 24, adding 105.3 mmbbls to supply this calendar year to date, until the week ended May 8th. With the small draw this week, the total amount added to inventories is 104.51 mmbbls. Available crude storage capacity has been strained, both on land, at refineries, and at sea in tankers. Recovery of demand combined with additional efforts to rein in supply may reduce pressure on storage capacity, which otherwise is forecast to be at maximum sometime in June.

The COVID-19 pandemic has not been contained, though there is evidence that some regions are succeeding in flattening the curve. The data are cyclical, however, and must be watched over time. For example, last week in the U.S., the average number of new cases per day was trending down using a 5-day moving average. Today, however, the trend is moving up. It is too soon to conclude that re-opening will create a major surge, though most health experts concur that an increase in cases is inevitable as shelter-in-place rules are relaxed. The Johns Hopkins Coronavirus Resource Center reports that global cases have risen to 4,444,670, with 302,493 deaths. Confirmed cases in the U.S. rose to 1,417,350, with 85,884 deaths attributed to the disease.

The American Petroleum Institute (API) released information on Tuesday showing another significant crude inventory build, amounting to 7.58 mmbbls. The API also reported a major build of 4.712 mmbbls of diesel. The API reported a drawdown from gasoline inventories amounting to 1.911 mmbbls. The API’s net inventory build was 10.381 mmbbls. Market analysts had predicted a similar pattern of crude and diesel inventory additions, plus a gasoline drawdown, with a total addition to inventories of 5.359 mmbbls.

Prices rose on Wednesday when the U.S. Energy Information Administration (EIA) official statistics instead reported a crude oil inventory draw. The drawdown from crude stocks was small at only 0.745 mmbbls, but it finally reversed a 15-week trend of growth in stockpiles. The EIA also reported a larger draw from gasoline stocks, amounting to 3.513 mmbbls. The addition to distillate stockpiles was 3.511 mmbbls, however. The EIA net result was an inventory drawdown of 0.747 mmbbls. This surprised industry watchers, and it was viewed as bullish news. Crude oil inventories have expanded in 16 of the 18 weeks so far this calendar year, sending a total of 104.51 mmbbls of crude oil into storage.

The EIA reports that crude oil in storage at Cushing rose from 35,501 thousand barrels during the week ended January 3, 2020, to 65,446 thousand barrels during the week ended May 1, 2020, an increase of 29,124 thousand barrels, before finally easing to 62,444 mmbbls during the week ended May 8. The amount of oil storage at Cushing is approximately 90 mmbbls, and it is being expanded to approximately 100 mmbbls, but the remaining capacity is at a premium, and some market participants fear that readily available storage will be full in the coming month. At least one major pipeline company has raised tariffs to deter shippers from placing oil in the line that has no clear destination. Some surplus crude will be stored in May and June in the National Strategic Petroleum Reserve (SPR).The U.S. government announced plans to take advantage of low prices and support the oil industry by purchasing up to 11.3 mmbbls of sweet crude and up to 18.7 mmbbls of sour crude for the SPR. This is not necessarily domestic crude. The delivery date is between May 1, and June 30. The EIA reports that SPR additions were made in the week ended April 24 (1.150 mmbbls), the week ended May 1 (1.716 mmbbls), and the latest week ended May 8 (1.933 mmbbls). Current SPR stocks are 639.766 mmbbls.

U.S. crude production continues to decline. The EIA reported that U.S. crude production during the week ended May 8 fell to 11.6 mmbpd, down 0.3 mmbpd from the prior week’s level of 11.9 mmbpd. According to the EIA’s weekly data series, U.S. crude production averaged 13.025 mmbpd in February 2020, the highest total ever. Production fell to 12.25 mmbpd during the first four weeks of April and 11.75 mmbpd during the first two weeks of May.