Exclusive Analysis by Dr. Nancy Yamaguchi

Markets are pensive after yesterday’s collapse, rethinking last week’s cheerfulness. Oil prices last week were volatile but trending up as the OPEC+ group discussed extending production cuts. The agreement reached over the weekend helped propel crude prices briefly above $40 on Monday. Markets surged when it was reported that the U.S. unemployment rate in May declined to 13.3%, rather than continuing to climb, as many economists had forecast. This week brought sober reflection. The 13.3% unemployment rate is very high, considering that unemployment peaked at 10% during the Great Recession in 2009. Over 21 million people are unemployed. Moreover, the OPEC+ cuts do not re-balance the global market in light of global demand destruction.

The National Bureau of Economic Research (NBER) declared that the U.S. entered a recession in February. The U.S. Federal Reserve Bank met this week, and Chair Jerome Powell warned that the economy faced a “long road” to recovery. Stock markets suffered a selloff yesterday, with the Dow Jones Industrial Average plunging by 1,861.82 points—the largest drop since March 16. While optimism remains as a long-term outlook, there are ups and downs along the way, which are testing the country’s attention span. Today, trading may be mercurial, as some investors seek bargains from yesterday’s selloff while others continue the retreat.

West Texas Intermediate (WTI) crude prices have fallen back to the $36-$37 a barrel level after the price rally that had highs touching $40/b on Monday. Crude and refined product prices are recovering in morning trades, but the expected market volatility may prevent a sustained upward trend today.

U.S. Department of Labor weekly data show 1.542 million initial jobless claims for the week ended June 6. The prior week’s figure was revised upward from 1.877 million to 1.897 million for the week ended May 30. There have been approximately 46.6 million unemployment claims so far this year, more than 44.2 million of them in the 12 weeks since COVID-19 shelter-in-place orders were launched.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have risen to 7,547,550, with 422,012 deaths. Confirmed cases in the U.S. rose to 2,023,347. U.S. deaths attributed to the disease have reached 113,820. In the U.S., 19 states reported an increase in new COVID-19 cases compared with the previous week.

WTI crude futures prices opened at $36.26 a barrel today, a decline of 2.9% from last Friday’s open of $37.33 a barrel. The week may be heading for a finish in the red. Our weekly price review covers hourly forward prices from Friday, June 5 through Friday, June 12. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Gasoline Prices

Gasoline prices fell to open at $1.1142 per gallon today on the NYMEX, compared with $1.1428/gallon on June 5. This was a loss of 2.86 cents (2.5%.) March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline rose significantly by 6.2 cents/gallon during the week ended June 8, reclaiming the $2/gallon level. Retail prices averaged $2.036/gallon at the national level. Gasoline futures prices are stabilizing today, trading in the range of $1.08/gallon to $1.14/gallon. The latest price is $1.1302/gallon.

Gasoline prices fell to open at $1.1142 per gallon today on the NYMEX, compared with $1.1428/gallon on June 5. This was a loss of 2.86 cents (2.5%.) March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline rose significantly by 6.2 cents/gallon during the week ended June 8, reclaiming the $2/gallon level. Retail prices averaged $2.036/gallon at the national level. Gasoline futures prices are stabilizing today, trading in the range of $1.08/gallon to $1.14/gallon. The latest price is $1.1302/gallon.

Source: Prices as reported by DTN Instant Market

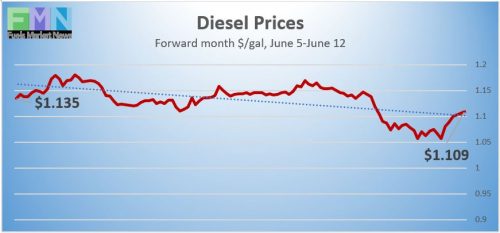

Diesel Prices

Diesel opened on the NYMEX today at $1.0849/gallon, up by 1.33 cents, or 1.2%, from last Friday’s open of $1.0716/gallon. U.S. average retail prices for diesel rose by one cent per gallon during the week ended June 8 to average $2.396/gallon. Diesel prices have weakened more or less steadily this year, but futures prices held value relative to crude and gasoline during this week’s decline. Diesel futures prices today are recovering, and the week may be headed for a finish in the black. Currently, diesel is trading in the range of $1.06-$1.13/gallon. The latest price is $1.1215/gallon.

Diesel opened on the NYMEX today at $1.0849/gallon, up by 1.33 cents, or 1.2%, from last Friday’s open of $1.0716/gallon. U.S. average retail prices for diesel rose by one cent per gallon during the week ended June 8 to average $2.396/gallon. Diesel prices have weakened more or less steadily this year, but futures prices held value relative to crude and gasoline during this week’s decline. Diesel futures prices today are recovering, and the week may be headed for a finish in the black. Currently, diesel is trading in the range of $1.06-$1.13/gallon. The latest price is $1.1215/gallon.

Source: Prices as reported by DTN Instant Market

WTI Crude Prices

WTI crude forward prices opened on the NYMEX today at $36.26 a barrel, compared with $37.33 a barrel last Friday. This was a decline of $1.07 a barrel (2.9%.) The prior week had brought a significant rally, based on better-than-expected jobs formation and a successful agreement among the OPEC+ group to expend production cuts. This week, markets reflected on the overall economic picture at home and abroad and saw a disturbing uptick in coronavirus cases. Markets retreated. Oil prices may be headed for a finish in the red. WTI prices are trading in the $36–$37 a barrel range currently. The latest price is $36.81 a barrel.

WTI crude forward prices opened on the NYMEX today at $36.26 a barrel, compared with $37.33 a barrel last Friday. This was a decline of $1.07 a barrel (2.9%.) The prior week had brought a significant rally, based on better-than-expected jobs formation and a successful agreement among the OPEC+ group to expend production cuts. This week, markets reflected on the overall economic picture at home and abroad and saw a disturbing uptick in coronavirus cases. Markets retreated. Oil prices may be headed for a finish in the red. WTI prices are trading in the $36–$37 a barrel range currently. The latest price is $36.81 a barrel.

Source: Prices as reported by DTN Instant Market

Price Movers This Week: Briefing

Markets are pensive after yesterday’s collapse, rethinking last week’s cheerfulness. Oil prices last week were volatile but trending up as the OPEC+ group discussed extending production cuts. The agreement reached over the weekend helped propel crude prices briefly above $40 on Monday. Mexico was the only member of the OPEC+ group that refused to commit to further cuts. Markets surged when it was reported that the U.S. unemployment rate in May declined to 13.3%, rather than continuing to climb, as many economists had forecast. This week brought sober reflection. The 13.3% unemployment rate is very high, considering that unemployment peaked at 10% during the Great Recession in 2009. Over 21 million people remain unemployed. Moreover, the OPEC+ cuts do not re-balance the global market in light of global demand destruction.

The National Bureau of Economic Research (NBER) declared that the U.S. entered a recession in February. The NBER is a private, non-profit, non-partisan research organization, and it is viewed as the official arbiter of recessions. This recession ended a 128-month long steak of economic expansion, the longest on record.

The U.S. Federal Reserve Bank met this week, and Chair Jerome Powell warned that the economy faced a “long road” to recovery. Chair Powell indicated that the unemployment rate would decline to 9.3% by the end of the year. The Fed offered reassurances that it would continue to support the economy, but that additional aid from Congress was likely to be needed as well. Stock markets suffered a selloff yesterday, with the Dow Jones Industrial Average falling by 1,861.82 points—the largest drop since March 16. While optimism remains as a long-term outlook, there are ups and downs along the way, which are testing the country’s attention span. The Wall Street drop is feeding into lower opens in Asia this morning. Today, trading may be mercurial, as some investors seek bargains from yesterday’s selloff, while others continue the retreat.

West Texas Intermediate (WTI) crude prices have fallen back to the $36-$37 a barrel level after the price rally that had highs touching $40/b on Monday. Crude and refined product prices are recovering in morning trades, but the expected market volatility may prevent a sustained upward trend today.

U.S. Department of Labor weekly data show 1.542 million initial jobless claims for the week ended June 6. The prior week’s figure was revised upward from 1.877 million to 1.897 million for the week ended May 30. There have been approximately 46.6 million unemployment claims so far this year, more than 44.2 million of them in the 12 weeks since COVID-19 shelter-in-place orders were launched.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have risen to 7,547,550, with 422,012 deaths. Confirmed cases in the U.S. rose to 2,023,347. U.S. deaths attributed to the disease have reached 113,820. With the economic re-opening, there are concerns that some people who have returned to work may be at risk of coronavirus infection. Nineteen states reported an increase in new COVID-19 cases compared with the previous week. This includes Florida, which yesterday recorded the highest number of new cases (1,698) in a single day since the pandemic began. The Houston area is considering a return to stay-at-home rules. U.S. Treasury Secretary Steven Mnuchin was quoted as saying “we can’t shut down the economy again.” However, it will be up to the governors of the individual states to make such decisions if indeed a second wave of infections takes hold.

The road to recovery in oil supply and demand is not a smooth one. Oil prices began to weaken midweek when the American Petroleum Institute (API) released information showing an addition of 8.4 mmbbls to crude oil stockpiles. The API reported a drawdown of 2.9 mmbbls from gasoline inventories, but an addition to inventories of 4.3 mmbbls of diesel. The API’s net inventory build was a significant 9.8 mmbbls. Market analysts had predicted drawdowns from crude and gasoline stockpiles plus a build in diesel inventories.

Prices were barely buoyed on Wednesday when U.S. Energy Information Administration (EIA) official statistics reported a slightly smaller addition to stockpiles: 5.72 mmbbls of crude oil, 0.866 mmbbls of gasoline and 1.568 mmbbls of diesel. The EIA net result was another sizeable inventory build amounting to 8.154 mmbbls. Crude oil inventories have expanded in 17 of the 22 weeks since the first week of January, sending a total of 111.1 mmbbls of crude oil into storage.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 thousand barrels during the week ended January 3, 2020, to 65,446 thousand barrels during the week ended May 1, 2020, an increase of 29,124 thousand barrels. Cushing stocks steadily were drained in May, falling to 51,723 mmbbls during the week ended May 29. The EIA reported Cushing stocks at 49,444 mmbbls during the week ended June 6. Some surplus crude is being stored in the National Strategic Petroleum Reserve (SPR.) U.S. President Donald Trump announced plans to support the oil industry by filling the SPR, which would have been a purchase of approximately 77 mmbbls. The Department of Energy cancelled a plan to purchase 30 mmbbls after failing to gain congressional approval. This was envisioned as up to 11.3 mmbbls of sweet crude and up to 18.7 mmbbls of sour crude, not necessarily domestic crude. Smaller additions have been made, however. The EIA reports that SPR additions were made in the weeks ended April 24 (1.150 mmbbls), May 1 (1.716 mmbbls), May 8 (1.933 mmbbls,) May 15 (1.882 mmbbls,) May 22 (2.111 mmbbls,) May 29 (4.02 mmbbls,) and June 5 (2.22 mmbbls.) Current SPR stocks are 649.999 mmbbls.

U.S. crude production continues to decline. The EIA reported that U.S. crude production during the week ended June 5 declined to 11.1 mmbpd, down 0.1 mmbpd from 11.2 mmbpd the prior week. According to the EIA’s weekly data series, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April and 11.52 mmbpd in May. The EIA has revised downward its forecast of 2020 production, cutting it to 11.56 mmbpd. However, the forecast of demand has been cut as well, leaving a supply overhang.