MARKET SNAPSHOT

Friday, June 21, 2019

By Dr. Nancy Yamaguchi

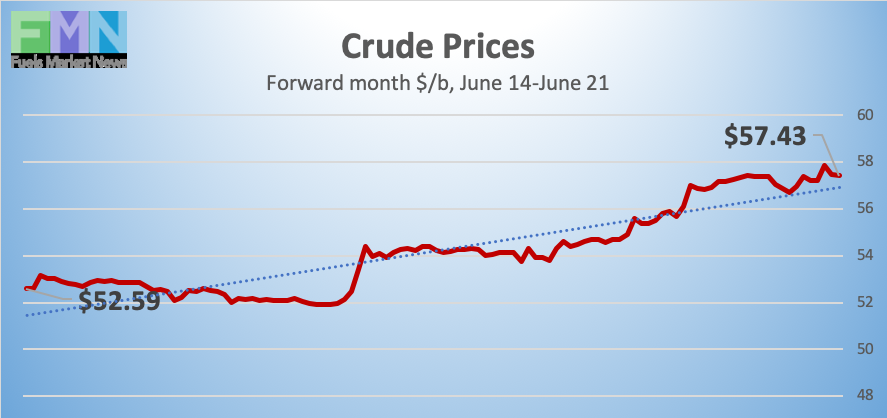

After a month of declining oil prices, geopolitical tensions in the Persian Gulf shot up, carrying oil prices with them. Iran shot down a US Navy drone near the Strait of Hormuz. Iran claimed that the drone was in its airspace, while the US maintained that it was over international waters. President Donald Trump approved military strikes against Iran, which subsequently he cancelled. The situation escalated dangerously, and appears to be calming today. Other factors this week also are supporting oil prices, including a decline in U.S. production and active rigs, an inventory reduction, and a steady interest rate with a more dovish outlook from the Fed. WTI crude prices opened this morning $5.08/b (9.7%) above last Friday’s level. Crude prices have reclaimed the territory above $57/b. Our weekly price review covers hourly forward prices from 9AM EST Friday June 14th through 9AM EST Friday June 21st. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

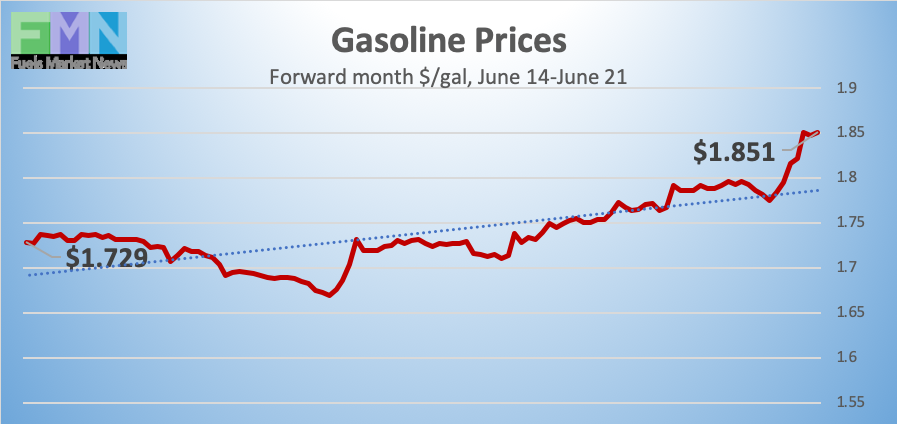

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.7199/gallon on Friday June 14th, and prices opened at $1.7887/gallon on Friday June 21st, an increase of 6.88 cents (4.0%.) Until this week, gasoline forward prices had fallen for four consecutive weeks, shedding nearly 35 cents/gallon. Gasoline prices had been at their lowest levels since February. The upward movement flattened briefly, but this morning brought news of explosions and a massive fire at the PES refinery in Philadelphia. Gasoline futures prices are surging. Gasoline trades are occurring mainly in the range of $1.80-$1.86/gallon. The latest price is $1.85/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.8092/gallon on Friday June 14th and opened on Friday June 21st at $1.8942/gallon, a significant weekly increase of 8.5 cents (4.7%.) Like crude and gasoline, diesel prices surged on news of the attacks on tankers in the Gulf of Oman. This week’s escalation ended a four-week downward price trend that slashed diesel forward prices by 31.81 cents/gallon over the four weeks leading to this week’s price hike. Diesel contracts currently are trading in the $1.88-$1.93/gallon range. The latest price is $1.9195/gallon.

WEST TEXAS INTERMEDIATE PRICES

PRICE MOVERS THIS WEEK : BRIEFING

After a month of declining oil prices, geopolitical tensions in the Persian Gulf shot up, carrying oil prices with them. Tensions began to ratchet up last week when two tankers were attacked near the Strait of Hormuz. The U.S. blamed Iran for the attacks, an accusation that Iranian officials denied. Over the past six weeks, there have been six attacks on tankers in the region. Yesterday, Iran shot down a U.S. Navy drone near the Strait of Hormuz. Iran claimed that the drone was in its airspace, while the U.S. maintained that it was over international waters. President Donald Trump approved military strikes against Iranian targets, ordering war planes and ships to move into position. He subsequently canceled the attack. The President reportedly warned Iran of the attacks via Omani officials. WTI crude prices jumped by approximately $5/b this week. So far, however, this has recouped less than half of the past month’s price drop. The previous four weeks saw WTI prices collapsing by $10.94/barrel.

Although U.S.-Iran relations were already contentious last week, oil prices remained subdued, in part because of market oversupply. This week, however, several other factors came into play that were supportive of prices. First, U.S. crude production declined. Baker Hughes reported that the active oil and gas rig count fell by 6 last Friday, continuing this year’s contraction. The active rig count has fallen by 106 so far this year.

Oil inventories also shrank this week. On Tuesday, the American Petroleum Institute (API) reported a small drawdown of 0.812 million barrels (mmbbls) from crude oil inventories. Gasoline inventories rose by 1.46 mmbbls. Diesel inventories were drawn down slightly by 0.05 mmbbls.

Official statistics were more bullish. The U.S. Energy Information Administration (EIA) reported across-the board inventory drawdowns of 3.106 mmbbls of crude oil, 1.692 mmbbls of gasoline, and 0.551-mmbbls from diesel inventories. The net drawdown was 5.349 mmbbls.

Oil prices also received a boost when the Fed decided to hold interest rates steady. The Fed left the door open for a rate cut later this year. Markets also rose upon news that progress was possible once again on the U.S.-China trade war.