MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

November 15, 2019: Crude prices dropped sharply on Thursday and dropped again overnight, and prices currently are in recovery mode. U.S. crude production hit a new record high of 12.8 million barrels per day last week, inventories rose, and the International Energy Agency (IEA) warned that the OPEC+ group would face a major challenge in 2020 as demand for their crude was expected to fall sharply. Markets received mixed messages about the U.S.-China trade war. Today’s White House announcement reiterated that progress on a Phase 1 deal has been made, and stock markets may open higher. WTI futures crude prices opened on Friday, November 8, at $57.08/b, and prices eased to an open of $56.91/b today, down slightly by $0.17/b. Currently, WTI futures prices are working to regain the $57.00/b level. This week may finish with crude prices in the black. Gasoline and diesel prices also retreated and are working to recover. Our weekly price review covers hourly forward prices from Friday, November 8, through Friday, November 15. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.6399/gallon on Friday, November 8, and prices opened at $1.6191/gallon on Friday, November 15. This was a decline of 2.08 cents (1.3%) after last week’s increase of 4.53 cents (2.8%.) U.S. average retail prices rose by 1.0 cents/gallon during the week ended November 11th. Gasoline futures prices dropped sharply on Thursday and fell again overnight, handing back midweek gains. Prices are currently in recovery mode, but the week finish in the red unless a steeper climb is achieved. Trades are occurring mainly in the range of $1.60-$1.63/gallon. The latest price is $1.6253/gallon.

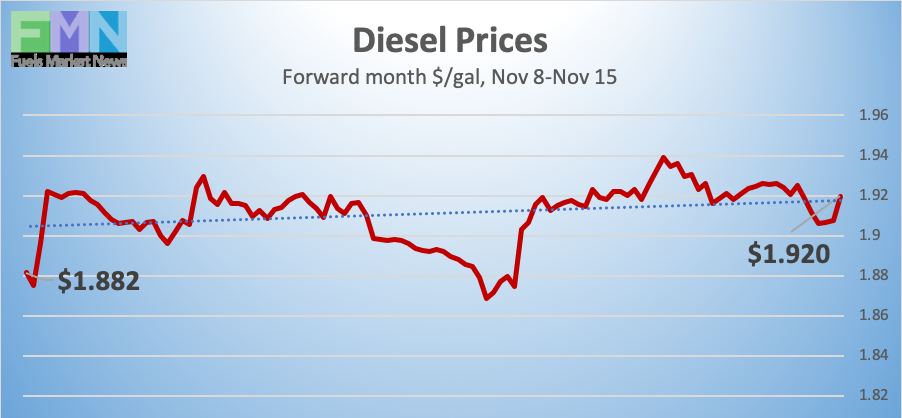

DIESEL PRICES

Diesel opened on the NYMEX at $1.9191/gallon on Friday, November 8, and opened on Friday, November 15, at $1.918/gallon, down slightly by 0.11 cents (0.1%.) This was a small erosion of last week’s gain of 4.42 cents. U.S. average retail prices for diesel rose by 1.1 cents/gallon during the week ended November 11th. Diesel futures prices dropped sharply on Thursday and fell again overnight. Prices currently have climbed back to their starting point, and the week may end in the black. Contracts currently are trading in the $1.90-$1.93/gallon range. The latest price is $1.9257/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, November 8, at $57.08/barrel and subsided to an open of $56.91/barrel on Friday, November 15, a small decline of $0.17/b (0.3%.) This gave back a small portion of last week’s gain of $2.93/b. Crude prices are stabilizing this morning in early trades, working to recapture and hold the $57/b level. The week may end with little change over last week. WTI crude is trading mainly in the range of $56.50/b-$57.25/b. The latest price is $57.01/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices initially held to some of last week’s market optimism based on hopes for a tariff roll-back between the U.S. and China. This was combined with the belief that Saudi Aramco’s long-awaited IPO would motivate Saudi Arabia to press for high oil prices. A high oil price will influence valuation. However, global oil supplies and U.S. inventories rose this week. Moreover, the International Energy Agency (IEA) cautioned that the OPEC+ group would face a challenge in 2020, because demand for its oil would fall. WTI crude prices dropped Thursday and overnight. Prices currently are in recovery mode, working to recapture and hold the $57/b level.

Last week’s news about impending tariff rollbacks appeared solid enough that markets rose. However, President Donald Trump stated that agreement had not been reached, and market optimism subsided. White House advisor Larry Kudlow has re-injected some optimism today by stating that China and the U.S. are in daily contact, and that progress indeed is being made on a Phase 1 deal. U.S. stocks may open higher today on these statements. Congress began public hearings on President Trump’s impeachment on Wednesday, complicating the credibility of White House announcements, which have not been consistent concerning the U.S.-China trade war.

The American Petroleum Institute (API) reported a surprise draw of 0.541 million barrels (mmbbls) from crude inventories, versus industry expectations of a 1.53-mmbbls inventory build. This strengthened prices on Wednesday, though the crude draw was more than countered by additions of 2.3 mmbbls to gasoline inventories and 2.3 mmbbls to diesel stockpiles. Industry experts had anticipated draws from diesel and gasoline inventories. The API’s net inventory build was 2.646 mmbbls.

The EIA released official statistics on Thursday, showing instead a crude build of 2.219 mmbbls. The EIA also reported a gasoline stock build of 1.861 mmbbls and a diesel stock draw of 2.477 mmbbls. The net result was an inventory build of 1.603 mmbbls. Even though the total inventory build was below the level reported by the API, oil prices dropped.

The EIA also reported that U.S. crude production hit a new record-high level of 12.8 mmbpd for the week ended November 8th. This has been accomplished despite a steady downward trend in active oil and gas rigs. The Baker Hughes rig count showed a weekly drop of 5 active rigs during the week ended November 8th. For the year to date, 258 rigs have exited the field. Opinions about the future of U.S. shale output are diverging, with forecasts of continued growth being countered with warnings that production will peak and fall far sooner than originally anticipated.