MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

November 8, 2019: Crude prices are falling today after a midweek surge. Prices rose upon the news that China and the U.S. would begin to roll back tariffs. Developments in the trade war routinely stimulate then quench buying enthusiasm, but this news was more concrete than most. Lack of unanimity in the White House is sending prices back down today. Oil prices received longer-term support this week when Saudi Aramco launched its long-awaited IPO. High oil prices will translate into high valuation, so Saudi Arabia has strong incentive to keep prices high. WTI futures crude prices opened on Friday, November 1, at $54.15/b, and prices rose to an open of $57.08/b today, a significant gain of $2.93/b. Currently, prices are declining, and WTI futures have retreated below $56.00/b. This week may finish with crude prices in the black nonetheless, since the starting basis last Friday was just above $54/b. Gasoline and diesel prices have retreated, and they may not be able to hang on to any of the midweek gains. Our weekly price review covers hourly forward prices from Friday, November 1, through Friday, November 8. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

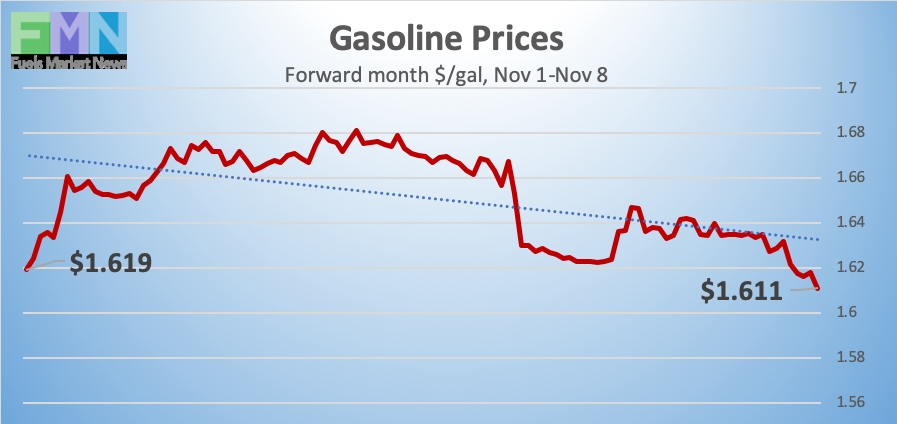

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.5946/gallon on Friday, November 1, and prices opened at $1.6399/gallon on Friday, November 8. This was a recovery of 4.53 cents (2.8%) after last week’s loss of 6.49 cents (3.9%.) Prior to that, gasoline futures had risen for three consecutive weeks. U.S. average retail prices rose by 0.9 cents/gallon during the week ended November 4th. This morning, futures prices are falling, handing back midweek gains. The week may end with prices back where they began, giving back all impact of the rally. Trades are occurring mainly in the range of $1.58-$1.64/gallon. The latest price is $1.5903/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.8749/gallon on Friday, November 1, and opened on Friday, November 8, at $1.9191/gallon, up by 4.42 cents (2.4%.) This recouped a portion of last week’s loss of 10.89 cents. Diesel futures prices are falling in early morning trades, as midweek optimism over U.S.-China tariffs fades. The week may finish with prices back where they began, handing back all the gains achieved during the week’s rally. Contracts currently are trading in the $1.87-$1.91/gallon range. The latest price is $1.8751/gallon.

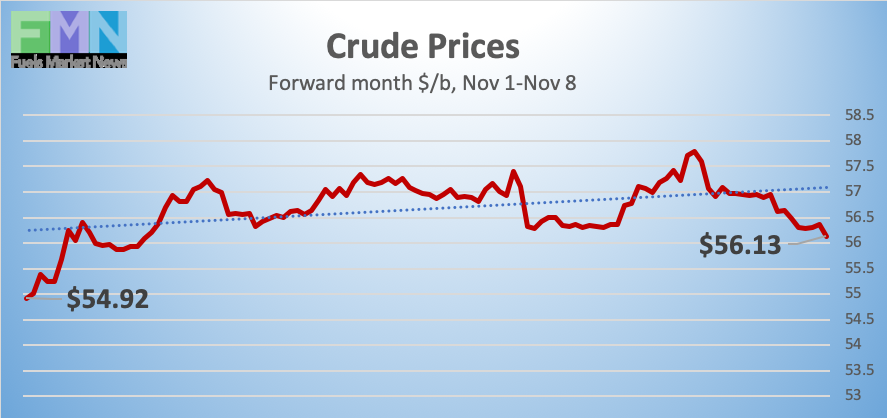

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, November 1, at $54.15/barrel and rallied to an open of $57.08/barrel on Friday, November 8, an increase of $2.93/b (5.4%.) This more than recouped last week’s loss of $1.92/b. Crude prices rose strongly midweek, based largely on the Saudi Aramco IPO and on the news that the U.S. and China would begin to roll back tariffs. But White House caveats today have deflated enthusiasm. Crude prices are falling this morning in early trades, but the week appears to be heading for a finish in the black, given the starting price of just over $54/b. WTI crude is trading mainly in the range of $56.00/b-$57.00/b. The latest price is $56.19/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices were pulled up by market optimism this week, with hopes for tariff roll-back between the U.S. and China overcoming abundant oil supplies. Saudi Aramco launched its long-awaited IPO, adding to market confidence, since a high oil price will influence valuation. Saudi Arabia has shifted focus away from pushing for deeper OPEC+ production cuts and instead will emphasize compliance with the existing agreement. WTI crude prices rose by nearly $3/b Friday-to-Friday. But WTI prices are falling today, hovering under $56.50/b currently, though prices hit highs of nearly $58/b yesterday.

The course of the U.S.-China trade war has been a long and winding one, with each fresh set of news alternately raising and dashing market optimism. This time, however, the news appeared more solid. A Chinese Ministry of Commerce spokesman said that both sides have agreed to roll back tariffs in phases. There were conflicting reports from the White House, however, about whether tariff agreements would be part of a phase one deal. White House advisors and the President are not in full agreement, and the two presidents are not scheduled to meet until next month, so the situation is changeable. The signs of progress bolstered markets despite the increase in weekly oil supplies. Inventories rose again, and U.S. production remained at its record-high 12.6 mmbpd level. Today, the apparent progress has been set back.

The American Petroleum Institute (API) reported another addition to crude inventories, but its impact was countered by draws from gasoline and diesel stockpiles. The API reported an addition of 4.3 million barrels (mmbbls) to U.S. crude inventories and drawdowns of 4.2 mmbbls from gasoline inventories plus 1.6 mmbbls from diesel inventories. Market experts had predicted a smaller crude build and smaller drawdowns of gasoline and diesel. The API’s net inventory draw was 1.5 mmbbls.

The EIA released more bearish official statistics on Wednesday. The EIA reported a sizeable stock build of 7.929 mmbbls of crude. Gasoline and diesel inventories fell by 2.828 mmbbls and 0.622 mmbbls respectively. The net result was an inventory build of 4.479 mmbbls.

The EIA also reported that U.S. crude production was maintained at its record-high level of 12.6 mmbpd for the fifth week running. This has been accomplished despite a steady downward trend in active oil and gas rigs. The Baker Hughes rig count showed a weekly drop of 8 active rigs during the week ended November 1st. For the year to date, 253 rigs have exited the field.