MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

January 17, 2020: Oil prices retreated to multi-week lows this week, with focus returning to oversupply and potentially weak demand. This week brought another major addition to U.S. oil inventories, plus news of a new record of 13.0 million barrels per day set in U.S. crude production. The signing of a Phase 1 trade deal with China on Wednesday so far has boosted stock markets more than oil markets. Crude prices are a far cry from the $65/b heights hit during the week of uncertainty when the world wondered whether the U.S.-Iran conflict would escalate. WTI crude futures prices are below $59/b this morning. Prices currently are in the $58.50-$59.00/b range. The week appears to be headed for a finish in the red.

WTI futures crude prices opened on Friday, January 10, at $59.61/b, and prices eased to an open of $58.59/b today, down by $1.02/b. WTI futures prices trended generally down, never hitting the $60/b level, and threatening to drop below $57/b as well midweek. Diesel prices weakened noticeably, following news of yet another significant addition to stockpiles. Our weekly price review covers hourly forward prices from Friday, January 10th, through Friday, January 17th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

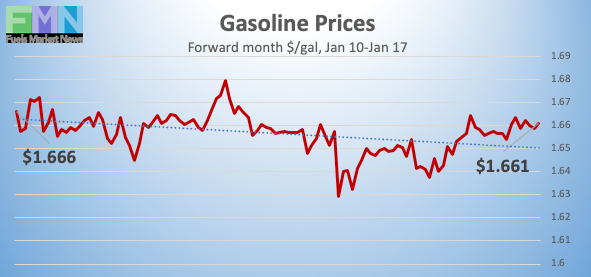

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.6579/gallon on Friday, January 10, and prices rose to open at $1.6644/gallon on Friday, January 17. This was a small increase of 0.65 cents (0.4%.) Gasoline futures prices ranged this week from a low of $1.6262/gallon on Wednesday to a high of $1.6851/gallon on Tuesday, a range of 5.89 cents. On Wednesday, the EIA reported a significant 6.678-mmbbl addition to gasoline stocks, building on the prior week’s massive 9.137-mmbbl build. U.S. average retail prices fell modestly by 0.8 cents/gallon during the week ended January 13th. Gasoline prices currently are stabilizing. Trades are occurring mainly in the range of $1.65-$1.67/gallon. The latest price is $1.6556/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.9522/gallon on Friday, January 10, and opened on Friday, January 17, at $1.8618/gallon, down sharply by 9.04 cents (4.6%.) U.S. average retail prices for diesel fell by 1.5 cents/gallon during the week ended January 13th. Diesel futures prices were volatile this week, ranging from a low of $1.8567/gallon on Thursday to a high of $1.94/gallon on Monday, a range of 8.33 cents. The EIA reported a massive inventory build of 8.171 mmbbls this week, pressuring diesel prices. The week appears to be heading for a finish in the red. Prices are currently attempting to stabilize after an early morning drop, with contracts trading in the $1.84-$1.87/gallon range. The latest price is $1.8526/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, January 10, at $59.61/b. Prices opened at $58.59/b today, a drop of $1.02 (1.7%.) WTI futures prices ranged from a high of $59.27/b on Monday to a low of $57.36/b on Wednesday, a range of $1.91/b. Prices declined this week, never regaining the $60/b level, and dipping below the $57.50/b level as well. During the week, prices were also pressured by major additions to refined product inventories. The week is heading for a finish in the red. WTI futures prices currently are stabilizing in the range of $58.50-$59.00/b. The latest price is $58.66/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices continued to retreat this week, falling to multi-week lows. Markets cast aside geopolitical concerns and refocused on global oversupply. Another massive addition to U.S. oil inventories suppressed prices, as did another record-setting week of U.S. crude production, which hit the 13.0 million barrel per day level for the first time. The signing of a Phase 1 deal between the U.S. and China boosted stock markets much more than oil markets. The Dow Jones Industrial Average jumped by an impressive 267.42 points yesterday. The Dow is up by over 428 points already in just the first two weeks of January.

Oil prices continued to ebb, however. U.S. oil inventories rose again this week. On Tuesday, the American Petroleum Institute (API) reported across-the-board additions to U.S. oil inventories: 1.1-million barrels (mmbbls) of crude oil, a massive addition of 6.8 mmbbls of diesel, and a significant addition of 3.2 mmbbls to gasoline stockpiles. Industry experts had anticipated a modest crude stock drawdown more than counterbalanced by drawdowns from gasoline and diesel stockpiles. The API’s net inventory build was a significant 11.1 mmbbls.

The U.S. Energy Information Administration (EIA) released an even more bearish set of official statistics, though the official data showed a drawdown from crude stocks of 2.549 mmbbls. Markets were shaken mainly by a huge addition to distillate stockpiles of 8.171 mmbbls, plus a major addition of 6.678 to gasoline inventories. Last week brought the largest addition to gasoline stocks in four years—9.137 mmbbls. This was in fact the fourth-largest addition to gasoline stockpiles in the three decades since the EIA started reporting the data in 1990. This current week brought another addition to gasoline stocks plus a major addition to distillate stocks. The net result was a huge inventory build of 12.3 mmbbls.

The EIA also reported that U.S. crude production attained a new record-high:13.0 mmbpd during the week ended January 10th. Approximately 1.2 mmbpd was added to U.S. crude oil output in 2019.